MetLife 2009 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

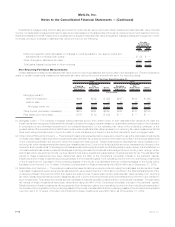

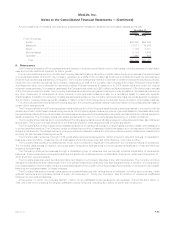

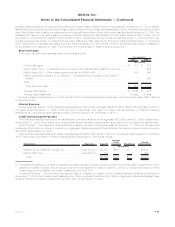

Account balances of contracts with insurance guarantees are invested in separate account asset classes as follows:

2009 2008

December 31,

(In millions)

Fund Groupings:

Equity........................................................... $48,852 $39,842

Balanced......................................................... 31,011 14,548

Bond ........................................................... 7,166 5,671

MoneyMarket...................................................... 2,104 2,456

Specialty......................................................... 1,865 488

Total .......................................................... $90,998 $63,005

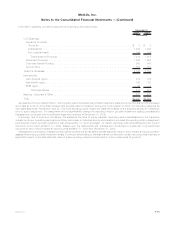

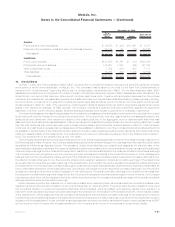

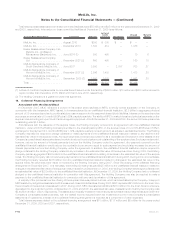

9. Reinsurance

The Company’s Insurance Products segment participates in reinsurance activities in order to limit losses, minimize exposure to significant

risks and provide additional capacity for future growth.

For its individual life insurance products, the Company has historically reinsured the mortality risk primarily on an excess of retention basis

or a quota share basis. Until 2005, the Company reinsured up to 90% of the mortality risk for all new individual life insurance policies that it

wrote through its various subsidiaries. During 2005, the Company changed its retention practices for certain individual life insurance policies.

Under the new retention guidelines, the Company reinsures up to 90% of the mortality risk in excess of $1 million. Retention limits remain

unchanged for other new individual life insurance policies. Policies reinsured in years prior to 2005 remain reinsured under the original

reinsurance agreements. On a case by case basis, the Company may retain up to $20 million per life and reinsure 100% of amounts in excess

of the Company’s retention limits. The Company evaluates its reinsurance programs routinely and may increase or decrease its retention at

any time. Placement of reinsurance is done primarily on an automatic basis and also on a facultative basis for risks with specific

characteristics. In addition to reinsuring mortality risk as described above, the Company reinsures other risks, as well as specific coverages.

The Company routinely reinsures certain classes of risks in order to limit its exposure to particular travel, avocation and lifestyle hazards.

For other policies within the Insurance Products segment, the Company generally retains most of the risk and only cedes particular risks on

certain client arrangements.

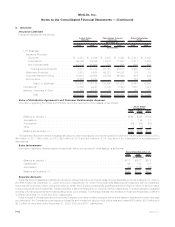

The Company’s Retirement Products segment reinsures a portion of the living and death benefit guarantees issued in connection with its

variable annuities. Under these reinsurance agreements, the Company pays a reinsurance premium generally based on fees associated with

the guarantees collected from policyholders, and receives reimbursement for benefits paid or accrued in excess of account values, subject to

certain limitations. The Company enters into similar agreements for new or in-force business depending on market conditions.

The Company’s International and Corporate Benefit Funding segments have periodically engaged in reinsurance activities, as considered

appropriate. The impact of these activities on the financial results of these segments has not been significant.

The Company’s Auto & Home segment purchases reinsurance to manage its exposure to large losses (primarily catastrophe losses) and

to protect statutory surplus. The Company cedes to reinsurers a portion of losses and premiums based upon the exposure of the policies

subject to reinsurance. To manage exposure to large property and casualty losses, the Company utilizes property catastrophe, casualty and

property per risk excess of loss agreements.

The Company also reinsures, through 100% quota share reinsurance agreements, certain long-term care and workers’ compensation

business written by MICC. These are run-off businesses which have been included within Banking, Corporate & Other.

The Company has exposure to catastrophes, which could contribute to significant fluctuations in the Company’s results of operations.

The Company uses excess of retention and quota share reinsurance arrangements to provide greater diversification of risk and minimize

exposure to larger risks.

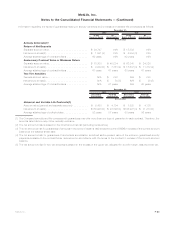

The Company reinsures its business through a diversified group of reinsurers and periodically monitors collectibility of reinsurance

balances. These reinsurance recoverable balances are stated net of allowances for uncollectible reinsurance, which as of December 31,

2009 and 2008, were immaterial.

The Company analyzes recent trends in arbitration and litigation outcomes in disputes, if any, with its reinsurers. The Company monitors

ratings and evaluates the financial strength of the Company’s reinsurers by analyzing their financial statements. In addition, the reinsurance

recoverable balance due from each reinsurer is evaluated as part of the overall monitoring process. Recoverability of reinsurance recoverable

balances are evaluated based on these analyses.

The Company has secured certain reinsurance recoverable balances with various forms of collateral, including secured trusts, funds

withheld accounts and irrevocable letters of credit. At December 31, 2009, the Company had $4.4 billion of unsecured unaffiliated

reinsurance recoverable balances.

At December 31, 2009, the Company had $11.7 billion of net unaffiliated ceded reinsurance recoverables. Of this total, $9.2 billion, or

79%, were with the Company’s five largest unaffiliated ceded reinsurers, including $3.0 billion of which were unsecured.

F-85MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)