MetLife 2009 Annual Report Download - page 149

Download and view the complete annual report

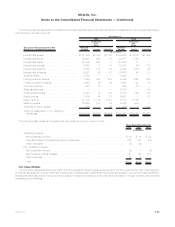

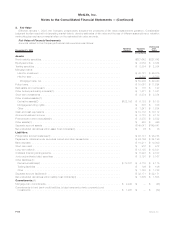

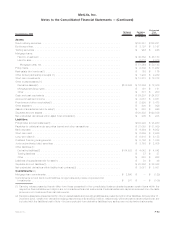

Please find page 149 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Short-term Investments — Certain short-term investments do not qualify as securities and are recognized at amortized cost in the

consolidated balance sheets. For these instruments, the Company believes that there is minimal risk of material changes in interest rates or

credit of the issuer such that estimated fair value approximates carrying value. In light of recent market conditions, short-term investments

have been monitored to ensure there is sufficient demand and maintenance of issuer credit quality and the Company has determined

additional adjustment is not required. Short-term investments that meet the definition of a security are recognized at estimated fair value in the

consolidated balance sheets in the same manner described above for similar instruments that are classified within captions of other major

investment classes.

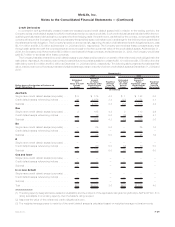

Other Invested Assets — Other invested assets in the consolidated balance sheets are principally comprised of freestanding derivatives

with positive estimated fair values, leveraged leases, joint venture investments, investments in tax credit partnerships, investment in a funding

agreement, MSRs, funds withheld at interest and various interest-bearing assets held in foreign subsidiaries. Leveraged leases and

investments in tax credit partnerships and joint venture investments, which are accounted for under the equity method or under the effective

yield method, are not financial instruments subject to fair value disclosure. Accordingly, they have been excluded from the preceding table.

The estimated fair value of derivatives — with positive and negative estimated fair values — is described in the section labeled

“Derivatives” which follows.

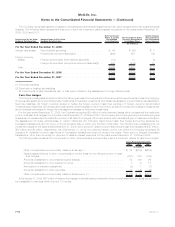

Although MSRs are not financial instruments, the Company has included them in the preceding table as a result of its election to carry

MSRs at estimated fair value. As sales of MSRs tend to occur in private transactions where the precise terms and conditions of the sales are

typically not readily available, observable market valuations are limited. As such, the Company relies primarily on a discounted cash flow

model to estimate the fair value of the MSRs. The model requires inputs such as type of loan (fixed vs. variable and agency vs. other), age of

loan, loan interest rates and current market interest rates that are generally observable. The model also requires the use of unobservable

inputs including assumptions regarding estimates of discount rates, loan prepayments and servicing costs.

The estimated fair value of the investment in funding agreements is estimated by discounting the expected future cash flows using current

market rates and the credit risk of the note issuer.

For funds withheld at interest and the various interest-bearing assets held in foreign subsidiaries, the Company evaluates the specific

facts and circumstances of each instrument to determine the appropriate estimated fair values. These estimated fair values were not

materially different from the recognized carrying values.

Cash and Cash Equivalents — Due to the short-term maturities of cash and cash equivalents, the Company believes there is minimal risk

of material changes in interest rates or credit of the issuer such that estimated fair value generally approximates carrying value. In light of

recent market conditions, cash and cash equivalent instruments have been monitored to ensure there is sufficient demand and maintenance

of issuer credit quality, or sufficient solvency in the case of depository institutions, and the Company has determined additional adjustment is

not required.

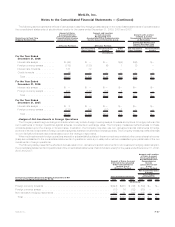

Accrued Investment Income — Due to the short-term until settlement of accrued investment income, the Company believes there is

minimal risk of material changes in interest rates or credit of the issuer such that estimated fair value approximates carrying value. In light of

recent market conditions, the Company has monitored the credit quality of the issuers and has determined additional adjustment is not

required.

Premiums and Other Receivables — Premiums and other receivables in the consolidated balance sheets are principally comprised of

premiums due and unpaid for insurance contracts, amounts recoverable under reinsurance contracts, amounts on deposit with financial

institutions to facilitate daily settlements related to certain derivative positions, amounts receivable for securities sold but not yet settled, fees

and general operating receivables and embedded derivatives related to the ceded reinsurance of certain variable annuity guarantees.

Premiums receivable and those amounts recoverable under reinsurance treaties determined to transfer sufficient risk are not financial

instruments subject to disclosure and thus have been excluded from the amounts presented in the preceding table. Amounts recoverable

under ceded reinsurance contracts, which the Company has determined do not transfer sufficient risk such that they are accounted for using

the deposit method of accounting, have been included in the preceding table with the estimated fair value determined as the present value of

expected future cash flows under the related contracts discounted using an interest rate determined to reflect the appropriate credit standing

of the assuming counterparty.

The amounts on deposit for derivative settlements essentially represent the equivalent of demand deposit balances and amounts due for

securities sold are generally received over short periods such that the estimated fair value approximates carrying value. In light of recent

market conditions, the Company has monitored the solvency position of the financial institutions and has determined additional adjustments

are not required.

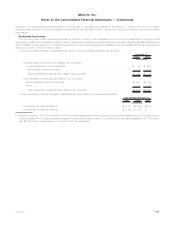

Embedded derivatives recognized in connection with ceded reinsurance of certain variable annuity guarantees are included in this caption

in the consolidated financial statements but excluded from this caption in the preceding table as they are separately presented. The estimated

fair value of these embedded derivatives is described in the section labeled “Embedded Derivatives within Asset and Liability Host Contracts”

which follows.

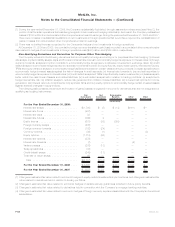

Other Assets — Other assets in the consolidated balance sheets are principally comprised of prepaid expenses, amounts held under

corporate owned life insurance, fixed assets, capitalized software, deferred sales inducements, VODA, VOCRA and a receivable for cash

paid to an unaffiliated financial institution under the MetLife Reinsurance Company of Charleston (“MRC”) collateral financing arrangement as

described in Note 12. With the exception of the receivable for cash paid to the unaffiliated financial institution, other assets are not considered

financial instruments subject to disclosure. Accordingly, the amount presented in the preceding table represents the receivable for the cash

paid to the unaffiliated financial institution under the MRC collateral financing arrangement for which the estimated fair value was determined

by discounting the expected future cash flows using a discount rate that reflects the credit of the unaffiliated financial institution.

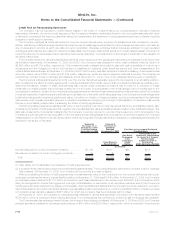

Separate Account Assets — Separate account assets are carried at estimated fair value and reported as a summarized total on the

consolidated balance sheets. The estimated fair value of separate account assets are based on the estimated fair value of the underlying

assets owned by the separate account. Assets within the Company’s separate accounts include: mutual funds, fixed maturity securities,

F-65MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)