MetLife 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

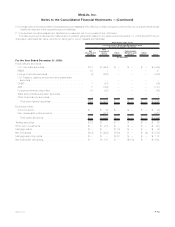

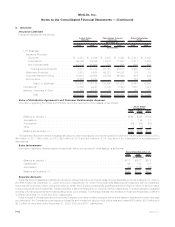

Net

Investment

Income

Net

Investment

Gains

(Losses) Other

Revenues

Policyholder

Benefits and

Claims Other

Expenses Total

Classification of Realized/Unrealized Gains

(Losses) included in Earnings

Total G ain s and Los ses

(In millions)

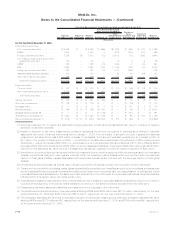

For the Year Ended December 31, 2008:

Fixed maturity securities:

U.S.corporatesecurities........................ $ 15 $ (711) $ — $ — $— $ (696)

RMBS.................................... 3 1 — — — 4

Foreigncorporatesecurities...................... 123 (135) — — — (12)

U.S. Treasury, agency and government guaranteed

securities ................................ — — — — — —

CMBS.................................... 4 (76) — — — (72)

ABS ..................................... 4 (129) — — — (125)

Foreigngovernmentsecurities .................... 27 (8) — — — 19

Stateandpoliticalsubdivisionsecurities.............. (1) 1 — — — —

Otherfixedmaturitysecurities..................... 1 — — — — 1

Totalfixedmaturitysecurities.................... $176 $(1,057) $ — $ — $— $ (881)

Equity securities:

Commonstock .............................. $ — $ (2) $ — $ — $— $ (2)

Non-redeemablepreferredstock................... — (195) — — — (195)

Totalequitysecurities......................... $ — $ (197) $ — $ — $— $ (197)

Tradingsecurities.............................. $(26) $ — $ — $ — $— $ (26)

Short-terminvestments .......................... $ 1 $ (1) $ — $ — $— $ —

Mortgageloans ............................... $ — $ — $ 4 $ — $— $ 4

Netderivatives................................ $103 $1,587 $ 39 $ — $— $1,729

Mortgage servicing rights . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $(149) $ — $— $ (149)

Netembeddedderivatives ........................ $ — $(2,682) $ — $182 $— $(2,500)

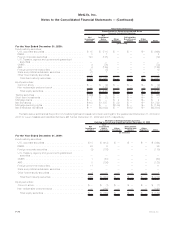

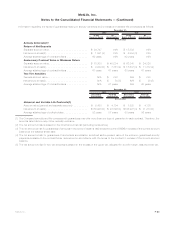

The table below summarizes the portion of unrealized gains and losses recorded in earnings for the years ended December 31, 2009 and

2008 for Level 3 assets and liabilities that were still held at December 31, 2009 and 2008, respectively.

Net

Investment

Income

Net

Investment

Gains

(Losses) Other

Revenues

Policyholder

Benefits and

Claims Other

Expenses Total

Changes in Unrealized Gains (Losses)

Relating to Assets and Liabilities Held at December 31, 2009

(In millions)

For the Year Ended December 31, 2009:

Fixed maturity securities:

U.S.corporatesecurities ........................ $18 $ (412) $ — $ — $ — $ (394)

RMBS .................................... 30 6 — — — 36

Foreigncorporatesecurities ...................... (3) (176) — — — (179)

U.S. Treasury, agency and government guaranteed

securities................................. — — — — — —

CMBS .................................... 1 (61) — — — (60)

ABS...................................... 8 (136) — — — (128)

Foreigngovernmentsecurities..................... 11 — — — — 11

Stateandpoliticalsubdivisionsecurities .............. — — — — — —

Otherfixedmaturitysecurities..................... 1 — — — — 1

Totalfixedmaturitysecurities .................... $66 $ (779) $ — $ — $ — $ (713)

Equity securities:

Commonstock............................... $— $ (1) $ — $ — $ — $ (1)

Non-redeemablepreferredstock ................... — (168) — — — (168)

Totalequitysecurities......................... $— $ (169) $ — $ — $ — $ (169)

F-74 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)