MetLife 2009 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

pledged qualifying loans and investment securities to the Federal Reserve Bank of New York as collateral. At December 31, 2008, MetLife

Bank’s liability for advances from the Federal Reserve Bank of New York under these facilities was $950 million, which is included in short-term

debt. MetLife Bank had no liability for advances from the Federal Reserve Bank of New York under these facilities at December 31, 2009. The

estimated fair value of loan and investment security collateral pledged by MetLife Bank to the Federal Reserve Bank of New York at

December 31, 2009 and 2008 was $1.5 billion and $1.6 billion, respectively. During the years ended December 31, 2009 and 2008, the

weighted average interest rate on these advances was 0.26% and 0.79%, respectively. During the years ended December 31, 2009 and

2008, respectively, the average daily balance of these advances was $1,513 million and $145 million and these advances were outstanding

for an average of 24 days and 41 days. The Company did not participate in these programs during 2007.

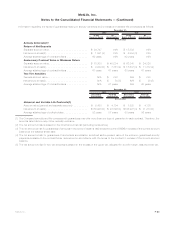

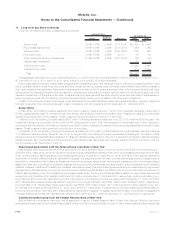

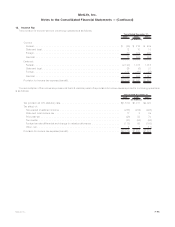

Short-term Debt

Short-term debt with maturities less than one year is as follows:

2009 2008

December 31,

(In millions)

Commercialpaper ................................................... $ 319 $ 714

MetLife Bank, N.A. — Collateralized borrowings from the Federal Reserve Bank of New York . . . — 950

MetLifeBank,N.A.—RepurchaseagreementswiththeFHLBofNY................... 585 695

MetLife Insurance Company of Connecticut — Collateralized borrowings from the FHLB of

Boston ......................................................... — 300

Other............................................................ 8 —

Totalshort-termdebt ................................................ $ 912 $ 2,659

Averagedailybalance................................................. $ 2,845 $ 1,252

Averagedaysoutstanding .............................................. 16days 25days

During the years ended December 31, 2009, 2008 and 2007, the weighted average interest rate on short-term debt was 0.42%, 2.4% and

5.0%, respectively.

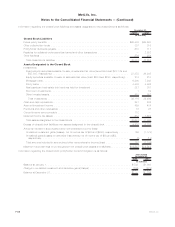

Interest Expense

Interest expense related to the Company’s indebtedness included in other expenses was $713 million, $554 million and $600 million for

the years ended December 31, 2009, 2008 and 2007, respectively, and does not include interest expense on collateral financing

arrangements, junior subordinated debt securities or common equity units. See Notes 12 and 13.

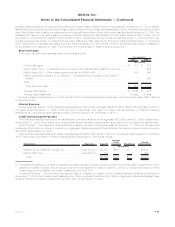

Credit and Committed Facilities

The Company maintains unsecured credit facilities and committed facilities, which aggregated $3.2 billion and $12.8 billion, respectively,

at December 31, 2009. When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements.

Credit Facilities. The unsecured credit facilities are used for general corporate purposes. At December 31, 2009, the Company had

outstanding $548 million in letters of credit and no aggregate drawdowns against these facilities. Remaining unused commitments were

$2.6 billion at December 31, 2009.

Total fees expensed associated with these credit facilities were $43 million and $17 million for the years ended December 31, 2009 and

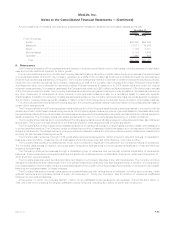

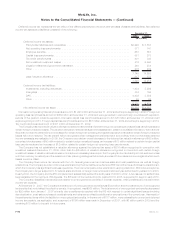

2008, respectively. Information on these credit facilities at December 31, 2009 is as follows:

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . June 2012 (1) $2,850 $548 $ — $2,302

MetLifeBank,N.A. ...................... August2010 300 — — 300

Total .............................. $3,150 $548 $— $2,602

(1) Proceeds are available to be used for general corporate purposes, to support the borrowers’ commercial paper programs and for the

issuance of letters of credit. All borrowings under the credit agreement must be repaid by June 2012, except that letters of credit

outstanding upon termination may remain outstanding until June 2013.

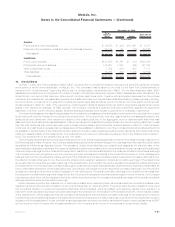

Committed Facilities. The committed facilities are used for collateral for certain of the Company’s affiliated reinsurance liabilities. At

December 31, 2009, the Company had outstanding $4.7 billion in letters of credit and $2.8 billion in aggregate drawdowns against these

facilities. Remaining unused commitments were $5.4 billion at December 31, 2009.

F-91MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)