MetLife 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

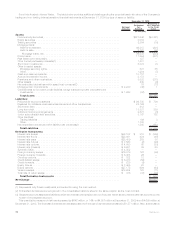

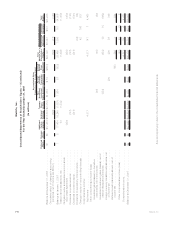

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2009 and 2008

(In millions, except share and per share data)

2009 2008

Assets

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $229,709 and $209,508,

respectively) .............................................................. $227,642 $188,251

Equity securities available-for-sale, at estimated fair value (cost: $3,187 and $4,131, respectively) . . . . . . . . 3,084 3,197

Trading securities, at estimated fair value (cost: $2,249 and $1,107, respectively) . . . . . . . . . . . . . . . . . . 2,384 946

Mortgage loans:

Held-for-investment, at amortized cost (net of valuation allowances of $721 and $304, respectively) . . . . . 48,181 49,352

Held-for-sale,principallyatestimatedfairvalue........................................ 2,728 2,012

Mortgageloans,net........................................................ 50,909 51,364

Policyloans................................................................ 10,061 9,802

Realestateandrealestatejointventuresheld-for-investment................................ 6,852 7,535

Realestateheld-for-sale........................................................ 44 51

Otherlimitedpartnershipinterests.................................................. 5,508 6,039

Short-terminvestments ........................................................ 8,374 13,878

Otherinvestedassets ......................................................... 12,709 17,248

Total investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 327,567 298,311

Cashandcashequivalents ....................................................... 10,112 24,207

Accruedinvestmentincome....................................................... 3,173 3,061

Premiumsandotherreceivables .................................................... 16,752 16,973

Deferredpolicyacquisitioncostsandvalueofbusinessacquired............................... 19,256 20,144

Currentincometaxrecoverable..................................................... 316 —

Deferredincometaxassets ....................................................... 1,228 4,927

Goodwill ................................................................... 5,047 5,008

Otherassets................................................................. 6,822 7,262

Assetsofsubsidiariesheld-for-sale .................................................. — 946

Separate account assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149,041 120,839

Totalassets .............................................................. $539,314 $501,678

Liabilities and Stockholders’ Equity

Liabilities:

Futurepolicybenefits.......................................................... $135,879 $130,555

Policyholder account balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138,673 142,921

Otherpolicyholderfunds........................................................ 8,446 7,762

Policyholderdividendspayable ................................................... 761 1,023

Payablesforcollateralundersecuritiesloanedandothertransactions .......................... 24,196 31,059

Bankdeposits .............................................................. 10,211 6,884

Short-termdebt ............................................................. 912 2,659

Long-termdebt.............................................................. 13,220 9,667

Collateralfinancingarrangements.................................................. 5,297 5,192

Juniorsubordinateddebtsecurities................................................. 3,191 3,758

Currentincometaxpayable...................................................... — 342

Otherliabilities .............................................................. 15,989 14,284

Liabilitiesofsubsidiariesheld-for-sale ............................................... — 748

Separate account liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149,041 120,839

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 505,816 477,693

Contingencies, Commitments and Guarantees (Note 16)

Stockholders’ Equity:

MetLife, Inc.’s stockholders’ equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized; 84,000,000 shares issued and

outstanding;$2,100aggregateliquidationpreference..................................... 1 1

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 822,359,818 and

798,016,664 shares issued at December 31, 2009 and 2008, respectively; 818,833,810 and

793,629,070 shares outstanding at December 31, 2009 and 2008, respectively . . . . . . . . . . . . . . . . . . . 8 8

Additionalpaid-incapital......................................................... 16,859 15,811

Retainedearnings ............................................................. 19,501 22,403

Treasury stock, at cost; 3,526,008 and 4,387,594 shares at December 31, 2009 and 2008, respectively . . . . (190) (236)

Accumulatedothercomprehensiveloss ............................................... (3,058) (14,253)

TotalMetLife,Inc.’sstockholders’equity............................................ 33,121 23,734

Noncontrollinginterests.......................................................... 377 251

Totalequity............................................................... 33,498 23,985

Totalliabilitiesandstockholders’equity............................................. $539,314 $501,678

See accompanying notes to the consolidated financial statements.

F-2 MetLife, Inc.