PNC Bank 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Ability and depth of lending management, and

• Changes in risk selection and underwriting standards.

A

LLOWANCE

F

OR

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

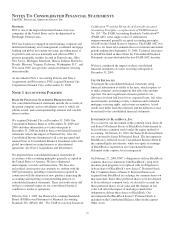

We maintain the allowance for unfunded loan commitments

and letters of credit at a level we believe is adequate to absorb

estimated probable losses related to these unfunded credit

facilities. We determine the adequacy of the allowance based

on periodic evaluations of the unfunded credit facilities

including an assessment of the probability of commitment

usage, credit risk factors for loans outstanding to these same

customers, and the terms and expiration dates of the unfunded

credit facilities. The allowance for unfunded loan

commitments and letters of credit is recorded as a liability on

the Consolidated Balance Sheet. Net adjustments to the

allowance for unfunded loan commitments and letters of

credit are included in the provision for credit losses.

M

ORTGAGE

A

ND

O

THER

S

ERVICING

R

IGHTS

We provide servicing under various loan servicing contracts

for commercial, residential, and other consumer loans. These

contracts are either purchased in the open market or retained

as part of a loan securitization or loan sale. All newly acquired

or originated servicing rights are initially measured at fair

value. Fair value is based on the present value of the expected

future cash flows, including assumptions as to:

• Interest rates for escrow and deposit balance

earnings,

• Discount rates,

• Stated note rates,

• Estimated prepayment speeds, and

• Estimated servicing costs.

For subsequent measurements of these assets, we have elected

to utilize either the amortization method or fair value

measurement based upon the asset class and our risk

management strategy for managing these assets. For

commercial mortgage loan servicing rights, we use the

amortization method. This election was made based on the

unique characteristics of the commercial mortgage loans

underlying these servicing rights with regard to market inputs

used in determining fair value and how we manage the risks

inherent in the commercial mortgage servicing rights assets.

Specific risk characteristics of commercial mortgages include

loan type, currency or exchange rate, interest rates, expected

cash flows and changes in the cost of servicing. We record

these servicing assets as other intangible assets and amortize

them over their estimated lives based on estimated net

servicing income. On a quarterly basis, we test the assets for

impairment by categorizing the pools of assets underlying the

servicing rights into various stratum. If the estimated fair

value of the assets is less than the carrying value, an

impairment loss is recognized and a valuation reserve is

established. Subsequent measurement of servicing rights for

home equity lines and loans, automobile loans and credit card

loans also follows the amortization method.

For servicing rights related to residential real estate loans, we

apply the fair value method. This election was made to be

consistent with our risk management strategy to hedge

changes in the fair value of these assets. We manage this risk

by hedging the fair value of this asset with derivatives and

securities which are expected to increase in value when the

value of the servicing right declines. The fair value of these

servicing rights is estimated by using a cash flow valuation

model which calculates the present value of estimated future

net servicing cash flows, taking into consideration actual and

expected mortgage loan prepayment rates, discount rates,

servicing costs, and other economic factors which are

determined based on current market conditions. Expected

mortgage loan prepayment assumptions are derived from an

internal proprietary model and consider empirical data drawn

from the historical performance of our managed portfolio and

adjusted for current market conditions. On a quarterly basis,

management obtains market value quotes from two

independent brokers that reflect current conditions in the

secondary market and any recently executed servicing

transactions. Management compares its valuation to the

information received from independent brokers and other

market data to determine if its estimated fair value is

reasonable in comparison to market participant valuations.

Contractual servicing fees are recognized as they are earned

and are reported net of amortization expense and any

impairment in the caption Corporate services on the

Consolidated Income Statement.

F

AIR

V

ALUE

O

F

F

INANCIAL

I

NSTRUMENTS

The fair value of financial instruments and the methods and

assumptions used in estimating fair value amounts and

financial assets and liabilities for which fair value was elected

based on the fair value guidance are detailed in Note 8 Fair

Value.

G

OODWILL

A

ND

O

THER

I

NTANGIBLE

A

SSETS

We assess goodwill for impairment at least annually, or when

events or changes in circumstances indicate the assets might

be impaired. Finite-lived intangible assets are amortized to

expense using accelerated or straight-line methods over their

respective estimated useful lives. We review finite-lived

intangible assets for impairment when events or changes in

circumstances indicate that the asset’s carrying amount may

not be recoverable from undiscounted future cash flows or it

may exceed its fair value.

D

EPRECIATION

A

ND

A

MORTIZATION

For financial reporting purposes, we depreciate premises and

equipment, net of salvage value, principally using the straight-

line method over their estimated useful lives.

We use estimated useful lives for furniture and equipment

ranging from one to 10 years, and depreciate buildings over an

estimated useful life of up to 40 years. We amortize leasehold

improvements over their estimated useful lives of up to 15

years or the respective lease terms, whichever is shorter.

99