MetLife 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

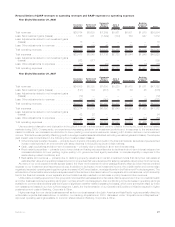

invested assets was due to increased cash flows from the sales of fixed annuity products and more customers electing the fixed option on

variable annuity sales, which were reinvested primarily in fixed maturity securities, other invested assets and mortgage loans. Yields were

adversely impacted by the severe downturn in the global financial markets which primarily impacted real estate joint ventures, fixed maturity

securities and cash, cash equivalents and short-term investments. The moderate improvement in the equity markets in 2009 led to an

increase in yields on other limited partnership interests and certain other invested assets, which partially offset the overall reduction in yields.

To manage the needs of our intermediate to longer-term liabilities, our portfolio consists primarily of investment grade corporate fixed maturity

securities, structured finance securities, mortgage loans and U.S. Treasury, agency and government guaranteed fixed maturity securities

and, to a lesser extent, certain other invested asset classes, including real estate joint ventures in order to provide additional diversification

and opportunity for long-term yield enhancement. As is typically the case with fixed annuity products, higher net investment income was

somewhat offset by higher interest credited expense. Growth in our fixed annuity policyholder account balances increased interest credited

expense by $177 million in 2009 and higher average crediting rates on fixed annuities increased interest credited expense by $37 million.

Operating earnings were negatively impacted by $348 million of operating losses related to the hedging programs for variable annuity

minimum death and income benefit guarantees, which are not embedded derivatives, partially offset by a decrease in the liability established

for these variable annuity guarantees. The various hedging strategies in place to offset the risk associated with these variable annuity

guarantee benefits were more sensitive to market movements than the liability for the guaranteed benefit. Market volatility, improvements in

the equity markets, and higher interest rates produced operating losses on these hedging strategies in the current year. Our hedging

strategies, which are a key part of our risk management, performed as anticipated. The decrease in annuity guarantee benefit liabilities was

due to the improvement in the equity markets, higher interest rates and the annual unlocking of future market expectations.

Other expenses increased by $221 million primarily due to an increase of $122 million from the impact of market conditions on certain

expenses. These expenses are largely comprised of reinsurance costs, pension and postretirement benefit expenses, and letter of credit

fees. In addition, variable expenses, such as commissions and premium taxes, increased $76 million, the majority of which have been offset

by DAC capitalization. The positive impact of our Operational Excellence initiative was reflected in lower information technology, travel,

professional services and advertising expenses, but was more than offset by increases largely due to business growth.

Finally, policy fees and other revenues decreased by $100 million, mainly due to lower average separate account balances in the current

year versus prior year.

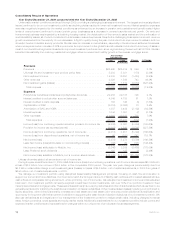

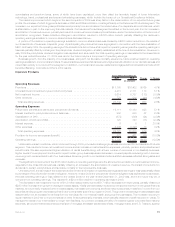

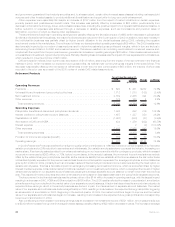

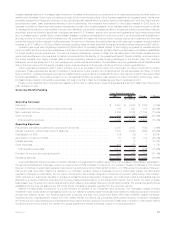

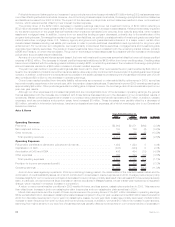

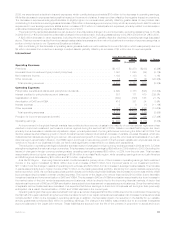

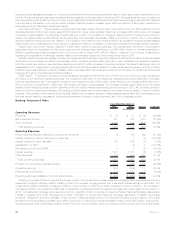

Corporate Benefit Funding

2009 2008 Change % Change

Years Ended December 31,

(In millions)

Operating Revenues

Premiums................................................... $ 2,561 $ 2,683 $ (122) (4.5)%

Universallifeandinvestment-typeproductpolicyfees...................... 176 227 (51) (22.5)%

Netinvestmentincome.......................................... 4,766 5,874 (1,108) (18.9)%

Otherrevenues............................................... 239 359 (120) (33.4)%

Totaloperatingrevenues ....................................... 7,742 9,143 (1,401) (15.3)%

Operating Expenses

Policyholder benefits and claims and policyholder dividends . . . . . . . . . . . . . . . . . . 4,797 4,977 (180) (3.6)%

Interestcreditedtopolicyholderaccountbalances ........................ 1,633 2,298 (665) (28.9)%

CapitalizationofDAC ........................................... (14) (18) 4 22.2%

AmortizationofDACandVOBA..................................... 15 29 (14) (48.3)%

Interestexpense .............................................. 3 2 1 50.0%

Otherexpenses............................................... 484 476 8 1.7%

Totaloperatingexpenses ....................................... 6,918 7,764 (846) (10.9)%

Provisionforincometaxexpense(benefit).............................. 273 466 (193) (41.4)%

Operatingearnings............................................. $ 551 $ 913 $ (362) (39.6)%

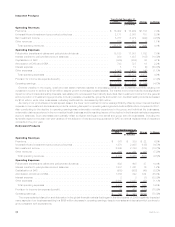

Corporate Benefit Funding benefited in certain markets in 2009 as a flight to quality helped drive our increase in market share, especially in

the structured settlement business, where we experienced a 53% increase in premiums. Our pension closeout business in the United

Kingdom continues to expand and experienced premium growth during 2009 of almost $400 million, or 105% before income taxes. However,

this growth was more than offset by a decline in our domestic pension closeout business driven by unfavorable market conditions and

regulatory changes. A combination of poor equity returns and lower interest rates have contributed to pension plans being under funded,

which reduces our customers’ flexibility to engage in transactions such as pension closeouts. Our customers’ plans funded status may be

affected by a variety of factors, including the ongoing phased implementation of the Pensions Protection Act of 2006. For each of these

businesses, the movement in premiums is almost entirely offset by the related change in policyholder benefits. The insurance liability that is

established at the time we assume the risk under these contracts is typically equivalent to the premium earned.

Market conditions also contributed to a lower demand for several of our investment-type products. The decrease in sales of these

investment-type products is not necessarily evident in our results of operations as the transactions related to these products are recorded

through the balance sheet. Our funding agreement products, primarily the London Inter-Bank Offer Rate (“LIBOR”) based contracts,

experienced the most significant impact from the volatile market conditions. As companies seek greater liquidity, investment managers

are refraining from repurchasing the contracts when they mature and are opting for more liquid investments. In addition, unfavorable market

conditions continued to impact the demand for global guaranteed interest contracts, a type of funding agreement.

21MetLife, Inc.