MetLife 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

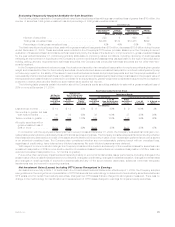

of OTTI loss recognized in earnings on fixed maturity securities still held by the Company at December 31, 2009 for which a portion of the OTTI

loss was recognized in other comprehensive loss for the year ended December 31, 2009.

Securities Lending

The Company participates in a securities lending program whereby blocks of securities, which are included in fixed maturity securities and

short-term investments, are loaned to third parties, primarily brokerage firms and commercial banks. The Company generally obtains

collateral in an amount equal to 102% of the estimated fair value of the loaned securities, which is obtained at the inception of a loan and

maintained at a level greater than or equal to 100% for the duration of the loan. In limited instances, during the extraordinary market events

beginning in the fourth quarter of 2008 and through part of 2009, we accepted collateral less than 102% at the inception of certain loans, but

never less than 100%, of the estimated fair value of such loaned securities. These loans involved U.S. Government Treasury Bills which are

considered to have limited variation in their estimated fair value during the term of the loan. Securities loaned under such transactions may be

sold or repledged by the transferee. The Company is liable to return to its counterparties the cash collateral under its control.

Elements of the securities lending program is presented in Note 3 of the Notes to the Consolidated Financial Statements under “—

Investments — Securities Lending.”

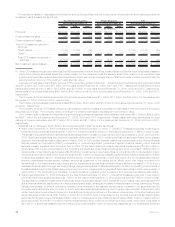

The estimated fair value of the securities related to the cash collateral on open at December 31, 2009 has been reduced to $3,193 million

from $4,986 million at December 31, 2008. Of the $3,193 million of estimated fair value of the securities related to the cash collateral on open

at December 31, 2009, $3,012 million were U.S. Treasury, agency and government guaranteed securities which, if put to the Company, can

be immediately sold to satisfy the cash requirements. The remainder of the securities on loan, related to the cash collateral aged less than

thirty days to ninety days or greater, was primarily U.S. Treasury, agency, and government guaranteed securities, and very liquid RMBS. The

U.S. Treasury securities on loan are primarily holdings of on-the-run U.S. Treasury securities, the most liquid U.S. Treasury securities

available. If these high quality securities that are on loan are put back to the Company, the proceeds from immediately selling these securities

can be used to satisfy the related cash requirements. The reinvestment portfolio acquired with the cash collateral consisted principally of fixed

maturity securities (including RMBS, ABS, U.S. corporate and foreign corporate securities). If the on loan securities or the reinvestment

portfolio become less liquid, the Company has the liquidity resources of most of its general account available to meet any potential cash

demands when securities are put back to the Company.

Security collateral on deposit from counterparties in connection with the securities lending transactions may not be sold or repledged,

unless the counterparty is in default, and is not reflected in the consolidated financial statements.

Invested Assets on Deposit, Held in Trust and Pledged as Collateral

The invested assets on deposit, invested assets held in trust and invested assets pledged as collateral at December 31, 2009 and 2008

are presented in a table in Note 3 of the Notes to the Consolidated Financial Statements “— Investments — Invested Assets on Deposit, Held

in Trust and Pledged as Collateral.”

See also “— Investments — Securities Lending” for the amount of the Company’s cash and invested assets received from and due back

to counterparties pursuant to the securities lending program.

Trading Securities

The Company has trading securities to support investment strategies that involve the active and frequent purchase and sale of securities,

the execution of short sale agreements and asset and liability matching strategies for certain insurance products. Trading securities which

consisted principally of publicly-traded fixed maturity and equity securities, were $2.4 billion and $0.9 billion, or 0.7% and 0.3% of total cash

and invested assets at estimated fair value, at December 31, 2009 and 2008, respectively. See Note 3 of the Notes to the Consolidated

Financial Statements “Investments— Trading Securities” for tables which present information about the trading securities, related short sale

agreement liabilities, investments pledged to secure short sale agreement liabilities, net investment income and changes in estimated fair

value included in net investment income at December 31, 2009 and 2008 and for the years ended December 31, 2009, 2008 and 2007.

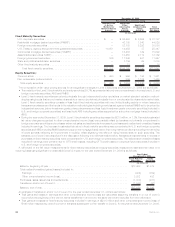

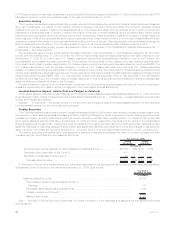

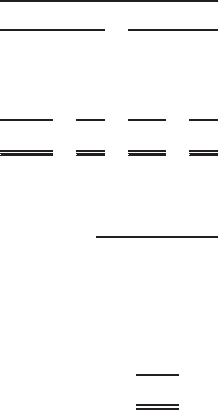

The trading securities and trading (short sale agreement) liabilities, measured at estimated fair value on a recurring basis and their

corresponding fair value hierarchy, are presented as follows:

Trading

Securities Trading

Liabilities

December 31, 2009

(In millions)

Quoted prices in active markets for identical assets and liabilities (Level 1) . . . . . . . . . . $1,886 79% $106 100%

Significantotherobservableinputs(Level2).............................. 415 17 — —

Significantunobservableinputs(Level3)................................ 83 4 — —

Totalestimatedfairvalue......................................... $2,384 100% $106 100%

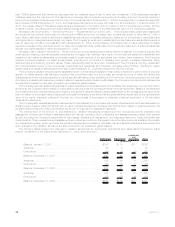

A rollforward of the fair value measurements for trading securities measured at estimated fair value on a recurring basis using significant

unobservable (Level 3) inputs for the year ended December 31, 2009, is as follows:

Year Ended

December 31, 2009

(In millions)

Balance,beginningofyear ................................................. $175

Total realized/unrealized gains (losses) included in:

Earnings .......................................................... 16

Purchases,sales,issuancesandsettlements.................................... (108)

Transferinand/oroutofLevel3 ............................................ —

Balance,endofyear.................................................... $ 83

See “— Summary of Critical Accounting Estimates” for further information on the estimates and assumptions that affect the amounts

reported above.

44 MetLife, Inc.