MetLife 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Risk on Freestanding Derivatives

The Company may be exposed to credit-related losses in the event of nonperformance by counterparties to derivative financial

instruments. Generally, the current credit exposure of the Company’s derivative contracts is limited to the net positive estimated fair value

of derivative contracts at the reporting date after taking into consideration the existence of netting agreements and any collateral received

pursuant to credit support annexes.

The Company manages its credit risk related to over-the-counter derivatives by entering into transactions with creditworthy counter-

parties, maintaining collateral arrangements and through the use of master agreements that provide for a single net payment to be made by

one counterparty to another at each due date and upon termination. Because exchange-traded futures are effected through regulated

exchanges, and positions are marked to market on a daily basis, the Company has minimal exposure to credit-related losses in the event of

nonperformance by counterparties to such derivative instruments. See Note 1 for a description of the impact of credit risk on the valuation of

derivative instruments.

The Company enters into various collateral arrangements, which require both the pledging and accepting of collateral in connection with

its derivative instruments. At December 31, 2009 and 2008, the Company was obligated to return cash collateral under its control of

$2,680 million and $7,758 million, respectively. This unrestricted cash collateral is included in cash and cash equivalents or in short-term

investments and the obligation to return it is included in payables for collateral under securities loaned and other transactions in the

consolidated balance sheets. At December 31, 2009 and 2008, the Company had also accepted collateral consisting of various securities

with a fair market value of $221 million and $1,249 million, respectively, which are held in separate custodial accounts. The Company is

permitted by contract to sell or repledge this collateral, but at December 31, 2009, none of the collateral had been sold or repledged.

The Company’s collateral arrangements for its over-the-counter derivatives generally require the counterparty in a net liability position,

after considering the effect of netting agreements, to pledge collateral when the fair value of that counterparty’s derivatives reaches a pre-

determined threshold. Certain of these arrangements also include credit-contingent provisions that provide for a reduction of these

thresholds (on a sliding scale that converges toward zero) in the event of downgrades in the credit ratings of the Company and/or the

counterparty. In addition, certain of the Company’s netting agreements for derivative instruments contain provisions that require the Company

to maintain a specific investment grade credit rating from at least one of the major credit rating agencies. If the Company’s credit ratings were

to fall below that specific investment grade credit rating, it would be in violation of these provisions, and the counterparties to the derivative

instruments could request immediate payment or demand immediate and ongoing full overnight collateralization on derivative instruments

that are in a net liability position after considering the effect of netting agreements.

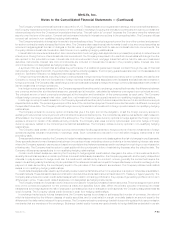

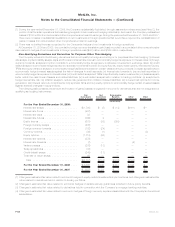

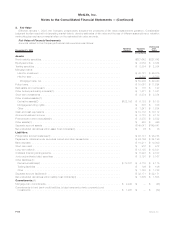

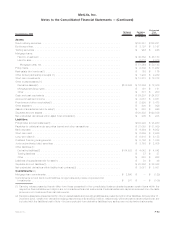

The following table presents the estimated fair value of the Company’s over-the-counter derivatives that are in a net liability position after

considering the effect of netting agreements, together with the estimated fair value and balance sheet location of the collateral pledged. The

table also presents the incremental collateral that the Company would be required to provide if there was a one notch downgrade in the

Company’s credit rating at the reporting date or if the Company’s credit rating sustained a downgrade to a level that triggered full overnight

collateralization or termination of the derivative position at the reporting date. Derivatives that are not subject to collateral agreements are not

included in the scope of this table.

Fixed Maturity

Securities(2)

One Notch

Downgrade

in the

Company’s

Credit

Rating

Downgrade in the

Company’s Credit Rating

to a Level that Triggers

Full Overnight

Collateralization or

Termina tion

of the Derivative Position

Estimated

Fair Value (1) of

Derivatives in Net

Liability Position

December 31, 2009

Estimated

Fair Value of

Collateral

Provided

December 31, 2009 Fair Value of Incremental Collateral

Provided Upon:

(In millions)

Derivatives subject to credit-contingent provisions . . . . . . $1,163 $1,017 $90 $218

Derivatives not subject to credit-contingent provisions . . . . 48 42 — —

Total .................................. $1,211 $1,059 $90 $218

(1) After taking into consideration the existence of netting agreements.

(2) Included in fixed maturity securities in the consolidated balance sheets. The counterparties are permitted by contract to sell or repledge

this collateral. At December 31, 2009, the Company did not provide any cash collateral.

Without considering the effect of netting agreements, the estimated fair value of the Company’s over-the-counter derivatives with credit-

contingent provisions that were in a gross liability position at December 31, 2009 was $1,645 million. At December 31, 2009, the Company

provided securities collateral of $1,017 million in connection with these derivatives. In the unlikely event that both: (i) the Company’s credit

rating is downgraded to a level that triggers full overnight collateralization or termination of all derivative positions; and (ii) the Company’s

netting agreements are deemed to be legally unenforceable, then the additional collateral that the Company would be required to provide to

its counterparties in connection with its derivatives in a gross liability position at December 31, 2009 would be $628 million. This amount does

not consider gross derivative assets of $488 million for which the Company has the contractual right of offset.

At December 31, 2008, the Company provided securities collateral for various arrangements in connection with derivative instruments of

$776 million, which is included in fixed maturity securities. The counterparties are permitted by contract to sell or repledge this collateral.

The Company also has exchange-traded futures, which require the pledging of collateral. At December 31, 2009 and 2008, the Company

pledged securities collateral for exchange-traded futures of $50 million and $282 million, respectively, which is included in fixed maturity

F-60 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)