PNC Bank 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

10 L

OAN

S

ALES AND

S

ECURITIZATIONS

Loan Sales

We sell residential and commercial mortgage loans in loan

securitization transactions sponsored by Government National

Mortgage Association (GNMA), FNMA, and FHLMC and in

certain instances to other third-party investors. GNMA,

FNMA, and the FHLMC securitize our transferred loans into

mortgage-backed securities for sale into the secondary market.

Generally, we do not retain any interest in the transferred

loans other than mortgage servicing rights. Refer to Note 9

Goodwill and Other Intangible Assets for further discussion

on our residential and commercial mortgage servicing rights

assets.

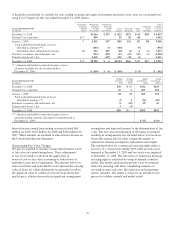

During 2009, residential and commercial mortgage loans sold

totaled $19.8 billion and $5.7 billion, respectively. During

2008, commercial mortgage loans sold totaled $3.1 billion.

There were no residential mortgage loans sales in 2008 as

these activities were obtained through our acquisition of

National City.

Our continuing involvement in these loan sales consists

primarily of servicing and limited repurchase obligations for

loan and servicer breaches in representations and warranties.

Generally, we hold a cleanup call repurchase option for loans

sold with servicing retained to the other third-party investors.

In certain circumstances as servicer, we advance principal and

interest payments to the GSEs and other third-party investors

and also may make collateral protection advances. Our risk of

loss in these servicing advances has historically been minimal.

We maintain a liability for estimated losses on loans expected

to be repurchased as a result of breaches in loan and servicer

representations and warranties. We have also entered into

recourse arrangements associated with commercial mortgage

loans sold to FNMA and FHLMC. Refer to Note 25

Commitments and Guarantees for further discussion on our

repurchase liability and recourse arrangements. Our maximum

exposure to loss in our loan sale activities is limited to these

repurchase and recourse obligations.

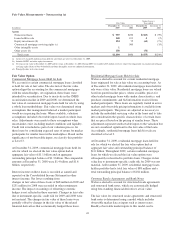

In addition, for certain loans transferred in the GNMA and

FNMA transactions, we hold an option to repurchase

individual delinquent loans that meet certain criteria. Without

prior authorization from these GSEs, this option gives PNC

the ability to repurchase the delinquent loan at par. Under

GAAP, once we have the unilateral ability to repurchase the

delinquent loan, effective control over the loan has been

regained and we are required to recognize the loan and a

corresponding repurchase liability on the balance sheet

regardless of our intent to repurchase the loan. At

December 31, 2009 and December 31, 2008, the balance of

our repurchase option asset and liability totaled $577 million

and $476 million, respectively.

Securitizations

In securitizations, loans are typically transferred to a

qualifying special purpose entity (QSPE) that is demonstrably

distinct from the transferor to transfer the risk from our

Consolidated Balance Sheet. A QSPE is a bankruptcy-remote

trust allowed to perform only certain passive activities. In

addition, these entities are self-liquidating and in certain

instances are structured as Real Estate Mortgage Investment

Conduits (REMICs) for tax purposes. The QSPEs are

generally financed by issuing certificates for various levels of

senior and subordinated tranches. QSPEs are exempt from

consolidation provided certain conditions are met.

Our securitization activities were primarily obtained through

our acquisition of National City. Credit card receivables,

automobile, and residential mortgage loans were securitized

through QSPEs sponsored by NCB. These QSPEs were

financed primarily through the issuance and sale of beneficial

interests to independent third parties and were not

consolidated on our balance sheet at December 31, 2009 or

December 31, 2008. However, see Note 1 Accounting Policies

regarding accounting guidance that impacts the accounting for

these QSPEs effective January 1, 2010.

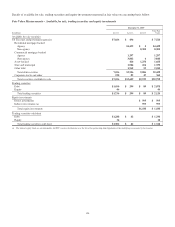

Qualitative and quantitative information about the

securitization QSPEs and our retained interests in these

transactions follow.

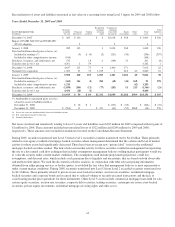

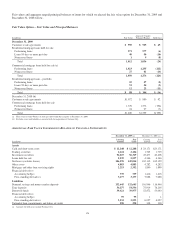

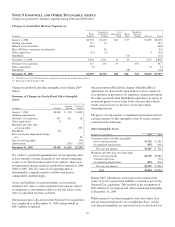

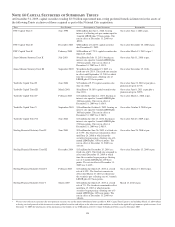

The following summarizes the assets and liabilities of the

securitization QSPEs associated with securitization

transactions that were outstanding at December 31, 2009.

December 31, 2009 December 31, 2008

In millions Credit Card Mortgage Credit Card Mortgage

Assets (a) $2,368 $232 $2,129 $319

Liabilities 1,622 232 1,824 319

(a) Represents period-end outstanding principal balances of loans transferred to the

securitization QSPEs.

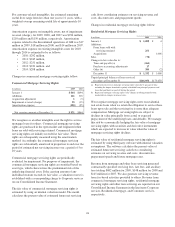

Credit Card Loans

At December 31, 2009, the credit card securitization series

2005-1, 2006-1, 2007-1, and 2008-3 were outstanding. During

the fourth quarter of 2009, the 2008-1 and 2008-2 credit card

securitization series matured. Our continuing involvement in

the securitized credit card receivables consists primarily of

servicing and our holding of certain retained interests.

Servicing fees earned approximate current market rates for

servicing fees; therefore, no servicing asset or liability is

recognized. We hold a clean-up call repurchase option to the

extent a securitization series extends past its scheduled note

principal payoff date. To the extent this occurs, the clean-up

call option is triggered when the principal balance of the asset-

backed notes of any series reaches 5% of the initial principal

balance of the asset-backed notes issued at the securitization

date.

129