MetLife 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

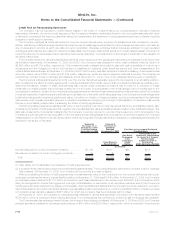

variable annuity products offered by the Company. The Company utilizes exchange-traded equity futures in non-qualifying hedging

relationships.

Equity index options are used by the Company primarily to hedge minimum guarantees embedded in certain variable annuity products

offered by the Company. To hedge against adverse changes in equity indices, the Company enters into contracts to sell the equity index

within a limited time at a contracted price. The contracts will be net settled in cash based on differentials in the indices at the time of exercise

and the strike price. In certain instances, the Company may enter into a combination of transactions to hedge adverse changes in equity

indices within a pre-determined range through the purchase and sale of options. Equity index options are included in equity options in the

preceding table. The Company utilizes equity index options in non-qualifying hedging relationships.

Equity variance swaps are used by the Company primarily to hedge minimum guarantees embedded in certain variable annuity products

offered by the Company. In an equity variance swap, the Company agrees with another party to exchange amounts in the future, based on

changesinequityvolatilityoveradefinedperiod.Equityvarianceswapsareincludedinvarianceswapsintheprecedingtable.TheCompany

utilizes equity variance swaps in non-qualifying hedging relationships.

Total rate of return swaps (“TRRs”) are swaps whereby the Company agrees with another party to exchange, at specified intervals, the

difference between the economic risk and reward of an asset or a market index and LIBOR, calculated by reference to an agreed notional

principal amount. No cash is exchanged at the outset of the contract. Cash is paid and received over the life of the contract based on the

terms of the swap. These transactions are entered into pursuant to master agreements that provide for a single net payment to be made by the

counterparty at each due date. The Company uses TRRs to hedge its equity market guarantees in certain of its insurance products. TRRs can

be used as hedges or to synthetically create investments. The Company utilizes TRRs in non-qualifying hedging relationships.

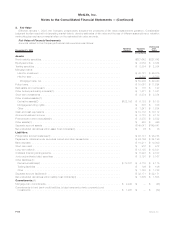

Hedging

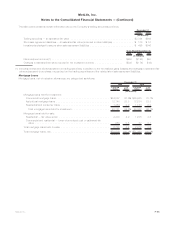

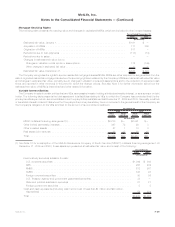

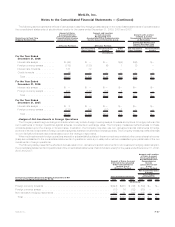

The following table presents the notional amount and estimated fair value of derivatives designated as hedging instruments by type of

hedge designation at:

Derivatives Designated as Hedging Instruments Notional

Amount Assets Liabilities Notional

Amount Assets Liabilities

Estimated

Fair

Value

Estimated

Fair

Value

2009 2008

December 31,

(In millions)

Fair Value Hedges:

Foreign currency swaps . . . . . . . . . . . . . . . . . . . $ 4,807 $ 854 $132 $ 6,093 $ 467 $ 550

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . . 4,824 500 75 4,141 1,338 153

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,631 1,354 207 10,234 1,805 703

Cash Flow Hedges:

Foreign currency swaps . . . . . . . . . . . . . . . . . . . 4,108 127 347 3,782 463 381

Interestrateswaps...................... 1,740 — 48 286 — 6

Interestrateforwards .................... — — — — — —

Creditforwards ........................ 220 2 6 — — —

Subtotal ........................... 6,068 129 401 4,068 463 387

Foreign Operations Hedges:

Foreign currency forwards . . . . . . . . . . . . . . . . . 1,880 27 13 1,670 32 50

Foreigncurrencyswaps................... — — — 164 1 —

Non-derivative hedging instruments . . . . . . . . . . . — — — 351 — 323

Subtotal ........................... 1,880 27 13 2,185 33 373

Total Qualifying Hedges . . . . . . . . . . . . . . . . . . . . $17,579 $1,510 $621 $16,487 $2,301 $1,463

F-54 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)