MetLife 2009 Annual Report Download - page 70

Download and view the complete annual report

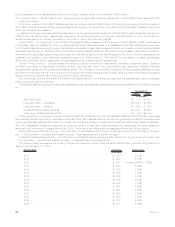

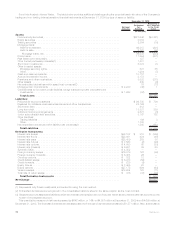

Please find page 70 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash provided by operating activities increased by $0.8 billion to $10.7 billion for the year ended December 31, 2008 as compared to

$9.9 billion for the year ended December 31, 2007.

Net cash used in financing activities was $4.1 billion for the year ended December 31, 2009 as compared to net cash provided by

financing activities of $6.2 billion for the year ended December 31, 2008. Accordingly, net cash provided by (used in) financing activities

decreased by $10.3 billion for the year ended December 31, 2009 as compared to the year ended December 31, 2008. During 2009 and

2008, the Company reduced securities lending activities in line with market conditions, which resulted in decreases in the cash collateral

received in connection with the securities lending program of $1.6 billion and $20.0 billion for the years ended December 31, 2009 and 2008,

respectively. The Company also experienced a $5.1 billion decrease in cash collateral received under derivatives transactions for the year

ended December 31, 2009 compared to an increase of $6.9 billion for the year ended December 31, 2008. The cash collateral received

under derivatives transactions is invested in cash, cash equivalents and short-term investments. Additionally, net cash flows from policy-

holder account balances decreased by $2.3 billion for the year ended December 31, 2009 compared to a net increase of $13.6 billion during

the year ended December 31, 2008, primarily as a result of unfavorable market conditions for the issuance of funding agreements and funding

agreement-backed notes during most of the period. During the year ended December 31, 2009, there was a net issuance of long-term and

junior subordinated debt of $2.9 billion compared to a net issuance of $667 million in the year ended December 31, 2008. Finally, during the

year ended December 31, 2009, the Company had a net increase in cash from the issuance of common stock of $1.0 billion as compared to a

$2.0 billion net increase during the year ended December 31, 2008.

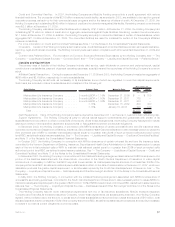

Net cash provided by financing activities was $6.2 billion and $3.9 billion for the years ended December 31, 2008 and 2007, respectively.

Accordingly, net cash provided by financing activities increased by $2.3 billion for the year ended December 31, 2008 as compared to the

prior year. In 2008 the Company reduced securities lending activities in line with market conditions, which resulted in a decrease of

$20.0 billion in the cash collateral received in connection with the securities lending program. Partially offsetting this decrease was a net

increase of $15.8 billion in policyholder account balances, which primarily reflected the Company’s increased level of funding agreements

with the FHLB of NY and with MetLife Short Term Funding LLC, an issuer of commercial paper. The Company also experienced a $6.9 billion

increase in cash collateral received under derivatives transactions, primarily as a result of the improvement in estimated fair value of the

derivatives. The cash collateral received under derivatives transactions is invested in cash, cash equivalents and short-term investments,

which partly explains the major increase in this category of liquid assets. The Company increased short-term debt by $2.0 billion in 2008

compared with a decrease of $0.8 billion in 2007, which primarily reflected new activity at MetLife Bank, which borrowed $1.0 billion from the

Federal Reserve Bank of New York under the Term Auction Facility and entered into $0.7 billion of short-term borrowing from the FHLB of NY in

order to fund residential mortgage origination operations acquired by the Company in 2008 and provide a cost effective substitute for cash

collateral received in connection with securities lending. In 2008 the net cash paid related to collateral financing arrangements was

