MetLife 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

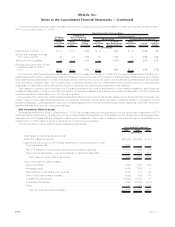

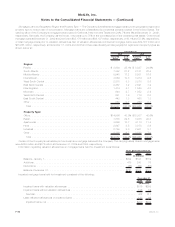

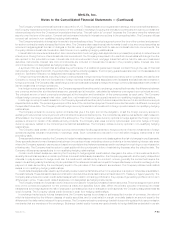

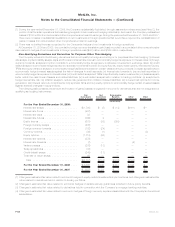

The Company invests in certain entities that are VIEs, as a passive investor holding a limited partnership interest, or as a sponsor or debt

holder. The following table presents the carrying amount and maximumexposuretolossrelatingtoVIEsforwhichtheCompanyholds

significant variable interests but is not the primary beneficiary and which have not been consolidated at December 31, 2009 and 2008:

Carrying

Amount

Maximum

Exposure

to Loss(1) Carrying

Amount

Maximum

Exposure

to Loss(1)

2009 2008

December 31,

(In millions)

Fixed maturity securities available-for-sale:

Foreigncorporatesecurities .............................. $1,254 $1,254 $1,080 $1,080

U.S.corporatesecurities ................................ 1,216 1,216 992 992

Otherlimitedpartnershipinterests............................ 2,543 2,887 3,496 4,004

Otherinvestedassets.................................... 416 409 318 108

Equity securities available-for-sale:

Non-redeemablepreferred ............................... 31 31 — —

Realestatejointventures.................................. 30 30 32 32

Total.............................................. $5,490 $5,827 $5,918 $6,216

(1) The maximum exposure to loss relating to the fixed maturity securities available-for-sale and equity securities available-for-sale is equal to

the carrying amounts or carrying amounts of retained interests. The maximum exposure to loss relating to the real estate joint ventures and

other limited partnership interests is equal to the carrying amounts plus any unfunded commitments. Such a maximum loss would be

expected to occur only upon bankruptcy of the issuer or investee. For certain of its investments in other invested assets, the Company’s

return is in the form of tax credits which are guaranteed by a creditworthy third-party. For such investments, the maximum exposure to loss

is equal to the carrying amounts plus any unfunded commitments, reduced by amounts guaranteed by third parties of $232 million and

$278 million at December 31, 2009 and 2008, respectively.

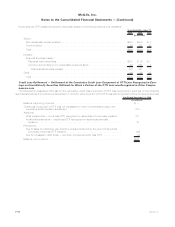

As described in Note 16, the Company makes commitments to fund partnership investments in the normal course of business. Excluding

these commitments, the Company did not provide financial or other support to investees designated as VIEs during the years ended

December 31, 2009, 2008 and 2007.

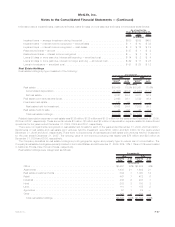

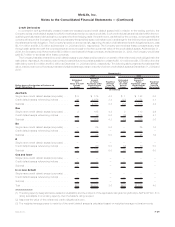

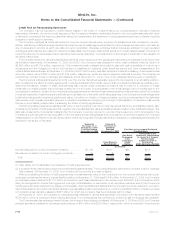

4. Derivative Financial Instruments

Accounting for Derivative Financial Instruments

SeeNote1foradescriptionoftheCompany’saccounting policies for derivative financial instruments.

See Note 5 for information about the fair value hierarchy for derivatives.

F-50 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)