MetLife 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

With respect to equity securities, the Company considers in its OTTI analysis its intent and ability to hold a particular equity security for a

period of time sufficient to allow for the recovery of its value to an amount equal to or greater than cost. Decisions to sell equity securities are

based on current conditions in relation to the same broad portfolio management considerations in a manner consistent with that described

above for fixed maturity securities.

With respect to perpetual hybrid securities, some of which are classified as fixed maturity securities and some of which are classified as

equity securities, within non-redeemable preferred stock, the Company considers in its OTTI analysis whether there has been any

deterioration in credit of the issuer and the likelihood of recovery in value of the securities that are in a severe and extended unrealized

loss position. The Company also considers whether any perpetual hybrid securities with an unrealized loss, regardless of credit rating, have

deferred any dividend payments.

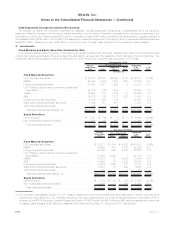

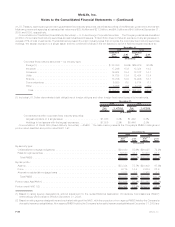

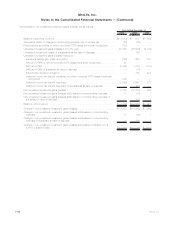

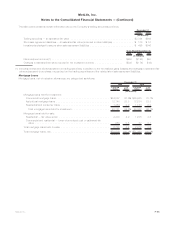

Net Unrealized Investment Gains (Losses)

The components of net unrealized investment gains (losses), included in accumulated other comprehensive income (loss), are as follows

at:

2009 2008 2007

Years Ended December 31,

(In millions)

Fixed maturity securities that were temporarily impaired . . . . . . . . . . . . . . . . . . . . . $(1,208) $(21,246) $ 3,479

Fixed maturity securities with noncredit OTTI losses in other comprehensive loss . . . . . (859) — —

Totalfixedmaturitysecurities..................................... (2,067) (21,246) 3,479

Equitysecurities............................................... (103) (934) 159

Derivatives .................................................. (144) (2) (373)

Other...................................................... 71 53 3

Subtotal .................................................. (2,243) (22,129) 3,268

Amounts allocated from:

Insuranceliabilitylossrecognition.................................. (118) 42 (608)

DAC and VOBA on which noncredit OTTI losses have been recognized . . . . . . . . . . 71 — —

DACandVOBA.............................................. 145 3,025 (327)

Policyholderdividendobligation ................................... — — (789)

Subtotal................................................. 98 3,067 (1,724)

Deferred income tax benefit (expense) on which noncredit OTTI losses have been

recognized................................................. 275 — —

Deferredincometaxbenefit(expense) ................................ 539 6,508 (423)

Netunrealizedinvestmentgains(losses)............................... (1,331) (12,554) 1,121

Net unrealized investment gains (losses) attributable to noncontrolling interests . . . . . . 1 (10) (150)

Net unrealized investment gains (losses) attributable to MetLife, Inc. . . . . . . . . . . . . . $(1,330) $(12,564) $ 971

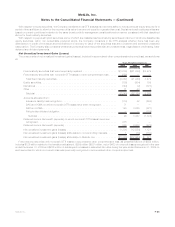

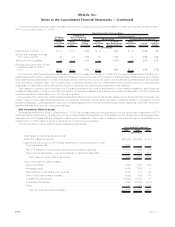

Fixed maturity securities with noncredit OTTI losses in accumulated other comprehensive loss, as presented above of $859 million,

includes $126 million related to the transition adjustment, $939 million ($857 million, net of DAC) of noncredit losses recognized in the year

ended December 31, 2009 and $206 million of subsequent increases in estimated fair value during the year ended December 31, 2009 on

such securities for which a noncredit loss was previously recognized in accumulated other comprehensive loss.

F-35MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)