PNC Bank 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.any other class or series of PNC’s capital stock, (v) the

purchase of fractional interests in shares of PNC capital stock

pursuant to the conversion or exchange provisions of such

stock or the security being converted or exchanged or (vi) any

stock dividends paid by PNC where the dividend stock is the

same stock as that on which the dividend is being paid.

PNC Bank, N.A. has contractually committed to Trust I that if

full dividends are not paid in a dividend period on the Trust I

Securities, LLC Preferred Securities or any other parity equity

securities issued by the LLC, neither PNC Bank, N.A. nor its

subsidiaries will declare or pay dividends or other

distributions with respect to, or redeem, purchase or acquire or

make a liquidation payment with respect to, any of its equity

capital securities during the next succeeding period (other than

to holders of the LLC Preferred Securities and any parity

equity securities issued by the LLC) except: (i) in the case of

dividends payable to subsidiaries of PNC Bank, N.A., to PNC

Bank, N.A. or another wholly-owned subsidiary of PNC Bank,

N.A. or (ii) in the case of dividends payable to persons that are

not subsidiaries of PNC Bank, N.A., to such persons only if,

(A) in the case of a cash dividend, PNC has first irrevocably

committed to contribute amounts at least equal to such cash

dividend or (B) in the case of in-kind dividends payable by

PNC REIT Corp., PNC has committed to purchase such

in-kind dividend from the applicable PNC REIT Corp. holders

in exchange for a cash payment representing the market value

of such in-kind dividend, and PNC has committed to

contribute such in-kind dividend to PNC Bank, N.A.

PNC Capital Trust E Trust Preferred Securities

In February 2008, PNC Capital Trust E issued $450 million of

7.75% Trust Preferred Securities due March 15, 2068 (the

Trust E Securities). PNC Capital Trust E’s only assets are

$450 million of 7.75% Junior Subordinated Notes due

March 15, 2068 and issued by PNC (the JSNs). The Trust E

Securities are fully and unconditionally guaranteed by PNC.

We may, at our option, redeem the JSNs at 100% of their

principal amount on or after March 15, 2013.

In connection with the closing of the Trust E Securities sale,

we agreed that, if we have given notice of our election to defer

interest payments on the JSNs or a related deferral period is

continuing, then PNC would be subject during such period to

restrictions on dividends and other provisions protecting the

status of the JSN debenture holder similar to or in some ways

more restrictive than those potentially imposed under the

Exchange Agreements with Trust II and Trust III, as described

above. PNC Capital Trusts C and D have similar protective

provisions with respect to $500 million in principal amount of

junior subordinated debentures. Also, in connection with the

closing of the Trust E Securities sale, we entered into a

replacement capital covenant, a copy of which was attached as

Exhibit 99.1 to PNC’s Form 8-K filed on February 13, 2008

and which is described in Note 14 Capital Securities of

Subsidiary Trusts in Item 8 of this Report.

Acquired Entity Trust Preferred Securities

As a result of the National City acquisition, we assumed

obligations with respect to $2.4 billion in principal amount of

junior subordinated debentures issued by the acquired entity.

As a result of the Mercantile, Yardville and Sterling

acquisitions, we assumed obligations with respect to $158

million in principal amount of junior subordinated debentures

issued by the acquired entities. Under the terms of these

debentures, if there is an event of default under the debentures

or PNC exercises its right to defer payments on the related

trust preferred securities issued by the statutory trusts or there

is a default under PNC’s guarantee of such payment

obligations, PNC would be subject during the period of such

default or deferral to restrictions on dividends and other

provisions protecting the status of the debenture holders

similar to or in some ways more restrictive than those

potentially imposed under the Exchange Agreements with

Trust II and Trust III, as described above.

We are subject to replacement capital covenants (RCCs) with

respect to four tranches of junior subordinated debentures

inherited from National City, copies of which RCCs were

attached, respectively, as Exhibit 99.2 to the National City

Form 8-K filed on February 4, 2008 and Exhibit 99.1 to the

National City Forms 8-K filed on November 9, 2006, May 25,

2007 and August 30, 2007. See Note 14 Capital Securities of

Subsidiary Trusts. Similarly, we are subject to a replacement

capital covenant with respect to our Series L Preferred Stock,

a copy of which was attached as Exhibit 99.1 to National

City’s Form 8-K filed on February 4, 2008. See Note 19

Equity in Item 8 of this Report.

F

AIR

V

ALUE

M

EASUREMENTS

A

ND

F

AIR

V

ALUE

O

PTION

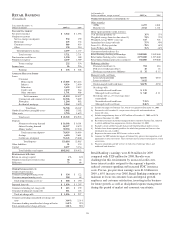

In addition to the following, see Note 8 Fair Value in the

Notes To Consolidated Financial Statements under Part II,

Item 8 of this Report for further information regarding fair

value. New GAAP was issued in 2009 for estimating fair

values when the volume and level of activity for the asset or

liability have significantly decreased. It also provides

guidance on identifying circumstances that indicate a

transaction is not orderly. As permitted, PNC adopted this

guidance effective January 1, 2009.

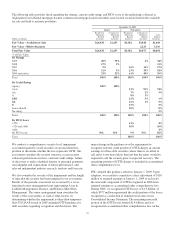

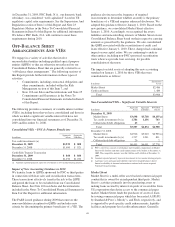

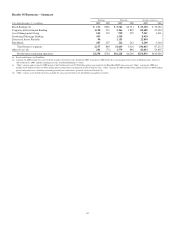

Assets and liabilities measured at fair value on a recurring

basis, including instruments for which PNC has elected the

fair value option, are summarized below. As prescribed by

GAAP, the assets and liabilities acquired from National City

on December 31, 2008 are excluded from the following

disclosures as of that date, but are included as of and for the

year ended December 31, 2009.

At December 31, 2009, assets recorded at fair value

represented 23% of total assets and fair value liabilities

represented 2% of total liabilities compared with 13% of total

assets and 2% of total liabilities as of December 31, 2008.

44