PNC Bank 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

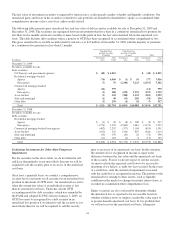

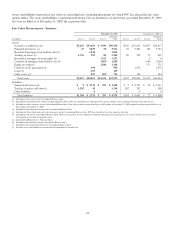

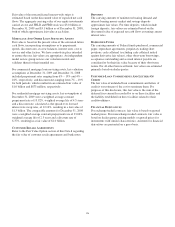

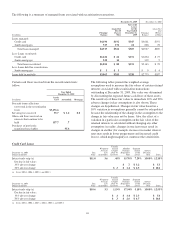

Fair values and aggregate unpaid principal balances of items for which we elected the fair value option for December 31, 2009 and

December 31, 2008 follow.

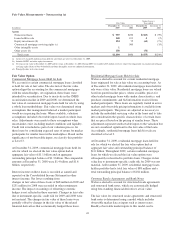

Fair Value Option – Fair Value and Principal Balances

In millions Fair Value

Aggregate Unpaid

Principal Balance Difference

December 31, 2009

Customer resale agreements $ 990 $ 925 $ 65

Residential mortgage loans held for sale

Performing loans 971 977 (6)

Loans 90 days or more past due 40 50 (10)

Nonaccrual loans 1 9 (8)

Total 1,012 1,036 (24)

Commercial mortgage loans held for sale (a)

Performing loans 1,023 1,235 (212)

Nonaccrual loans 27 41 (14)

Total 1,050 1,276 (226)

Residential mortgage loans – portfolio

Performing loans 25 27 (2)

Loans 90 days or more past due 51 54 (3)

Nonaccrual loans 12 23 (11)

Total $ 88 $ 104 $ (16)

December 31, 2008 (b)

Customer resale agreements $1,072 $ 980 $ 92

Commercial mortgage loans held for sale

Performing loans 1,376 1,572 (196)

Nonaccrual loans 24 27 (3)

Total $1,400 $1,599 $(199)

(a) There were no loans 90 days or more past due within this category at December 31, 2009.

(b) Excludes assets and liabilities associated with the acquisition of National City.

