MetLife 2009 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

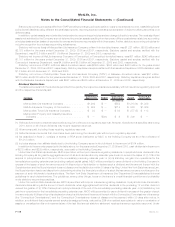

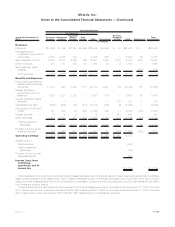

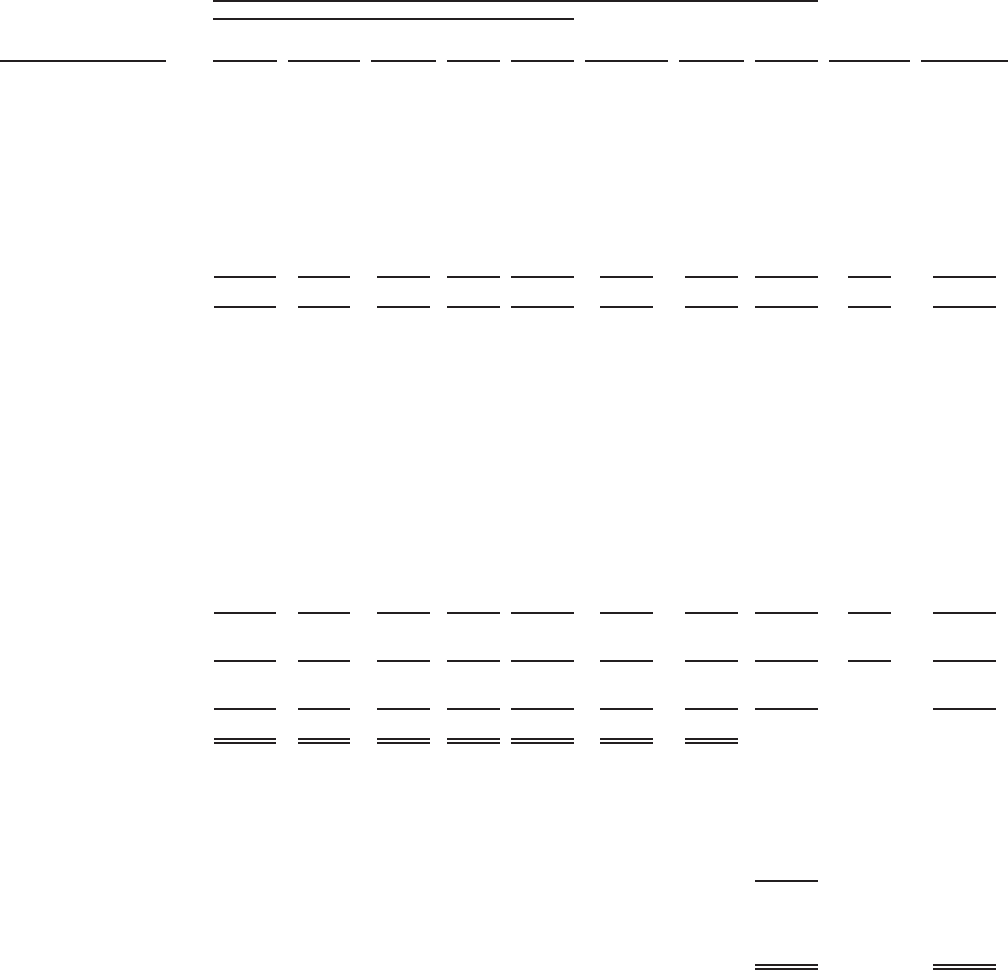

Year Ended December 31,

2007: Insurance

Products Retirement

Products

Corporate

Benefit

Funding Auto

& Home Total International

Banking,

Corporate

& Other Total Adjustments Total

Consolidated

U.S. Business

Operating Earnings

(In millions)

Revenues

Premiums . . . . . . . . . . . $15,269 $ 339 $1,265 $2,966 $19,839 $3,096 $ 35 $22,970 $ — $22,970

Universal life and

investment-type product

policy fees . . . . . . . . . 2,061 2,005 189 — 4,255 995 — 5,250 (12) 5,238

Net investment income . . . 6,079 2,740 6,636 196 15,651 1,249 1,428 18,328 (271) 18,057

Other revenues . . . . . . . . 810 181 335 43 1,369 24 72 1,465 — 1,465

Net investment gains

(losses) ........... — — — — — — — — (578) (578)

Total revenues . . . . . . . 24,219 5,265 8,425 3,205 41,114 5,364 1,535 48,013 (861) 47,152

Benefits and Expenses

Policyholder benefits and

claims and policyholder

dividends . . . . . . . . . . 17,001 605 3,365 1,811 22,782 2,521 46 25,349 157 25,506

Interest credited to

policyholder account

balances . . . . . . . . . . 1,037 1,321 2,723 — 5,081 354 — 5,435 26 5,461

Interest credited to bank

deposits . . . . . . . . . . . — — — — — — 200 200 — 200

Capitalization of DAC . . . . (885) (932) (25) (471) (2,313) (743) (8) (3,064) — (3,064)

Amortization of DAC and

VOBA . . . . . . . . . . . . . 727 822 38 468 2,055 309 11 2,375 (125) 2,250

Interest expense . . . . . . . 10 3 6 — 19 3 875 897 — 897

Other expenses . . . . . . . 4,241 2,088 477 832 7,638 2,180 328 10,146 (24) 10,122

Total benefits and

expenses . . . . . . . . . 22,131 3,907 6,584 2,640 35,262 4,624 1,452 41,338 34 41,372

Provision for income tax

expense (benefit) . . . . . 714 469 631 139 1,953 172 (157) 1,968 (293) 1,675

Operating earnings . . . . $ 1,374 $ 889 $1,210 $ 426 $ 3,899 $ 568 $ 240 4,707

Adjustments to:

Total revenues . . . . . . . (861)

Total benefits and

expenses......... (34)

Provision for income tax

(expense) benefit . . . . . 293

Income (loss) from

continuing

operations, net of

income tax ........ $ 4,105 $ 4,105

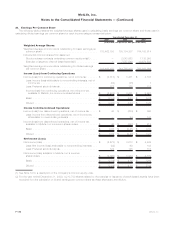

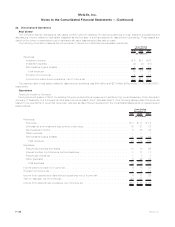

Net investment income and net investment gains (losses) are based upon the actual results of each segment’s specifically identifiable

asset portfolio adjusted for allocated equity. Other costs are allocated to each of the segments based upon: (i) a review of the nature of such

costs; (ii) time studies analyzing the amount of employee compensation costs incurred by each segment; and (iii) cost estimates included in

the Company’s product pricing.

Revenues derived from any customer did not exceed 10% of consolidated revenues for the years ended December 31, 2009, 2008 and

2007. Revenues from U.S. operations were $35.9 billion, $44.6 billion and $41.7 billion for the years ended December 31, 2009, 2008 and

2007, respectively, which represented 87%, 87% and 88%, respectively, of consolidated revenues.

F-127MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)