MetLife 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

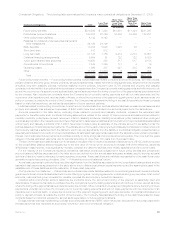

Credit and Committed Facilities. In 2007, the Holding Company and MetLife Funding entered into a credit agreement with various

financial institutions. The proceeds of this $2.85 billion unsecured credit facility, as amended in 2008, are available to be used for general

corporate purposes, as back-up for their commercial paper programs and for the issuance of letters of credit. At December 31, 2009, the

Holding Company had outstanding $548 million in letters of credit and no drawdowns against this facility. Remaining unused commitments

were $2.3 billion at December 31, 2009.

The Holding Company maintains committed facilities with a capacity of $1.8 billion. At December 31, 2009, the Holding Company had

outstanding $712 million in letters of credit and no aggregate drawdowns against these facilities. Remaining unused commitments were

$1.1 billion at December 31, 2009. In addition, the Holding Company is a party to committed facilities of certain of its subsidiaries, which

aggregated $11.0 billion at December 31, 2009. The committed facilities are used for collateral for certain of the Company’s affiliated

reinsurance liabilities.

For more information on Credit and Committed Facilities see Note 11 of the Notes to the Consolidated Financial Statements.

Covenants. Certain of the Holding Company’s debt instruments, credit facilities and committed facilities contain various administrative,

reporting, legal and financial covenants. The Holding Company believes it was in compliance with all covenants at December 31, 2009 and

2008.

Common and Preferred Stock. For information on Common Stock and Preferred Stock issued by the Holding Company, see “— The

Company — Liquidity and Capital Sources — Common Stock” and “— The Company — Liquidity and Capital Sources — Preferred Stock.”

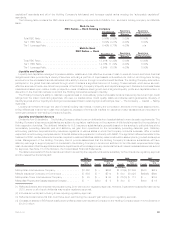

Liquidity and Capital Uses

The primary uses of liquidity of the Holding Company include debt service, cash dividends on common and preferred stock, capital

contributions to subsidiaries, payment of general operating expenses, acquisitions and the repurchase of the Holding Company’s common

stock.

Affiliated Capital Transactions. During the years ended December 31, 2009 and 2008, the Holding Company invested an aggregate of

$986 million and $2.6 billion, respectively, in various subsidiaries.

The Holding Company lends funds, as necessary, to its subsidiaries, some of which are regulated, to meet their capital requirements.

Such loans are included in loans to subsidiaries and consisted of the following at:

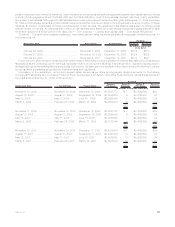

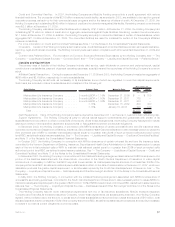

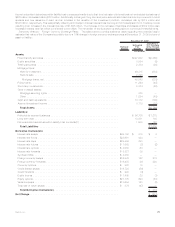

Subsidiaries Interest Rate Maturity Date 2009 2008

December 31,

(In millions)

Metropolitan Life Insurance Company . . . . . . . . 3-month LIBOR + 1.15% December 31, 2009 $ — $ 700

Metropolitan Life Insurance Company . . . . . . . . 6-month LIBOR + 1.80% December 31, 2011 775 —

Metropolitan Life Insurance Company . . . . . . . . 6-month LIBOR + 1.80% December 31, 2011 300 —

Metropolitan Life Insurance Company . . . . . . . . 7.13% December 15, 2032 400 400

Metropolitan Life Insurance Company . . . . . . . . 7.13% January 15, 2033 100 100

Total ............................ $1,575 $1,200

Debt Repayments. None of the Holding Company’s debt is due before December 2011, so there is no near-term debt refinancing risk.

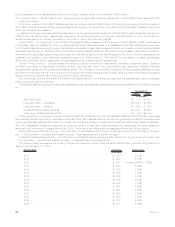

Support Agreements. The Holding Company is party to various capital support commitments and guarantees with certain of its

subsidiaries and a corporation in which it owns 50% of the equity. Under these arrangements, the Holding Company has agreed to cause

each such entity to meet specified capital and surplus levels or has guaranteed certain contractual obligations.

In December 2009, the Holding Company, in connection with MRV’s reinsurance of certain universal life and term life insurance risks,

committed to the Vermont Department of Banking, Insurance, Securities and Health Care Administration to take necessary action to cause the

third protected cell of MRV to maintain total adjusted capital equal to or greater than 200% of such protected cell’s authorized control

level RBC, as defined in state insurance statutes. See “— The Company — Liquidity and Capital Sources — Credit and Committed Facilities”

and Note 11 of the Notes to the Consolidated Financial Statements.

In October 2007, the Holding Company, in connection with MRV’s reinsurance of certain universal life and term life insurance risks,

committed to the Vermont Department of Banking, Insurance, Securities and Health Care Administration to take necessary action to cause

each of the two initial protected cells of MRV to maintain total adjusted capital equal to or greater than 200% of such protected cell’s

authorized control level RBC, as defined in state insurance statutes. See “— The Company — Liquidity and Capital Sources — Credit and

Committed Facilities” and Note 11 of the Notes to the Consolidated Financial Statements.

In December 2007, the Holding Company, in connection with the collateral financing arrangement associated with MRC’s reinsurance of a

portion of the liabilities associated with the closed block, committed to the South Carolina Department of Insurance to make capital

contributions, if necessary, to MRC so that MRC may at all times maintain its total adjusted capital at a level of not less than 200% of the

company action level RBC, as defined in state insurance statutes as in effect on the date of determination or December 31, 2007, whichever

calculation produces the greater capital requirement, or as otherwise required by the South Carolina Department of Insurance. See “— The

Company — Liquidity and Capital Sources — Debt Issuances and Other Borrowings” and Note 12 of the Notes to the Consolidated Financial

Statements.

In May 2007, the Holding Company, in connection with the collateral financing arrangement associated with MRSC’s reinsurance of

universal life secondary guarantees, committed to the South Carolina Department of Insurance to take necessary action to cause MRSC to

maintain total adjusted capital equal to the greater of $250,000 or 100% of MRSC’s authorized control level RBC, as defined in state insurance

statutes. See “— The Company — Liquidity and Capital Sources — Debt Issuances and Other Borrowings” and Note 12 of the Notes to the

Consolidated Financial Statements.

The Holding Company has net worth maintenance agreements with two of its insurance subsidiaries, MetLife Investors Insurance

Company and First MetLife Investors Insurance Company. Under these agreements, as subsequently amended, the Holding Company

agreed, without limitation as to the amount, to cause each of these subsidiaries to have a minimum capital and surplus of $10 million, total

adjusted capital at a level not less than 150% of the company action level RBC, as defined by state insurance statutes, and liquidity necessary

to enable it to meet its current obligations on a timely basis.

67MetLife, Inc.