MetLife 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

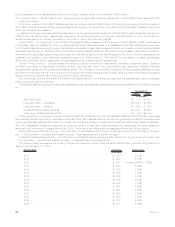

the net embedded derivatives within liability host contracts primarily due to first time inclusion of international net embedded derivatives of

$626 million decreased risk by $778 million. Additionally, a change in long-term and junior subordinated debt due to an improvement in credit

spreads and new issuance of debt, and an increase in the duration of the investment portfolio, decreased risk by $318 million and

$193 million, respectively. This was partially offset by an increase in interest rates across the long end of the swaps and U.S. Treasury curves

resulting in an increase in the interest rate risk of $1,668 million. The increase in the net base of liabilities and assets of $522 million also

increased interest rate risk which contributed to the offset. The remainder of the fluctuation is attributable to numerous immaterial items.

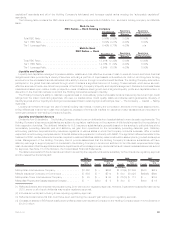

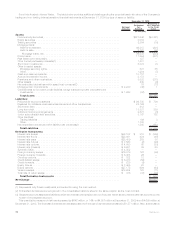

Sensitivity Analysis: Foreign Currency Exchange Rates. The table below provides additional detail regarding the potential loss in

estimated fair value of the Company’s portfolio due to a 10% change in foreign currency exchange rates at December 31, 2009 by type of

asset or liability:

Notional

Amount

Estimated

Fair

Value(1)

Assuming a

10% Increase

in the Foreign

Exchange Rate

December 31, 2009

(In millions)

Assets:

Fixedmaturitysecurities .............................................. $227,642 $(2,060)

Equitysecurities ................................................... 3,084 (5)

Tradingsecurities .................................................. 2,384 (93)

Mortgage loans:

Held-for-investment................................................ 46,315 (338)

Held-for-sale .................................................... 2,728 —

Mortgageloans,net.............................................. 49,043 (338)

Policyloans ...................................................... 11,294 (45)

Short-terminvestments............................................... 8,374 (65)

Other invested assets:

Mortgageservicingrights............................................ 878 —

Other......................................................... 1,284 (49)

Cashandcashequivalents ............................................ 10,112 (100)

Accruedinvestmentincome............................................ 3,173 (10)

Total Assets ................................................... $(2,765)

Liabilities:

Policyholderaccountbalances.......................................... $ 96,735 $1,275

Long-termdebt.................................................... 13,831 103

Netembeddedderivativeswithinliabilityhostcontracts(2) ........................ 1,505 122

Total Liabilities ................................................. $1,500

Derivative Instruments:

Interestrateswaps ................................................. $38,152 $ 315 $ 5

Interestratefloors .................................................. $23,691 424 —

Interestratecaps .................................................. $28,409 283 —

Interestratefutures ................................................. $ 7,563 (2) (2)

Interestrateoptions................................................. $ 4,050 60 —

Interestrateforwards ................................................ $ 9,921 39 —

SyntheticGICs .................................................... $ 4,352 — —

Foreigncurrencyswaps .............................................. $16,879 122 215

Foreigncurrencyforwards............................................. $ 6,485 26 220

Currencyoptions................................................... $ 822 18 —

Creditdefaultswaps ................................................ $ 6,723 (56) —

Creditforwards.................................................... $ 220 (4) —

Equityfutures..................................................... $ 7,405 23 (1)

Equityoptions..................................................... $27,175 694 (61)

Varianceswaps.................................................... $13,654 123 (2)

Totalrateofreturnswaps ............................................. $ 376 (47) —

Total Derivative Instruments ........................................ $ 374

Net Change ....................................................... $ (891)

73MetLife, Inc.