MetLife 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

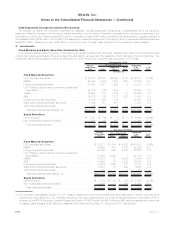

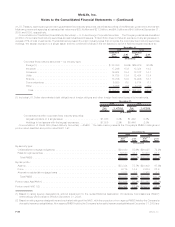

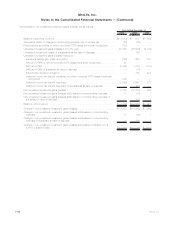

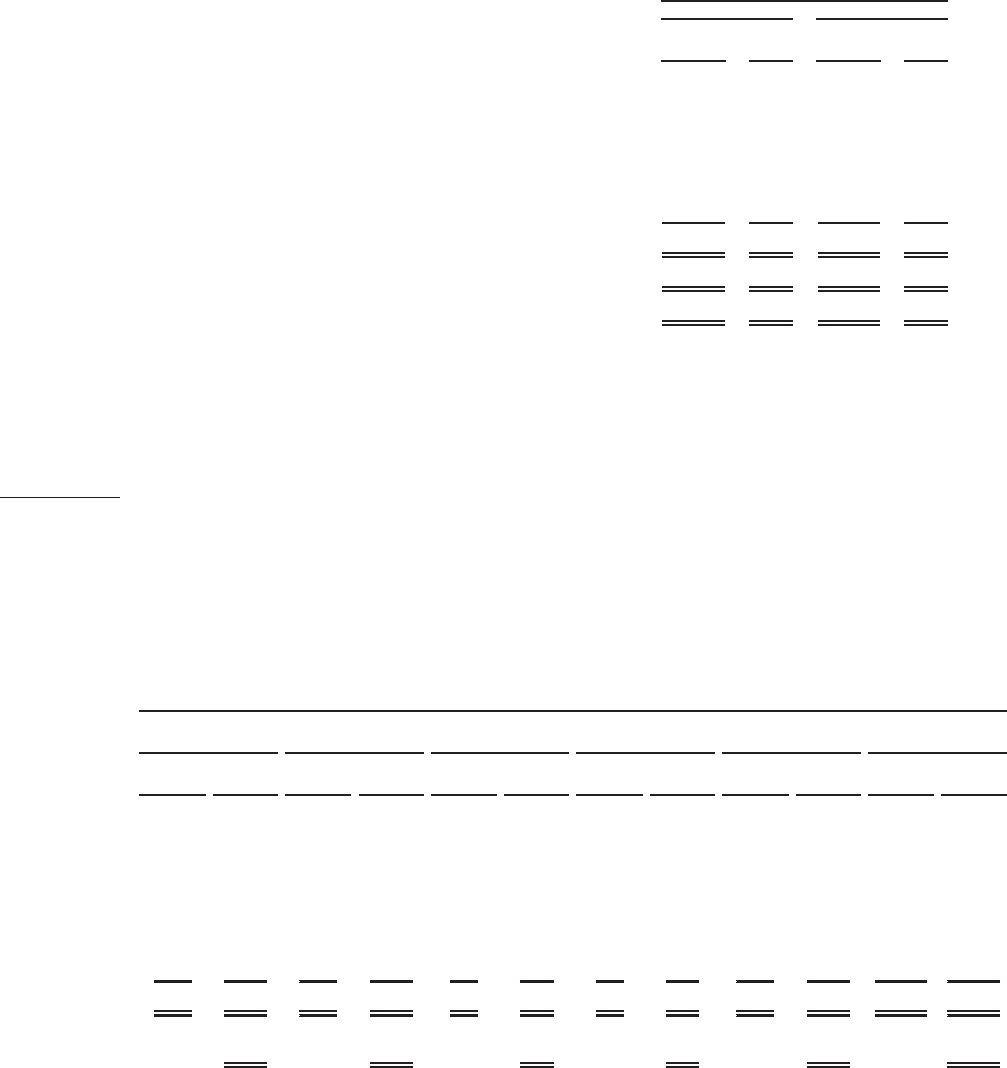

The following table presents the types of and certain other information about ABS held by the Company at:

Estimated

Fair

Value %of

Total

Estimated

Fair

Value %of

Total

2009 2008

December 31,

(In millions)

By collateral type:

Creditcardloans ....................................... $ 7,057 53.6% $ 5,190 49.3%

Studentloans.......................................... 1,855 14.1 1,085 10.3

RMBS backed by sub-prime mortgage loans . . . . . . . . . . . . . . . . . . . . . . 1,044 7.9 1,142 10.9

Automobileloans ....................................... 963 7.3 1,051 10.0

Otherloans........................................... 2,243 17.1 2,055 19.5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13,162 100.0% $10,523 100.0%

Portion rated Aaa/AAA(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,354 71.1% $ 7,934 75.4%

PortionratedNAIC1(2)..................................... $11,573 87.9% $ 9,393 89.3%

RMBS backed by sub-prime mortgage loans — portion credit enhanced by

financialguarantorinsurers................................ 37.6% 37.2%

Of the 37.6% and 37.2% credit enhanced, the financial guarantor insurers

were rated as follows:

ByfinancialguarantorinsurersratedAa/AA ..................... 17.2% 18.8%

ByfinancialguarantorinsurersratedA ........................ 7.9% —%

ByfinancialguarantorinsurersratedBaa/BBB ................... —% 37.3%

(1) Based on rating agency designations, without adjustment for the revised NAIC methodology which became effective December 31,

2009.

(2) Based on rating agency designations and equivalent ratings of the NAIC, with the exception of non-agency RMBS backed by sub-prime

mortgage loans held by the Company’s domestic insurance subsidiaries. Non-agency RMBS backed by sub-prime mortgage loans held

by the Company’s domestic insurance subsidiaries at December 31, 2009 are included based on final ratings from the revised NAIC

rating methodology which became effective December 31, 2009 (which may not correspond to rating agency designations).

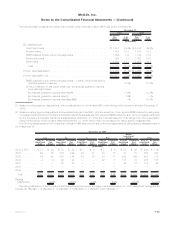

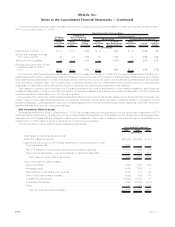

The following tables present the Company’s holdings of ABS supported by sub-prime mortgage loans by rating agency designations and

byvintageyearat:

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

December 31, 2009

(In millions)

2003 & Prior . . . $ 57 $ 48 $ 73 $ 58 $11 $ 8 $ 7 $ 6 $ 98 $ 56 $ 246 $ 176

2004 . . . . . . . . 99 68 316 222 39 27 24 15 31 15 509 347

2005 . . . . . . . . 64 45 226 144 40 26 24 18 209 139 563 372

2006 . . . . . . . . 6 6 62 22 — — 22 5 115 72 205 105

2007 . . . . . . . . — — 78 28 — — — — 36 16 114 44

2008 . . . . . . . . — — — — — — — — — — — —

2009 . . . . . . . . — — — — — — — — — — — —

Total . . . . . . . $226 $ 167 $755 $ 474 $90 $ 61 $77 $ 44 $489 $ 298 $1,637 $1,044

Ratings

Distribution . . . 16.0% 45.4% 5.8% 4.2% 28.6% 100.0%

The rating distribution of the Company’s ABS supported by sub-prime mortgage loans at December 31, 2009 using NAIC ratings are as

follows: 69.1% NAIC 1, 4.2% NAIC 2, 12.2% NAIC 3, 6.2% NAIC 4, 8.3% NAIC 5 and 0% NAIC 6.

F-33MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)