MetLife 2009 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assertion of monetary damages or other relief. Jurisdictions may permit claimants not to specify the monetary damages sought or may permit

claimants to state only that the amount sought is sufficient to invoke the jurisdiction of the trial court. In addition, jurisdictions may permit

plaintiffs to allege monetary damages in amounts well exceeding reasonably possible verdicts in the jurisdiction for similar matters. This

variability in pleadings, together with the actual experience of the Company in litigating or resolving through settlement numerous claims over

an extended period of time, demonstrate to management that the monetary relief which may be specified in a lawsuit or claim bears little

relevance to its merits or disposition value. Thus, unless stated below, the specific monetary relief sought is not noted.

Due to the vagaries of litigation, the outcome of a litigation matter and the amount or range of potential loss at particular points in time may

normally be inherently impossible to ascertain with any degree of certainty. Inherent uncertainties can include how fact finders will view

individually and in their totality documentary evidence, the credibility and effectiveness of witnesses’ testimony and how trial and appellate

courts will apply the law in the context of the pleadings or evidence presented, whether by motion practice, or at trial or on appeal. Disposition

valuations are also subject to the uncertainty of how opposing parties and their counsel will themselves view the relevant evidence and

applicable law.

On a quarterly and annual basis, the Company reviews relevant information with respect to litigation and contingencies to be reflected in

the Company’s consolidated financial statements. In 2007, the Company received $39 million upon the resolution of an indemnification claim

associated with the 2000 acquisition of General American Life Insurance Company (“GALIC”), and the Company reduced legal liabilities by

$38 million after the settlement of certain cases. The review includes senior legal and financial personnel. Unless stated below, estimates of

possible losses or ranges of loss for particular matters cannot in the ordinary course be made with a reasonable degree of certainty. Liabilities

are established when it is probable that a loss has been incurred and the amount of the loss can be reasonably estimated. Liabilities have

been established for a number of the matters noted below. In 2009, the Company increased legal liabilities for litigation matters pending

against the Company. It is possible that some of the matters could require the Company to pay damages or make other expenditures or

establish accruals in amounts that could not be estimated at December 31, 2009.

Asbestos-Related Claims

MLIC is and has been a defendant in a large number of asbestos-related suits filed primarily in state courts. These suits principally allege

that the plaintiff or plaintiffs suffered personal injury resulting from exposure to asbestos and seek both actual and punitive damages. MLIC

has never engaged in the business of manufacturing, producing, distributing or selling asbestos or asbestos-containing products nor has

MLIC issued liability or workers’ compensation insurance to companies in the business of manufacturing, producing, distributing or selling

asbestos or asbestos-containing products. The lawsuits principally have focused on allegations with respect to certain research, publication

and other activities of one or more of MLIC’s employees during the period from the 1920’s through approximately the 1950’s and allege that

MLIC learned or should have learned of certain health risks posed by asbestos and, among other things, improperly publicized or failed to

disclose those health risks. MLIC believes that it should not have legal liability in these cases. The outcome of most asbestos litigation

matters, however, is uncertain and can be impacted by numerous variables, including differences in legal rulings in various jurisdictions, the

nature of the alleged injury and factors unrelated to the ultimate legal merit of the claims asserted against MLIC. MLIC employs a number of

resolution strategies to manage its asbestos loss exposure, including seeking resolution of pending litigation by judicial rulings and settling

individual or groups of claims or lawsuits under appropriate circumstances.

Claims asserted against MLIC have included negligence, intentional tort and conspiracy concerning the health risks associated with

asbestos. MLIC’s defenses (beyond denial of certain factual allegations) include that: (i) MLIC owed no duty to the plaintiffs— it had no special

relationship with the plaintiffs and did not manufacture, produce, distribute or sell the asbestos products that allegedly injured plaintiffs;

(ii) plaintiffs did not rely on any actions of MLIC; (iii) MLIC’s conduct was not the cause of the plaintiffs’ injuries; (iv) plaintiffs’ exposure occurred

after the dangers of asbestos were known; and (v) the applicable time with respect to filing suit has expired. During the course of the litigation,

certain trial courts have granted motions dismissing claims against MLIC, while other trial courts have denied MLIC’s motions to dismiss.

There can be no assurance that MLIC will receive favorable decisions on motions in the future. While most cases brought to date have settled,

MLIC intends to continue to defend aggressively against claims based on asbestos exposure, including defending claims at trials.

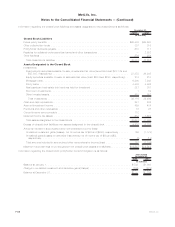

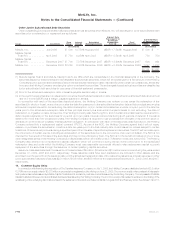

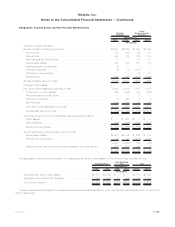

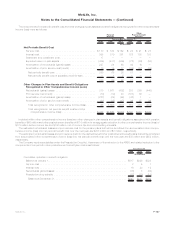

The approximate total number of asbestos personal injury claims pending against MLIC as of the dates indicated, the approximate number

of new claims during the years ended on those dates and the approximate total settlement payments made to resolve asbestos personal

injury claims at or during those years are set forth in the following table:

2009 2008 2007

December 31,

(In millions, except number of

claims)

Asbestospersonalinjuryclaimsatyearend ............................ 68,804 74,027 79,717

Numberofnewclaimsduringtheyear................................ 3,910 5,063 7,161

Settlementpaymentsduringtheyear(1) ............................... $ 37.6 $ 99.0 $ 28.2

(1) Settlement payments represent payments made by MLIC during the year in connection with settlements made in that year and in prior

years. Amounts do not include MLIC’s attorneys’ fees and expenses and do not reflect amounts received from insurance carriers.

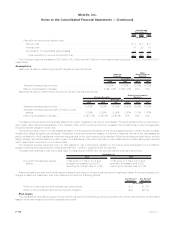

In 2006, MLIC received approximately 7,870 new claims, ending the year with a total of approximately 87,070 claims, and paid

approximately $35.5 million for settlements reached in 2006 and prior years. In 2005, MLIC received approximately 18,500 new claims,

ending the year with a total of approximately 100,250 claims, and paid approximately $74.3 million for settlements reached in 2005 and prior

years. In 2004, MLIC received approximately 23,900 new claims, ending the year with a total of approximately 108,000 claims, and paid

approximately $85.5 million for settlements reached in 2004 and prior years. In 2003, MLIC received approximately 58,750 new claims,

ending the year with a total of approximately 111,700 claims, and paid approximately $84.2 million for settlements reached in 2003 and prior

F-98 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)