MetLife 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

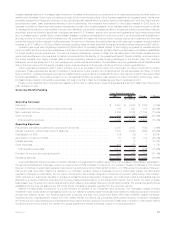

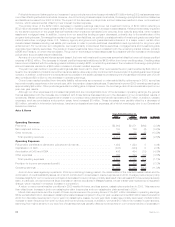

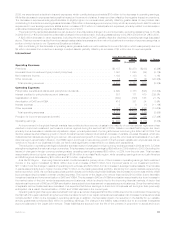

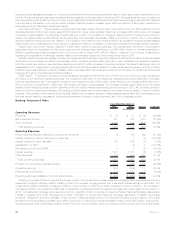

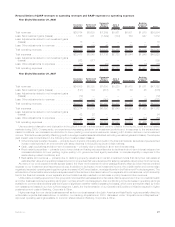

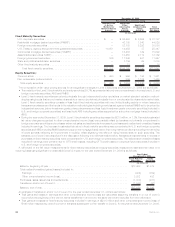

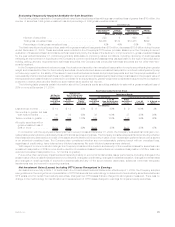

Banking, Corporate & Other

2008 2007 Change % Change

Years Ended December 31,

(In millions)

Operating Revenues

Premiums .................................................... $ 27 $ 35 $ (8) (22.9)%

Netinvestmentincome............................................ 808 1,428 (620) (43.4)%

Otherrevenues................................................. 184 72 112 155.6%

Totaloperatingrevenues ......................................... 1,019 1,535 (516) (33.6)%

Operating Expenses

Policyholderbenefitsandclaimsandpolicyholderdividends.................... 46 46 — —%

Interestcreditedtopolicyholderaccountbalances.......................... 7 — 7 —%

Interestcreditedtobankdeposits..................................... 166 200 (34) (17.0)%

CapitalizationofDAC............................................. (3) (8) 5 62.5%

AmortizationofDACandVOBA ...................................... 5 11 (6) (54.5)%

Interestexpense................................................ 1,033 875 158 18.1%

Otherexpenses ................................................ 699 328 371 113.1%

Totaloperatingexpenses......................................... 1,953 1,452 501 34.5%

Provisionforincometaxexpense(benefit) ............................... (495) (157) (338) (215.3)%

Operatingearnings .............................................. (439) 240 (679) (282.9)%

Preferredstockdividends.......................................... 125 137 (12) (8.8)%

Operating earnings available to common shareholders . . . . . . . . . . . . . . . . . . . . . . . $ (564) $ 103 $(667) (647.6)%

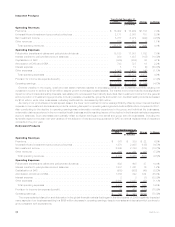

As a result of the extraordinary market conditions that began in late 2008, we experienced decreasing yields on our other limited

partnership interests and cash, cash equivalents and short-term investments. The decreased yields resulted in a $403 million decrease in

investment results, despite the positive impact of a higher asset base resulting from the investment of a portion of the proceeds from debt

issuances in 2008 and late 2007. These lower investment results were the primary driver of the $667 million decline in operating earnings

available to common shareholders as compared to 2007.

Increases in interest expense, corporate expenses and legal costs also contributed to the decline in operating earnings (loss). Higher

interest expense was the result of the various debt issuances in 2008 and late 2007. The implementation of our Operational Excellence

initiative resulted in higher postemployment related costs. In addition, corporate support expenses, including incentive compensation, rent,

advertising, and information technology costs, were higher than in 2007. Lastly, legal costs were higher due primarily to the commutation of

three asbestos-related excess insurance policies. The increases in these corporate expenses were partially offset by a reduction in deferred

compensation costs.

Banking results improved operating earnings by $21 million primarily due to the acquisitions made by MetLife Bank in 2008. See Note 2 of

the Notes to the Consolidated Financial Statements.

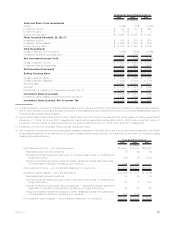

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as inflation

may affect interest rates.

Inflation in the United States has remained contained and been in a general downtrend for an extended period. However, in light of recent

and ongoing aggressive fiscal and monetary stimulus measures by the U.S. federal government and foreign governments, it is possible that

inflation could increase in the future. An increase in inflation could affect our business in several ways. During inflationary periods, the value of

fixed income investments falls which could increase realized and unrealized losses. Inflation also increases expenses for labor and other

materials, potentially putting pressure on profitability if such costs can not be passed through in our product prices. Inflation could also lead to

increased costs for losses and loss adjustment expenses in our Auto & Home business, which could require us to adjust our pricing to reflect

our expectations for future inflation. If actual inflation exceeds the expectations we use in pricing our policies, the profitability of our Auto &

Home business would be adversely affected. Prolonged and elevated inflation could adversely affect the financial markets and the economy

generally, and dispelling it may require governments to pursue a restrictive fiscal and monetary policy, which could constrain overall economic

activity,inhibitrevenuegrowthandreducethenumberofattractiveinvestmentopportunities.

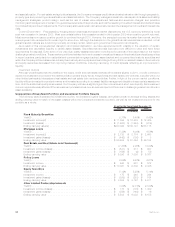

Investments

Investment Risks. The Company’s primary investment objective is to optimize, net of income tax, risk-adjusted investment income and

risk-adjusted total return while ensuring that assets and liabilities are managed on a cash flow and duration basis. The Company is exposed to

four primary sources of investment risk:

• credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and

interest;

• interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates;

• liquidity risk, relating to the diminished ability to sell certain investments in times of strained market conditions; and

• market valuation risk, relating to the variability in the estimated fair value of investments associated with changes in market factors such

as credit spreads.

The Company manages risk through in-house fundamental analysis of the underlying obligors, issuers, transaction structures and real

estate properties. The Company also manages credit risk, market valuation risk and liquidity risk through industry and issuer diversification

31MetLife, Inc.