MetLife 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The underlying assets of the separate accounts are principally comprised of cash and cash equivalents, short-term investments, fixed

maturity and equity securities, mutual funds, real estate, private equity investments and hedge funds investments.

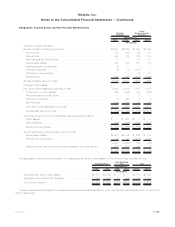

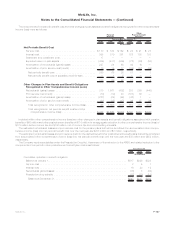

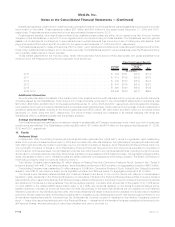

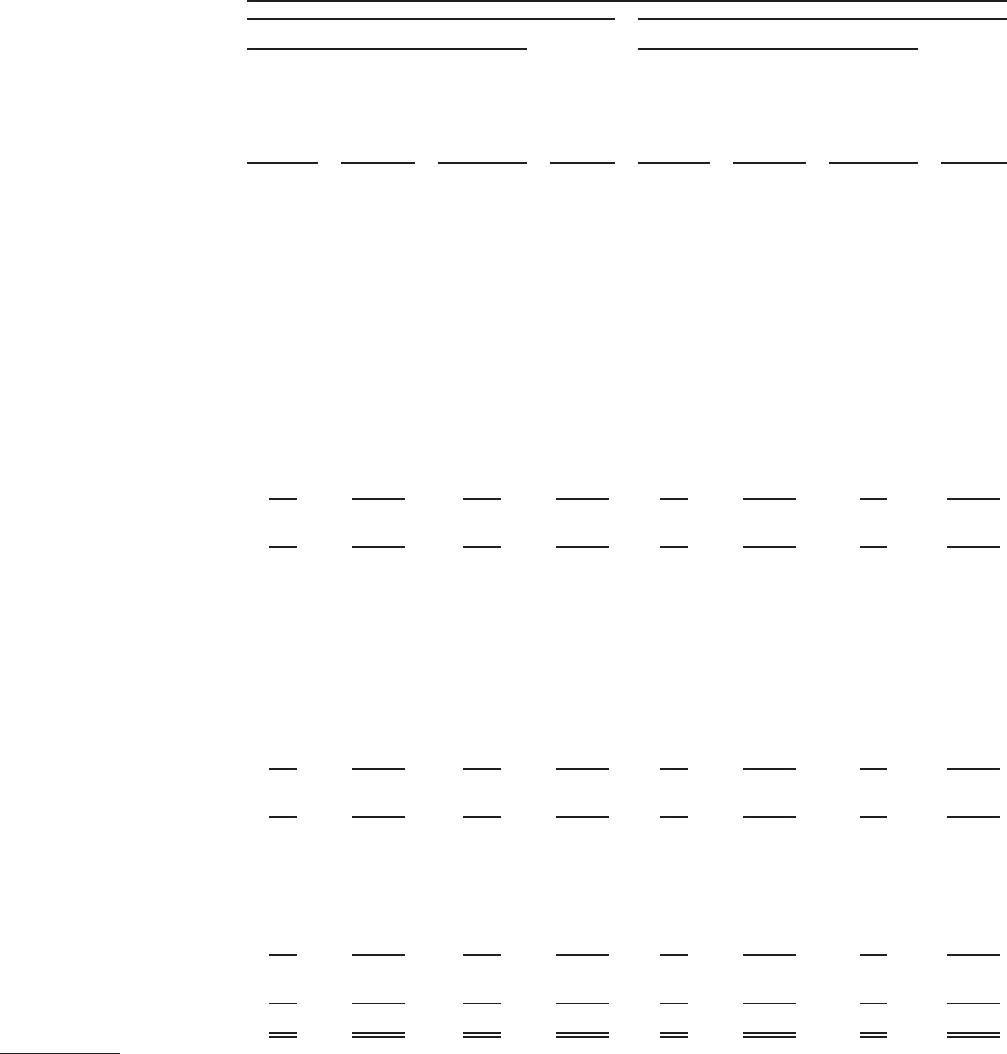

The fair values of the Subsidiaries’ pension plan assets at December 31, 2009 by asset class were as follows:

Quoted

Prices

In Active

Markets

for

Identical

Assets and

Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Quoted

Prices

In Active

Markets

for

Identical

Assets and

Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Fair Value Measurements at

Reporting Date Using Fair Value Measurements at

Reporting Date Using

Pension Assets Other Postretirement Assets

December 31, 2009

(In millions)

Asset Class

Short-terminvestments ..... $23 $ — $ — $ 23 $11 $ — $— $ 11

Fixed maturities and equity

securities............. — 63 — 63 — 57 — 57

Insurance general account . . . — 90 — 90 — 440 — 440

Investments in separate

accounts — equity

securities:

Large cap growth(1) . . . . . . . — 115 — 115 — 68 — 68

Largecapvalue(2) ........ — — — — — 176 — 176

Largecapcore(3)......... — 1,338 — 1,338 — 24 — 24

Smallcapgrowth(4) ....... — 149 — 149 — — — —

Small cap core(5) . . . . . . . . . — 112 — 112 — 72 — 72

Developed international(6) . . . — 423 — 423 — 75 — 75

Total separate accounts —

equity securities . . . . . . . . — 2,137 — 2,137 — 415 — 415

Investments in separate

accounts — fixed income

securities:

Long duration (government &

credit)(7) ............. — 2,149 — 2,149 — — — —

Core(8)................ — 326 — 326 — 128 — 128

U.S. government and

agencies ............. — — — — — 17 — 17

Mortgage-backed securities . . — — — — — 28 — 28

Short-termandcash....... — 80 — 80 — 19 — 19

Total separate accounts —

fixed income securities . . . . — 2,555 — 2,555 — 192 — 192

Investments in separate

accounts — alternatives:

Multi-strategy hedge

funds(9).............. — 238 — 238 — 6 — 6

Realestate(10)........... — 49 242 291 — — — —

Private equity(11) . . . . . . . . . — — 373 373 — — — —

Total separate accounts —

alternatives............ — 287 615 902 — 6 — 6

Total ................. $23 $5,132 $615 $5,770 $11 $1,110 $— $1,121

(1) Investment portfolio includes U.S. equity securities with relatively large market capitalization that exhibit signs of above average sales

and earnings growth.

(2) Investment portfolio includes U.S. equity securities with relatively large market capitalization and low price to book and price to earnings

ratios.

F-109MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)