MetLife 2009 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

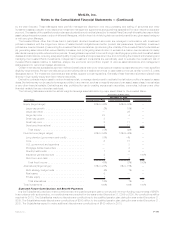

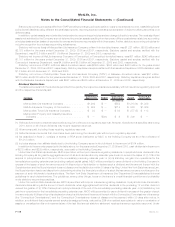

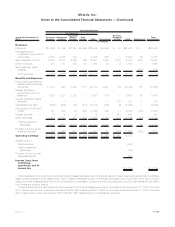

Other Comprehensive Income (Loss)

The following table sets forth the reclassification adjustments required for the years ended December 31, 2009, 2008 and 2007 in other

comprehensive income (loss) that are included as part of net income for the current year that have been reported as a part of other

comprehensive income (loss) in the current or prior year:

2009 2008 2007

Years Ended December 31,

(In millions)

Holding gains (losses) on investments arising during the year . . . . . . . . . . . . . . . . . $18,548 $(26,650) $(1,494)

Incometaxeffectofholdinggains(losses) ............................. (6,243) 8,989 581

Reclassification adjustments:

Recognized holding (gains) losses included in current year income . . . . . . . . . . . . 1,954 2,040 176

Amortization of premiums and accretion of discounts associated with investments . . (490) (926) (831)

Incometaxeffect.............................................. (493) (377) 254

Allocation of holding (gains) losses on investments relating to other policyholder

amounts.................................................. (2,979) 4,809 676

Income tax effect of allocation of holding (gains) losses to other policyholder

amounts.................................................. 1,002 (1,621) (264)

Unrealizedinvestmentlossofsubsidiaryatdateofsale..................... — 131 —

Deferred income tax on unrealized investment loss of subsidiary at date of sale . . . . . — (60) —

Net unrealized investment gains (losses), net of income tax . . . . . . . . . . . . . . . . . . 11,299 (13,665) (902)

Foreigncurrencytranslationadjustment,netofincometax................... 63 (700) 346

Definedbenefitplanadjustment,netofincometax........................ (102) (1,199) 564

Othercomprehensiveincome(loss).................................. 11,260 (15,564) 8

Other comprehensive income (loss) attributable to noncontrolling interests . . . . . . . . 11 (10) 1

Other comprehensive income (loss) attributable to noncontrolling interests of

subsidiaryatdateofdisposal .................................... — 150 8

Foreign currency translation adjustment attributable to noncontrolling interests of

subsidiaryatdateofdisposal .................................... — 107 (56)

Defined benefit plans adjustment attributable to noncontrolling interests of subsidiary

atdateofdisposal ........................................... — (4) (1)

Other comprehensive income (loss) attributable to MetLife, Inc., excluding cumulative

effectofchangeinaccountingprinciple ............................. 11,271 (15,321) (40)

Cumulative effect of change in accounting principle, net of income tax of $40 million,

effective April 1, 2009 (See Note 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (76) — —

Other comprehensive income (loss) attributable to MetLife, Inc. . . . . . . . . . . . . . . . $11,195 $(15,321) $ (40)

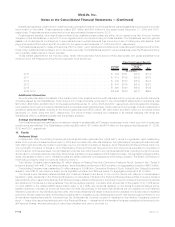

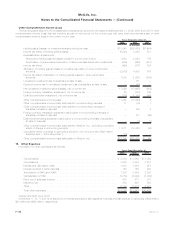

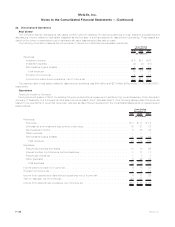

19. Other Expenses

Information on other expenses is as follows:

2009 2008 2007

Years Ended December 31,

(In millions)

Compensation ............................................... $ 3,804 $ 3,368 $ 3,362

Commissions................................................ 3,433 3,384 3,207

Interestanddebtissuecosts ..................................... 1,083 1,086 987

Interestcreditedtobankdeposits................................... 163 166 200

AmortizationofDACandVOBA .................................... 1,307 3,489 2,250

CapitalizationofDAC........................................... (3,019) (3,092) (3,064)

Rent,netofsubleaseincome...................................... 479 477 373

Insurancetax ................................................ 550 497 503

Other ..................................................... 2,756 2,572 2,587

Totalotherexpenses ........................................... $10,556 $11,947 $10,405

Interest and Debt Issue Costs

See Notes 11, 12, 13 and 14 for attribution of interest expense by debt issuance. Includes interest expense on tax audits of $39 million,

$35 million and $90 million, respectively.

F-120 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)