A

DDITIONAL

F

AIR

V

ALUE

I

NFORMATION

R

ELATED TO

F

INANCIAL

I

NSTRUMENTS

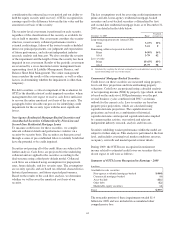

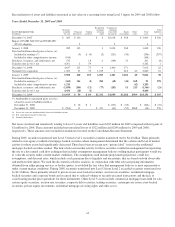

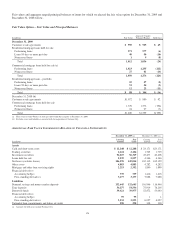

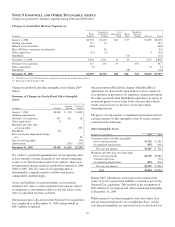

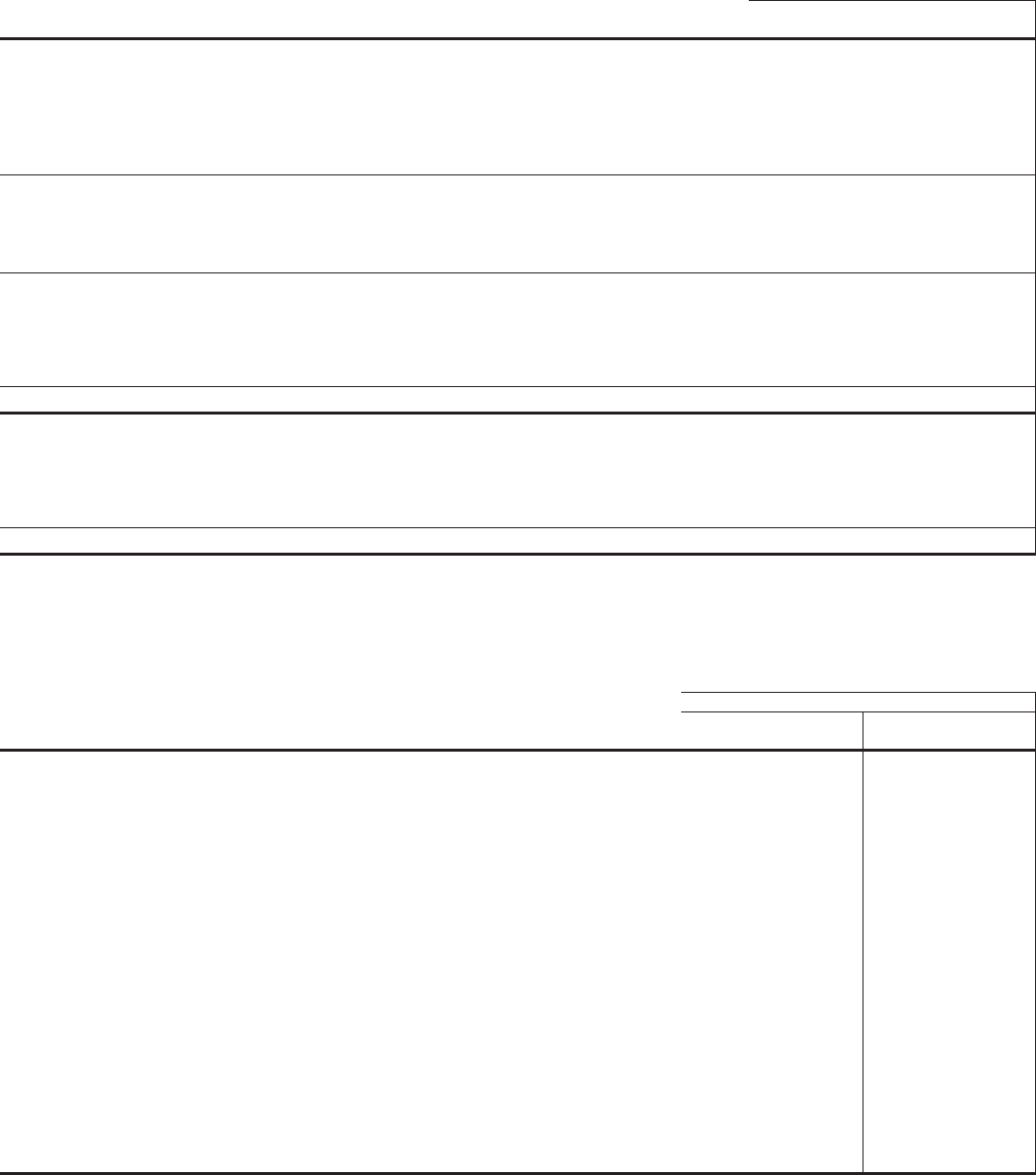

December 31, 2009 (a) December 31, 2008 (a)

In millions

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets

Cash and short-term assets $ 12,248 $ 12,248 $ 23,171 $23,171

Trading securities 2,124 2,124 1,725 1,725

Investment securities 56,027 56,319 43,473 43,406

Loans held for sale 2,539 2,597 4,366 4,366

Net loans (excludes leases) 146,270 145,014 165,112 162,159

Other assets 4,883 4,883 4,282 4,282

Mortgage and other loan servicing rights 2,253 2,352 1,890 1,899

Financial derivatives

Accounting hedges 739 739 1,416 1,416

Free-standing derivatives 3,177 3,177 7,088 7,088

Liabilities

Demand, savings and money market deposits 132,645 132,645 116,946 116,946

Time deposits 54,277 54,534 75,919 76,205

Borrowed funds 39,621 39,977 52,872 53,063

Financial derivatives

Accounting hedges 95 95 11

Free-standing derivatives 3,533 3,533 6,057 6,057

Unfunded loan commitments and letters of credit 290 290 338 338

(a) Amounts for both years include National City.

124