MetLife 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

To my fellow shareholders:

In my letter to you last year, I talked about some of the attributes that define and

differentiate MetLife — our financial strength, our leading position in the insurance

industry and the guarantees we provide our customers. In 2009, these attributes once

again proved to be critically important, and enabled us to grow premiums, fees & other

revenues 4% over 2008. This growth was achieved in one of the most challenging

economic environments seen in decades, proving that MetLife’s customers value what

we bring to the marketplace — demonstrated expertise in meeting their long-term financial needs.

As shareholders of this great company, you know that our extensive track record of success can also be

attributed to the long-term view we take. Over time, we have built leading insurance and retirement businesses with

tremendous scale which, when combined with our unwavering focus on meeting client needs, have enabled us to

increase market share and further strengthen our leadership positions.

Extending Our Lead in the U.S.

Last August, we took a bold step in reorganizing our businesses in the United States to position MetLife for

further success. Specifically, we combined the former Institutional and Individual Businesses, as well as our Auto &

Home unit, into a single organization now called U.S. Business. This realignment recognized that we can better

serve both employee benefit plan sponsors and individual customers through a single, integrated organization.

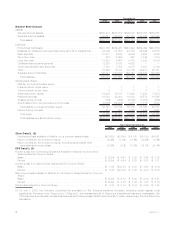

In U.S. Business — which consists of Insurance Products, Retirement Products, Corporate Benefit Funding

and Auto & Home — premiums, fees & other revenues grew 2% over 2008 to $28.6 billion. Importantly, this growth

was achieved while we simultaneously maintained our pricing and risk management discipline. Briefly, I would like to

share some highlights of the performance of these businesses to illustrate how our financial strength, scale and

experience are benefiting us:

•InInsurance Products, premiums, fees & other revenues increased 4% as each of the businesses that

make up this segment — group life, individual life and non-medical health — grew over 2008. The scale that

MetLife has built in a number of group businesses has enabled us to generate profitable growth, and this was

particularly the case with our group life and non-medical health businesses, where we continue to maintain

leading market positions. On the individual side, we also saw strong demand for our whole and term life

insurance products, sales of which grew 46% and 23%, respectively.

• The demand for the guarantees associated with many of our annuity products helped drive a 5% increase in

premiums, fees & other revenues in our Retirement Products business. In addition, total annuity deposits

grew 10%. In 2009, we also maintained our leading position in the annuity marketplace, ending the year as the

number one seller of annuities, according to VARDS and LIMRA.

• Financial strength and long-term experience are just two factors that have made us a leader and expert in

providing pension closeouts, structured settlements and other solutions that make up our Corporate

Benefit Funding business. During 2009, we continued to capture market share in the structured settlement

business, growing premiums for this product line 53% over 2008. In addition, our long history of developing

innovative pension risk transfer solutions enabled us to generate $944 million in pension closeout premiums.

•OurAuto & Home business also had another solid year, with sales of new policies increasing 10% over

2008. Today, we remain the largest provider of group auto and home insurance and this business continues to

generate strong profits for MetLife, ending the year with an excellent return on equity of 18% and a combined

ratio of 92.3%.