$0.5 billion resulting from payments made by the Holding Company to an unaffiliated financial institution in connection with the collateral

financing arrangement associated with MRC’s reinsurance of the closed block liabilities, which compares to $4.9 billion of cash provided by

collateral financing arrangement transactions completed in 2007, as market conditions in 2008 reduced the availability and attractiveness of

such financing. In 2008, there was a net issuance of $0.7 billion of long-term debt and junior subordinated debt securities, compared to a net

issuance in 2007 of $1.1 billion. Finally, in order to strengthen its capital base, in 2008 the Company reduced its level of common stock

repurchase activity by $0.5 billion compared with 2007 repurchasing only $1.3 billion of common stock in 2008 as compared to $1.8 billion in

2007, and issued $3.3 billion of stock compared with no issuance in 2007. The Company also paid dividends on the preferred stock and

common stock of $0.7 billion, which was comparable to the dividends paid in 2007.

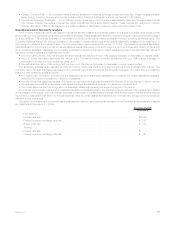

Net cash used in investing activities was $13.9 billion for the year ended December 31, 2009, as compared to $2.7 billion for the year

ended December 31, 2008. The net cash used in investing activities in the year ended December 31, 2009 corresponded with a net decrease

of $14.1 billion in cash and cash equivalents in the same period, reflecting the Company’s effort to redeploy the elevated level of cash and

cash equivalents accumulated at year end 2008 in response to extraordinary market conditions. The net cash used in investing activities in the

year ended December 31, 2009 was primarily composed of net purchases of $19.5 billion of fixed maturity securities, partially offset by a net

reduction of $5.5 billion in short-term investments. In the comparable 2008 period, there were net sales of $15.4 billion of fixed maturity

securities, offset by net purchases of $4.0 billion in mortgage loans and net purchases of short-term investments of $11.3 billion, while cash

and cash equivalents increased by $13.9 billion.

Net cash used in investing activities was $2.7 billion and $10.6 billion for the years ended December 31, 2008 and 2007, respectively.

Accordingly, net cash used in investing activities decreased by $7.9 billion for the year ended December 31, 2008 as compared to the prior

year. The Company reduced the level of cash available for investing activities in 2008 in order to significantly increase cash and cash

equivalents as a liquidity cushion in response to the deterioration in the financial markets in 2008. Cash and cash equivalents increased

$13.9 billion at December 31, 2008 compared to the prior year. The net decrease in the amount of cash used in investing activities was

primarily reflected in a decrease in net purchases of fixed maturity and equity securities of $15.8 billion and $2.4 billion, respectively, as well as

a decrease in the net purchases of real estate and real estate joint ventures of $0.5 billion, a decrease in other invested assets of $0.5 billion

and a decrease of $0.5 billion in the net origination of mortgage loans. In addition, the 2007 period included the sale of MetLife Australia’s

annuities and pension businesses of $0.7 billion. These decreases in net cash used in investing activities were partially offset by an increase

in cash invested in short-term investments of $11.3 billion due to a repositioning from other investment classes due to volatile market

conditions, an increase in net purchases of other limited partnership interests of $0.1 billion and an increase in policy loans of $0.3 billion. In

addition, the 2008 period includes an increase of $0.4 billion of cash used to purchase businesses and the decrease of $0.3 billion of cash

held by a subsidiary, which was split-off from the Company.

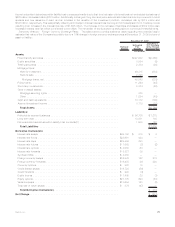

The Holding Company

Capital

Restrictions and Limitations on Bank Holding Companies and Financial Holding Companies. The Holding Company and its insured

depository institution subsidiary, MetLife Bank, are subject to risk-based and leverage capital guidelines issued by the federal banking

regulatory agencies for banks and financial holding companies. The federal banking regulatory agencies are required by law to take specific

prompt corrective actions with respect to institutions that do not meet minimum capital standards. At their most recently filed reports with the

federal banking regulatory agencies, the Holding Company and MetLife Bank met the minimum capital standards as per federal banking

regulatory agencies with all of MetLife Bank’s risk-based and leverage capital ratios meeting the federal banking regulatory agencies “well

64 MetLife, Inc.