MetLife 2009 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

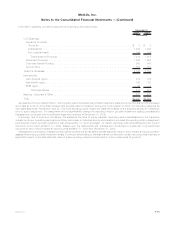

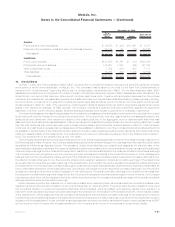

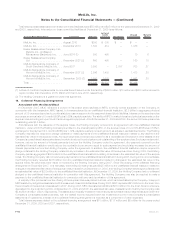

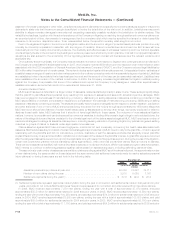

Information regarding the closed block revenues and expenses is as follows:

2009 2008 2007

Years Ended December 31,

(In millions)

Revenues

Premiums..................................................... $2,708 $2,787 $2,870

Netinvestmentincomeandotherrevenues ............................... 2,197 2,248 2,350

Net investment gains (losses):

Other-than-temporaryimpairmentsonfixedmaturitysecurities.................. (107) (94) (3)

Other-than-temporary impairments on fixed maturity securities transferred to other

comprehensiveloss ........................................... 40 — —

Othernetinvestmentgains(losses),net................................ 199 10 31

Totalnetinvestmentgains(losses).................................. 132 (84) 28

Totalrevenues............................................... 5,037 4,951 5,248

Expenses

Policyholderbenefitsandclaims ...................................... 3,329 3,393 3,457

Policyholderdividends............................................. 1,394 1,498 1,492

Otherexpenses................................................. 203 217 231

Totalexpenses............................................... 4,926 5,108 5,180

Revenues, net of expenses before provision for income tax expense (benefit) . . . . . . . . . 111 (157) 68

Provision(benefit)forincometaxexpense(benefit) .......................... 36 (68) 21

Revenues, net of expenses and provision for income tax expense (benefit) . . . . . . . . . . . $ 75 $ (89) $ 47

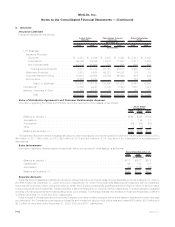

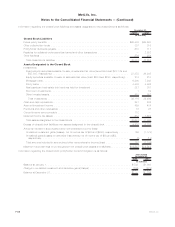

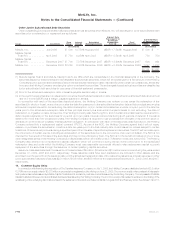

The change in the maximum future earnings of the closed block is as follows:

2009 2008 2007

Years Ended December 31,

(In millions)

BalanceatDecember31,........................................... $4,587 $4,518 $4,429

Less:........................................................

Cumulative effect of a change in accounting principle, net of income tax . . . . . . . . . . . — — (4)

Closedblockadjustment(1)........................................ 144 — —

BalanceatJanuary1, ............................................. 4,518 4,429 4,480

Changeduringyear .............................................. $ (75) $ 89 $ (47)

(1) The closed block adjustment represents an intra-company reallocation of assets which affected the closed block. The adjustment had no

impact on the Company’s consolidated financial statements.

MLIC charges the closed block with federal income taxes, state and local premium taxes and other additive state or local taxes, as well as

investment management expenses relating to the closed block as provided in the Plan. MLIC also charges the closed block for expenses of

maintaining the policies included in the closed block.

F-89MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)