PNC Bank 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

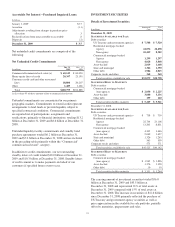

Goodwill and Other Intangible Assets

Goodwill increased $637 million and other intangible assets

increased $584 million at December 31, 2009 compared with

December 31, 2008. Note 2 Acquisitions and Divestitures and

Note 9 Goodwill and Other Intangible Assets in the Notes To

Consolidated Financial Statements in Item 8 of this Report

have further details on the National City-related items that

were the primary drivers of these increases.

F

UNDING AND

C

APITAL

S

OURCES

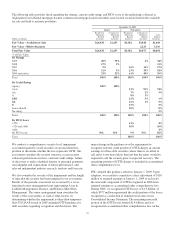

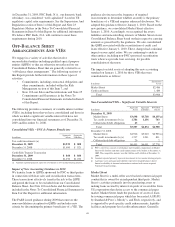

Details Of Funding Sources

In millions

Dec. 31

2009

Dec. 31

2008

Deposits

Money market $ 85,838 $ 77,889

Demand 40,406 33,001

Retail certificates of deposit 48,622 58,315

Savings 6,401 6,056

Other time 1,088 13,620

Time deposits in foreign offices 4,567 3,984

Total deposits 186,922 192,865

Borrowed funds

Federal funds purchased and repurchase

agreements 3,998 5,153

Federal Home Loan Bank borrowings 10,761 18,126

Bank notes and senior debt 12,362 13,664

Subordinated debt 9,907 11,208

Other 2,233 4,089

Total borrowed funds 39,261 52,240

Total $226,183 $245,105

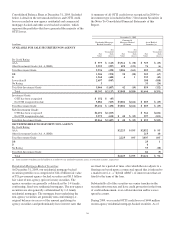

Total funding sources decreased $18.9 billion at December 31,

2009 compared with December 31, 2008 driven by declines in

other time deposits, retail certificates of deposit and Federal

Home Loan Bank borrowings, partially offset by increases in

money market and demand deposits.

Total deposits decreased $5.9 billion at December 31, 2009

compared with December 31, 2008. Relationship-growth

driven increases in money market, demand and savings

deposits were more than offset by declines in other time

deposits, reflecting a planned run-off of brokered certificates

of deposits, and non-relationship retail certificates of deposits.

We anticipate that growth in relationship-based deposits will

be offset by additional run-off of higher-cost retail time

deposits in 2010.

Interest-bearing deposits represented 76% of total deposits at

December 31, 2009 compared with 81% at December 31,

2008.

The $13.0 billion decline in borrowed funds since

December 31, 2008 primarily resulted from repayments of

Federal Home Loan Bank borrowings along with decreases in

all other borrowed fund categories.

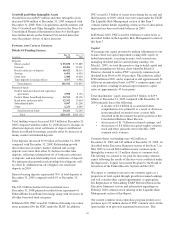

In March 2009, PNC issued $1.0 billion of floating rate senior

notes guaranteed by the FDIC under the TLGP. In addition,

PNC issued $1.5 billion of senior notes during the second and

third quarters of 2009, which were not issued under the TLGP.

The Liquidity Risk Management section of this Item 7

contains further details regarding actions we have taken which

impacted our borrowed funds balances in 2009.

In February 2010, PNC issued $2.0 billion of senior notes as

described further in the Liquidity Risk Management section of

this Item 7.

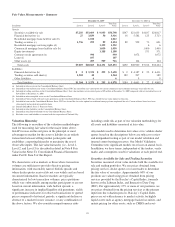

Capital

We manage our capital position by making adjustments to our

balance sheet size and composition, issuing debt, equity or

hybrid instruments, executing treasury stock transactions,

managing dividend policies and retaining earnings. On

March 1, 2009, we took the proactive step to build capital and

further strengthen our balance sheet when the Board of

Directors decided to reduce PNC’s quarterly common stock

dividend from $0.66 to $0.10 per share. The reduction added

$766 million in 2009, and is expected to add approximately $1

billion on an annualized basis, to PNC’s common equity and

cash positions, resulting in annual improvement in capital

ratios of approximately 40 basis points.

Total shareholders’ equity increased $4.5 billion, to $29.9

billion, at December 31, 2009 compared with December 31,

2008 primarily due to the following:

• A decline of $2.0 billion in accumulated other

comprehensive loss primarily as a result of decreases

in net unrealized securities losses as more fully

described in the Investment Securities portion of this

Consolidated Balance Sheet Review,

• An increase of $1.7 billion in retained earnings, and

• An increase of $.6 billion in capital surplus-common

stock and other, primarily due to the May 2009

common stock issuance.

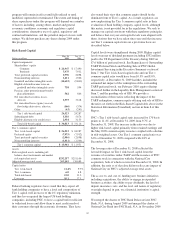

Common shares outstanding were 462 million at

December 31, 2009 and 443 million at December 31, 2008. As

described in the Executive Summary section of this Item 7, in

May 2009 we raised $624 million in new common equity

through the issuance of 15 million shares of common stock.

The offering was related to our plan for increasing common

equity following the results of the stress tests conducted under

the Supervisory Capital Assessment Program by the Board of

Governors of the Federal Reserve System and the OCC.

We expect to continue to increase our common equity as a

proportion of total capital through growth in retained earnings

and will consider other capital opportunities as appropriate.

See Repurchase of Outstanding TARP Preferred Stock in the

Executive Summary section and information regarding our

February 2010 common stock offering in the Liquidity Risk

Management section of this Report.

Our current common stock repurchase program permits us to

purchase up to 25 million shares of PNC common stock on the

open market or in privately negotiated transactions. This

38