MetLife 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

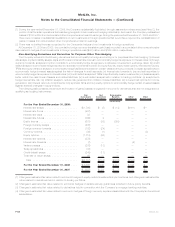

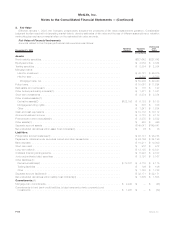

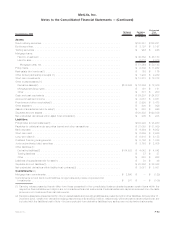

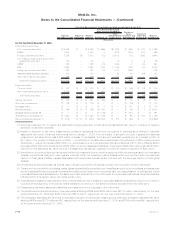

5. Fair Value

Effective January 1, 2008, the Company prospectively adopted the provisions of fair value measurement guidance. Considerable

judgment is often required in interpreting market data to develop estimates of fair value and the use of different assumptions or valuation

methodologies may have a material effect on the estimated fair value amounts.

Fair Value of Financial Instruments

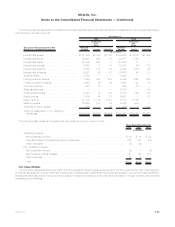

Amounts related to the Company’s financial instruments are as follows:

December 31, 2009 Notional

Amount Carrying

Value

Estimated

Fair

Value

(In millions)

Assets:

Fixedmaturitysecurities................................................. $227,642 $227,642

Equitysecurities...................................................... $ 3,084 $ 3,084

Tradingsecurities..................................................... $ 2,384 $ 2,384

Mortgage loans:

Held-for-investment .................................................. $ 48,181 $ 46,315

Held-for-sale....................................................... 2,728 2,728

Mortgageloans,net................................................. $ 50,909 $ 49,043

Policyloans......................................................... $ 10,061 $ 11,294

Realestatejointventures(1) .............................................. $ 115 $ 127

Otherlimitedpartnershipinterests(1)......................................... $ 1,571 $ 1,581

Short-terminvestments ................................................. $ 8,374 $ 8,374

Other invested assets:(1)

Derivativeassets(2) .................................................. $122,156 $ 6,133 $ 6,133

Mortgageservicingrights............................................... $ 878 $ 878

Other ........................................................... $ 1,241 $ 1,284

Cashandcashequivalents............................................... $ 10,112 $ 10,112

Accruedinvestmentincome .............................................. $ 3,173 $ 3,173

Premiumsandotherreceivables(1).......................................... $ 3,375 $ 3,532

Otherassets(1) ...................................................... $ 425 $ 440

Separateaccountassets ................................................ $149,041 $149,041

Netembeddedderivativeswithinassethostcontracts(3)............................ $ 76 $ 76

Liabilities:

Policyholderaccountbalances(1)........................................... $ 97,131 $ 96,735

Payables for collateral under securities loaned and other transactions . . . . . . . . . . . . . . . . . . . $ 24,196 $ 24,196

Bankdeposits ....................................................... $ 10,211 $ 10,300

Short-termdebt...................................................... $ 912 $ 912

Long-termdebt(1)..................................................... $ 13,185 $ 13,831

Collateralfinancingarrangements........................................... $ 5,297 $ 2,877

Juniorsubordinateddebtsecurities ......................................... $ 3,191 $ 3,167

Other liabilities:(1)

Derivativeliabilities(2) ................................................. $ 73,721 $ 4,115 $ 4,115

Tradingliabilities .................................................... $ 106 $ 106

Other ........................................................... $ 1,788 $ 1,788

Separateaccountliabilities(1) ............................................. $ 32,171 $ 32,171

Netembeddedderivativeswithinliabilityhostcontracts(3)........................... $ 1,505 $ 1,505

Commitments:(4)

Mortgageloancommitments.............................................. $ 2,220 $ — $ (48)

Commitments to fund bank credit facilities, bridge loans and private corporate bond

investments ....................................................... $ 1,261 $ — $ (52)

F-62 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)