PNC Bank 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2009, the FASB issued SFAS 166 which was codified

in December 2009 as ASU 2009-16 – Transfers and Servicing

(Topic 860) – Accounting For Transfers of Financial Assets.

This revised guidance removes the concept of a qualifying

special-purpose entity from existing GAAP and removes the

exception from applying FASB ASC 810-10, Consolidation,

to qualifying special purpose entities. The amended standard

clarifies that an entity must consider all arrangements or

agreements made contemporaneously with or in

contemplation of a transfer even if not entered into at the time

of the transfer when applying surrender of control conditions.

The new guidance is effective January 1, 2010. See Recent

Accounting Pronouncements in this Note for further details.

L

OANS

H

ELD

F

OR

S

ALE

We designate loans as held for sale when we have the intent to

sell them. We transfer loans to the loans held for sale category

at the lower of cost or fair market value. At the time of

transfer, write-downs on the loans are recorded as charge-offs.

We establish a new cost basis upon transfer. Any subsequent

lower-of-cost-or-market adjustment is determined on an

individual loan basis and is recognized as a valuation

allowance with any charges included in other noninterest

income. Gains or losses on the sale of these loans are included

in other noninterest income when realized.

We have elected to account for certain commercial mortgage

loans held for sale at fair value. The changes in the fair value

of these loans are measured and recorded in other noninterest

income each period. See Note 8 Fair Value for additional

information. Also, we elected fair value for residential real

estate loans held for sale or securitization acquired from

National City.

Interest income with respect to loans held for sale classified as

performing is accrued based on the principal amount

outstanding using a constant effective yield method.

In certain circumstances, loans designated as held for sale may

be transferred to held for investment based on a change in

strategy. We transfer these loans at the lower of cost or fair

market value; however, any loans originated for sale and

designated at fair value will remain at fair value for the life of

the loan.

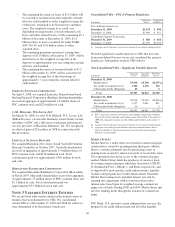

N

ONPERFORMING

A

SSETS

Nonperforming assets include:

• Nonaccrual loans,

• Troubled debt restructurings, and

• Foreclosed assets.

Nonperforming assets exclude purchased impaired loans.

Measurement of delinquency and past due status are based on

the contractual terms of each loan.

A loan acquired and accounted for under FASB ASC

Receivables (Topic 310) – Loans and Debt Securities

Acquired with Deteriorated Credit Quality is reported as an

accruing loan and a performing asset.

We generally classify commercial loans as nonaccrual when

we determine that the collection of interest or principal is

doubtful or when a default of interest or principal has existed

for 90 days or more and the loans are not well-secured or in

the process of collection. When the accrual of interest is

discontinued, any accrued but uncollected interest previously

included in net interest income is reversed. We charge off

small business commercial loans less than $1 million at 120

days after transfer to nonaccrual status. We charge off other

nonaccrual loans based on the facts and circumstances of the

individual loans.

Most consumer loans and lines of credit, not secured by

residential real estate, are charged off after 120 to 180 days

past due. Generally, they are not placed on nonaccrual status.

Subprime mortgage loans for first liens with a loan to value

ratio of greater than 90% and second liens are classified as

nonaccrual at 90 days past due.

Home equity installment loans and lines of credit, as well as

residential mortgage loans, that are well secured by residential

real estate are classified as nonaccrual at 180 days past due or

if a partial write-down has occurred. These loans are

considered well secured if the fair market value of the

property, less 15% to cover potential foreclosure expenses, is

greater than or equal to the recorded investment in the loan

including any superior liens. A fair market value assessment

of the property is initiated when the loan becomes 90 to 120

days past due.

Home equity installment loans and lines of credit and

residential real estate loans that are not well secured, but are in

the process of collection, are charged-off at 180 days past due

to the lower of cost or market value, less liquidation costs. The

unsecured portion of these loans is charged off in accordance

with regulatory guidelines. The remaining portion of the loan

is placed on nonaccrual status.

Additionally, residential mortgage loans serviced by others

under master servicing arrangements and primary-serviced

residential loans not in process of foreclosure are also

classified as nonaccrual at 180 days past due or if a partial

write-down has occurred.

A loan is categorized as a troubled debt restructuring (TDR) if

a significant concession is granted due to deterioration in the

financial condition of the borrower. TDRs may include certain

modifications of terms of loans, receipts of assets from

debtors in partial or full satisfaction of loans, or a combination

97