MetLife 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

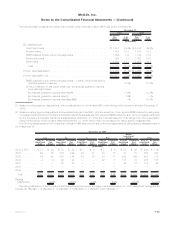

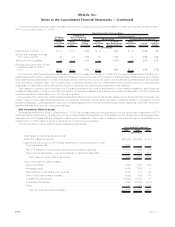

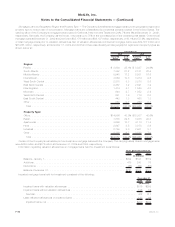

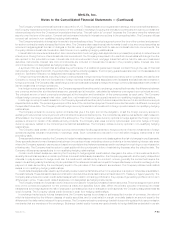

Net Investment Income

The components of net investment income are as follows:

2009 2008 2007

Years Ended December 31,

(In millions)

Fixedmaturitysecurities......................................... $11,617 $13,577 $14,576

Equitysecurities .............................................. 178 258 265

Tradingsecurities ............................................. 400 (193) 50

Mortgageloans............................................... 2,743 2,855 2,811

Policyloans................................................. 648 601 572

Realestateandrealestatejointventures .............................. (196) 574 943

Otherlimitedpartnershipinterests................................... 174 (170) 1,309

Cash,cashequivalentsandshort-terminvestments ....................... 129 353 491

Internationaljointventures(1)...................................... (115) 43 17

Other ..................................................... 205 350 320

Totalinvestmentincome........................................ 15,783 18,248 21,354

Less:Investmentexpenses....................................... 945 1,957 3,297

Netinvestmentincome ........................................ $14,838 $16,291 $18,057

(1) Amounts are presented net of changes in estimated fair value of derivatives related to economic hedges of the Company’s investment in

these equity method international joint investments that do not qualify for hedge accounting of ($143) million, $178 million and $12 million

for the years ended December 31, 2009, 2008 and 2007, respectively. The current year losses were primarily attributable to losses on

equity derivatives and losses on foreign currency derivatives (both of which are used to hedge embedded derivative risk) due to improving

equity markets in the current period and the U.S. Dollar weakening against several major foreign currencies. In addition, included in the

equity in earnings of the joint ventures were losses attributable to the narrowing of the Company’s own credit spread, which is included in

the valuation of certain liabilities, including embedded derivatives, that are carried at estimated fair value.

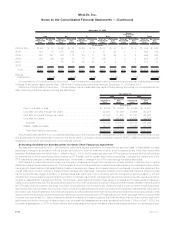

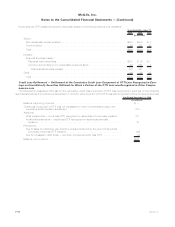

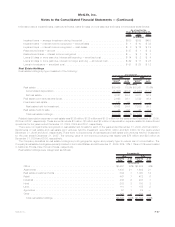

Securities Lending

The Company participates in securities lending programs whereby blocks of securities, which are included in fixed maturity securities and

short-term investments, are loaned to third parties, primarily brokerage firms and commercial banks. The Company generally obtains

collateral in an amount equal to 102% of the estimated fair value of the securities loaned. Securities loaned under such transactions may be

sold or repledged by the transferee. The Company is liable to return to its counterparties the cash collateral under its control, the amounts of

which by aging category are presented below.

Elements of the securities lending programs are presented below at:

2009 2008

December 31,

(In millions)

Securities on loan:

Costoramortizedcost................................................ $21,012 $20,791

Estimatedfairvalue .................................................. $20,949 $22,885

Aging of cash collateral liability:

Open(1).......................................................... $ 3,290 $ 5,118

Lessthanthirtydays ................................................. 13,605 14,711

Thirtydaysorgreaterbutlessthansixtydays ................................. 3,534 3,472

Sixtydaysorgreaterbutlessthanninetydays................................. 92 —

Ninetydaysorgreater ................................................ 995 —

Totalcashcollateralliability............................................ $21,516 $23,301

Securitycollateralondepositfromcounterparties ................................ $ 6 $ 279

Reinvestmentportfolio—estimatedfairvalue................................... $20,339 $19,509

(1) Open — meaning that the related loaned security could be returned to the Company on the next business day requiring the Company to

immediately return the cash collateral.

The estimated fair value of the securities related to the cash collateral on open at December 31, 2009 has been reduced to $3,193 million

from $4,986 million at December 31, 2008. Of the $3,193 million of estimated fair value of the securities related to the cash collateral on open

F-43MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)