MetLife 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Mortgage Loans

The Company’s mortgage loans are principally collateralized by commercial, agricultural and residential properties, as well as automo-

biles. The carrying value of mortgage loans was $50.9 billion and $51.4 billion, or 15.1% and 15.9% of total cash and invested assets at

December 31, 2009 and 2008, respectively. See Note 3 of the Notes to the Consolidated Financial Statements “Investments — Mortgage

Loans” for a table that presents the carrying value by type of the Company’s mortgage loans held-for-investment of $48.2 billion and

$49.4 billion at December 31, 2009 and 2008, respectively, as well as the components of the mortgage loans held-for-sale of $2.7 billion and

$2.0 billion at December 31, 2009 and 2008, respectively.

Commercial Mortgage Loans by Geographic Region and Property Type. The Company diversifies its commercial mortgage loans by both

geographic region and property type. See Note 3 of the Notes to the Consolidated Financial Statements “Investments — Mortgage Loans —

Mortgage Loans by Geographic Region and Property Type” for tables that present the distribution across geographic regions and property

types for commercial mortgage loans held-for-investment at December 31, 2009 and 2008.

Mortgage Loan Credit Quality — Restructured, Potentially Delinquent, Delinquent or Under Foreclosure. The Company monitors its

mortgage loan investments on an ongoing basis, including reviewing loans that are restructured, potentially delinquent, and delinquent or

under foreclosure. These loan classifications are consistent with those used in industry practice.

The Company defines restructured mortgage loans as loans in which the Company, for economic or legal reasons related to the debtor’s

financial difficulties, grants a concession to the debtor that it would not otherwise consider. The Company defines potentially delinquent loans

as loans that, in management’s opinion, have a high probability of becoming delinquent in the near term. The Company defines delinquent

mortgage loans, consistent with industry practice, as loans in which two or more interest or principal payments are past due. The Company

defines mortgage loans under foreclosure as loans in which foreclosure proceedings have formally commenced.

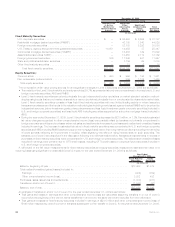

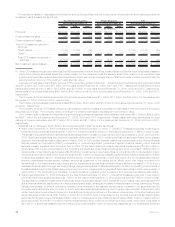

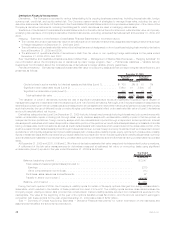

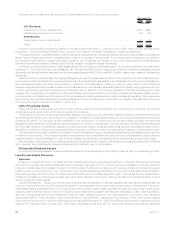

The following table presents the amortized cost and valuation allowance (amortized cost is carrying value before valuation allowances) for

commercial mortgage loans, agricultural mortgage loans, and residential and consumer loans held-for-investment distributed by loan

classification at:

Amortized

Cost %of

Total Valuation

Allowance

%of

Amortized

Cost Amortized

Cost %of

Total Valuation

Allowance

%of

Amortized

Cost

2009 2008

December 31,

(In millions)

Commercial:

Performing . . . . . . . . . . . . . . . . . . . . . . . $35,066 99.7% $548 1.6% $36,192 100.0% $232 0.6%

Restructured...................... — — — —% — — — —%

Potentiallydelinquent ................ 102 0.3 41 40.2% 2 — — —%

Delinquentorunderforeclosure ......... 8 — — —% 3 — — —%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $35,176 100.0% $589 1.7% $36,197 100.0% $232 0.6%

Agricultural(1):

Performing ....................... $11,950 97.5% $ 33 0.3% $12,054 98.0% $ 16 0.1%

Restructured...................... 36 0.3 10 27.8% 1 — — —%

Potentially delinquent . . . . . . . . . . . . . . . . 128 1.0 34 26.6% 133 1.1 18 13.5%

Delinquent or under foreclosure . . . . . . . . . 141 1.2 38 27.0% 107 0.9 27 25.2%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $12,255 100.0% $115 0.9% $12,295 100.0% $ 61 0.5%

Residential and Consumer(2):

Performing ....................... $ 1,389 94.4% $ 16 1.2% $ 1,116 95.8% $ 11 1.0%

Restructured...................... 1 0.1 — —% — — — —%

Potentiallydelinquent ................ 10 0.7 — —% 17 1.5 — —%

Delinquent or under foreclosure . . . . . . . . . 71 4.8 1 1.4% 31 2.7 — —%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,471 100.0% $ 17 1.2% $ 1,164 100.0% $ 11 0.9%

(1) The Company diversifies its agricultural mortgage loans held-for-investment by both geographic region and product type. Of the

$12,255 million of agricultural mortgage loans outstanding at December 31, 2009, 54% were subject to rate resets prior to maturity. A

substantial portion of these loans has been successfully renegotiated and remain outstanding to maturity.

(2) Residential and consumer loans consist of primarily residential mortgage loans, home equity lines of credit, and automobile loans

held-for-investment.

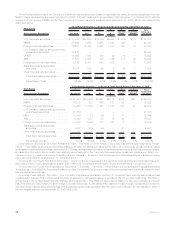

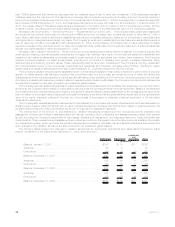

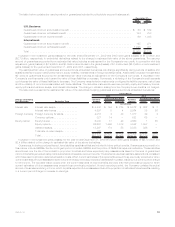

Mortgage Loan Credit Quality — Monitoring Process — Commercial and Agricultural Loans. The Company reviews all commercial

mortgage loans on an ongoing basis. These reviews may include an analysis of the property financial statements and rent roll, lease rollover

analysis, property inspections, market analysis, estimated valuations of the underlying collateral, loan-to-value ratios, debt service coverage

ratios, and tenant creditworthiness. The monitoring process focuses on higher risk loans, which include those that are classified as

restructured, potentially delinquent, delinquent or in foreclosure, as well as loans with higher loan-to-value ratios and lower debt service

coverage ratios. The monitoring process for agricultural loans is generally similar, with a focus on higher risk loans, including reviews of the

portfolio on a geographic and sector basis.

Loan-to-value ratios and debt service coverage ratios are common measures in the assessment of the quality of commercial mortgage

loans. Loan-to-value ratios compare the amount of the loan to the estimated fair value of the underlying collateral. A loan-to-value ratio greater

45MetLife, Inc.