MetLife 2009 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

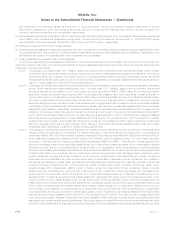

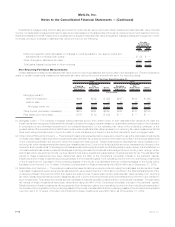

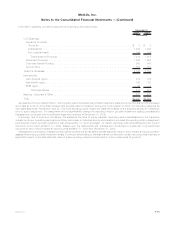

6. Deferred Policy Acquisition Costs and Value of Business Acquired

Information regarding DAC and VOBA is as follows:

DAC VOBA Total

(In millions)

Balance at January 1, 2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13,212 $4,292 $17,504

Effectofadoptionofnewaccountingprinciple .......................... (205) (248) (453)

Capitalizations............................................... 3,064 — 3,064

Acquisitions ................................................ — 48 48

Subtotal ................................................. 16,071 4,092 20,163

Less: Amortization related to:

Netinvestmentgains(losses).................................... (115) (11) (126)

Otherexpenses ............................................ 1,881 495 2,376

Totalamortization.......................................... 1,766 484 2,250

Less:Unrealizedinvestmentgains(losses) ............................ 75 63 138

Less:Other................................................. (30) (5) (35)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,260 3,550 17,810

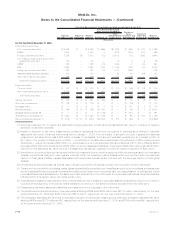

Capitalizations............................................... 3,092 — 3,092

Acquisitions ................................................ — (5) (5)

Subtotal ................................................. 17,352 3,545 20,897

Less: Amortization related to:

Netinvestmentgains(losses).................................... 489 32 521

Otherexpenses ............................................ 2,460 508 2,968

Totalamortization.......................................... 2,949 540 3,489

Less:Unrealizedinvestmentgains(losses) ............................ (2,753) (599) (3,352)

Less:Other................................................. 503 113 616

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,653 3,491 20,144

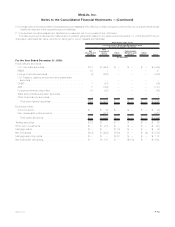

Capitalizations............................................... 3,019 — 3,019

Subtotal ................................................. 19,672 3,491 23,163

Less: Amortization related to:

Netinvestmentgains(losses).................................... (625) (87) (712)

Otherexpenses ............................................ 1,754 265 2,019

Totalamortization.......................................... 1,129 178 1,307

Less:Unrealizedinvestmentgains(losses) ............................ 2,314 505 2,819

Less:Other................................................. (163) (56) (219)

Balance at December 31, 2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $16,392 $2,864 $19,256

See Note 2 for a description of acquisitions and dispositions.

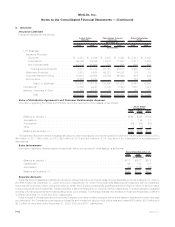

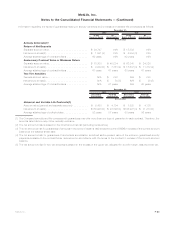

The estimated future amortization expense allocated to other expenses for the next five years for VOBA is $394 million in 2010,

$352 million in 2011, $311 million in 2012, $264 million in 2013 and $222 million in 2014.

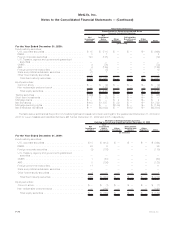

Amortization of DAC and VOBA is attributed to both investment gains and losses and to other expenses for the amount of gross margins or

profits originating from transactions other than investment gains and losses. Unrealized investment gains and losses represent the amount of

DAC and VOBA that would have been amortized if such gains and losses had been recognized.

F-77MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)