MetLife 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

at December 31, 2009, $3,012 million were U.S. Treasury, agency and government guaranteed securities which, if put to the Company, can

be immediately sold to satisfy the cash requirements. The remainder of the securities on loan, related to the cash collateral aged less than

thirty days to ninety days or greater, was primarily U.S. Treasury, agency and government guaranteed securities, and very liquid RMBS. The

reinvestment portfolio acquired with the cash collateral consisted principally of fixed maturity securities (including RMBS, ABS, U.S. corporate

and foreign corporate securities).

Security collateral on deposit from counterparties in connection with the securities lending transactions may not be sold or repledged,

unless the counterparty is in default, and is not reflected in the consolidated financial statements.

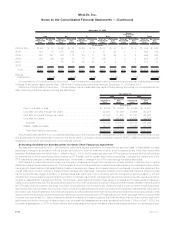

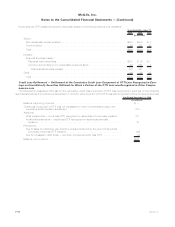

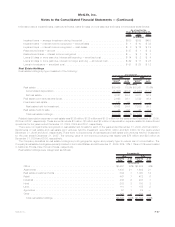

Invested Assets on Deposit, Held in Trust and Pledged as Collateral

The invested assets on deposit, invested assets held in trust and invested assets pledged as collateral are presented in the table below.

The amounts presented in the table below are at estimated fair value for cash and cash equivalents, fixed maturity and equity securities and at

carrying value for mortgage loans.

2009 2008

December 31,

(In millions)

Invested assets on deposit:

Regulatoryagencies(1)................................................ $ 1,383 $ 1,282

Invested assets held in trust:

Collateralfinancingarrangements(2) ....................................... 5,653 4,431

Reinsurancearrangements(3)............................................ 2,719 2,037

Invested assets pledged as collateral:

Debtandfundingagreements—FHLBofNY(4)................................ 20,612 20,880

Debtandfundingagreements—FHLBofBoston(4) ............................. 419 1,284

Fundingagreements—FarmerMAC(5) ..................................... 2,871 2,875

FederalReserveBankofNewYork(6)....................................... 1,537 1,577

Collateralfinancingarrangements(7) ....................................... 80 316

Derivativetransactions(8) .............................................. 1,671 1,744

Shortsaleagreements(9)............................................... 496 346

Other............................................................. — 180

Totalinvestedassetsondeposit,heldintrustandpledgedascollateral ................ $37,441 $36,952

(1) The Company had investment assets on deposit with regulatory agencies consisting primarily of fixed maturity and equity securities.

(2) The Company held in trust cash and securities, primarily fixed maturity and equity securities, to satisfy collateral requirements.

(3) The Company has pledged certain investments, primarily fixed maturity securities, in connection with certain reinsurance transactions.

(4) The Company has pledged fixed maturity securities and mortgage loans in support of its debt and funding agreements with the Federal

Home Loan Bank of New York (“FHLB of NY”) and has pledged fixed maturity securities to the Federal Home Loan Bank of Boston (“FHLB of

Boston”). The nature of these Federal Home Loan Bank arrangements is described in Note 8.

(5) The Company has pledged certain agricultural real estate mortgage loans in connection with funding agreements with the Federal

AgriculturalMortgageCorporation(“FarmerMAC”).ThenatureoftheFarmerMACarrangementsisdescribedinNote8.

(6) The Company has pledged qualifying mortgage loans and fixed maturity securities in connection with collateralized borrowings from the

Federal Reserve Bank of New York’s Term Auction Facility. The nature of the Federal Reserve Bank of New York arrangements is described

in Note 11.

(7) The Holding Company has pledged certain collateral in support of the collateral financing arrangements described in Note 12.

(8) Certain of the Company’s invested assets are pledged as collateral for various derivative transactions as described in Note 4.

(9) Certain of the Company’s trading securities and cash and cash equivalents are pledged to secure liabilities associated with short sale

agreements in the trading securities portfolio as described in the following section.

See also the immediately preceding section “Securities Lending” for the amount of the Company’s cash and invested assets received from

and due back to counterparties pursuant to the securities lending program.

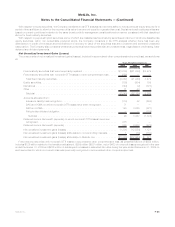

Trading Securities

The Company has trading securities portfolios to support investment strategies that involve the active and frequent purchase and sale of

securities, the execution of short sale agreements and asset and liability matching strategies for certain insurance products.

F-44 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)