MetLife 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

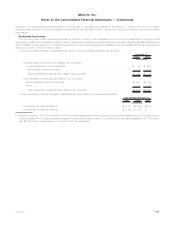

on the underlying assets, interest rates and market volatility may result in significant fluctuations in the estimated fair value of these embedded

derivatives that could materially affect net income.

The estimated fair value of the embedded equity and bond indexed derivatives contained in certain funding agreements is determined

using market standard swap valuation models and observable market inputs, including an adjustment for theCompany’sowncreditthattakes

into consideration publicly available information relating to the Company’s debt, as well as its claims paying ability. The estimated fair value of

these embedded derivatives are included, along with their funding agreements host, within policyholder account balances with changes in

estimated fair value recorded in net investment gains (losses). Changes in equity and bond indices, interest rates and the Company’s credit

standing may result in significant fluctuations in the estimated fair value of these embedded derivatives that could materially affect net income.

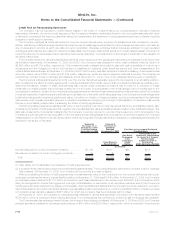

Assets and Liabilities of Subsidiaries Held-For-Sale — The carrying value of the assets and liabilities of subsidiaries held-for-sale reflects

those assets and liabilities which were previously determined to be financial instruments and which were reflected in other financial statement

captions in the table above in previous periods but have been reclassified to this caption to reflect the discontinued nature of the operations.

The estimated fair value of the assets and liabilities of subsidiaries held-for-sale have been determined on a basis consistent with the asset

type as described herein.

Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments —

Theestimatedfairvaluesformortgageloancommitments and commitments to fund bank credit facilities, bridge loans and private corporate

bond investments reflected in the above table represent the difference between the discounted expected future cash flows using interest

rates that incorporate current credit risk for similar instruments on the reporting date and the principal amounts of the original commitments.

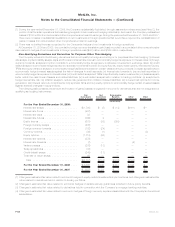

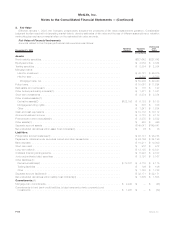

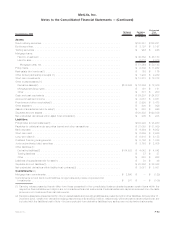

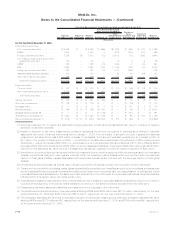

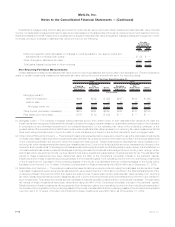

Assets and Liabilities Measured at Fair Value

Recurring Fair Value Measurements

The assets and liabilities measured at estimated fair value on a recurring basis, including those items for which the Company has elected

the fair value option, are determined as described in the preceding section. These estimated fair values and their corresponding fair value

hierarchy are summarized as follows:

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Fair Value Measurements at Reporting Date Using

December 31, 2009

(In millions)

Assets

Fixed maturity securities:

U.S.corporatesecurities............................. $ — $ 65,493 $ 6,694 $ 72,187

RMBS......................................... — 42,180 1,840 44,020

Foreigncorporatesecurities........................... — 32,738 5,292 38,030

U.S. Treasury, agency and government guaranteed securities . . . . . 10,951 14,459 37 25,447

CMBS......................................... — 15,483 139 15,622

ABS .......................................... — 10,450 2,712 13,162

Foreigngovernmentsecurities ......................... 306 11,240 401 11,947

Stateandpoliticalsubdivisionsecurities................... — 7,139 69 7,208

Otherfixedmaturitysecurities ......................... — 13 6 19

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . 11,257 199,195 17,190 227,642

Equity securities:

Commonstock................................... 490 995 136 1,621

Non-redeemablepreferredstock........................ — 359 1,104 1,463

Totalequitysecurities ............................. 490 1,354 1,240 3,084

Tradingsecurities................................... 1,886 415 83 2,384

Short-terminvestments(1) ............................. 5,650 2,500 23 8,173

Mortgageloans(2)................................... — 2,445 25 2,470

Derivativeassets(3).................................. 103 5,600 430 6,133

Netembeddedderivativeswithinassethostcontracts(4) ......... — — 76 76

Mortgageservicingrights(5) ............................ — — 878 878

Separate account assets(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,601 129,545 1,895 149,041

Totalassets ..................................... $36,987 $341,054 $21,840 $399,881

F-68 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)