MetLife 2009 Annual Report Download - page 57

Download and view the complete annual report

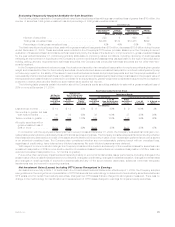

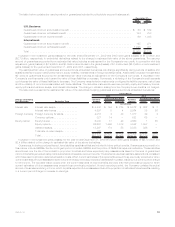

Please find page 57 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.entered into with the FHLB of NY was $2.4 billion and $1.8 billion at December 31, 2009 and 2008, respectively, which is included in long-term

debt and short-term debt depending upon the original tenor of the advance. During the years ended December 31, 2009, 2008 and 2007,

MetLife Bank received advances related to long-term borrowings totaling $1.3 billion, $220 million and $390 million, respectively, from the

FHLB of NY. MetLife Bank made repayments to the FHLB of NY of $497 million, $371 million and $175 million related to long-term borrowings

for the years ended December 31, 2009, 2008 and 2007, respectively. The advances on the repurchase agreements related to both long-

term and short-term debt were collateralized by residential mortgages, mortgage loans held-for-sale, commercial mortgages and mortgage-

backed securities with estimated fair values of $5.5 billion and $3.1 billion at December 31, 2009 and 2008, respectively.

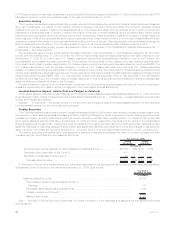

Collateral for Securities Lending

The Company has non-cash collateral for securities lending on deposit from customers, which cannot be sold or repledged, and which

has not been recorded on its consolidated balance sheets. The amount of this collateral was $6 million and $279 million at December 31,

2009 and 2008, respectively.

Insolvency Assessments

See Note 16 of the Notes to the Consolidated Financial Statements.

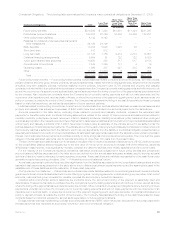

Policyholder Liabilities

The Company establishes, and carries as liabilities, actuarially determined amounts that are calculated to meet policy obligations when a

policy matures or is surrendered, an insured dies or becomes disabled or upon the occurrence of other covered events, or to provide for

future annuity payments. Amounts for actuarial liabilities are computed and reported in the consolidated financial statements in conformity

with GAAP. For more details on Policyholder Liabilities see “Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Summary of Critical Accounting Estimates.” Also see Notes 1 and 8 of the Notes to the Consolidated Financial Statements for

an analysis of certain policyholder liabilities at December 31, 2009 and 2008.

Due to the nature of the underlying risks and the high degree of uncertainty associated with the determination of actuarial liabilities, the

Company cannot precisely determine the amounts that will ultimately be paid with respect to these actuarial liabilities, and the ultimate

amounts may vary from the estimated amounts, particularly when payments may not occur until well into the future.

However, we believe our actuarial liabilities for future benefits are adequate to cover the ultimate benefits required to be paid to

policyholders. We periodically review our estimates of actuarial liabilities for future benefits and compare them with our actual experience. We

revise estimates, to the extent permitted or required under GAAP, if we determine that future expected experience differs from assumptions

used in the development of actuarial liabilities.

The Company has experienced, and will likely in the future experience, catastrophe losses and possibly acts of terrorism, and turbulent

financial markets that may have an adverse impact on our business, results of operations, and financial condition. Catastrophes can be

caused by various events, including pandemics, hurricanes, windstorms, earthquakes, hail, tornadoes, explosions, severe winter weather

(including snow, freezing water, ice storms and blizzards), fires and man-made events such as terrorist attacks. Due to their nature, we cannot

predict the incidence, timing, severity or amount of losses from catastrophes and acts of terrorism, but we make broad use of catastrophic

and non-catastrophic reinsurance to manage risk from these perils.

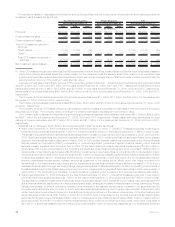

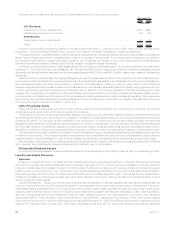

Future Policy Benefits

The Company establishes liabilities for amounts payable under insurance policies. Generally, amounts are payable over an extended

period of time and related liabilities are calculated as the present value of expected future benefits to be paid, reduced by the present value of

expected future net premiums. Such liabilities are established based on methods and underlying assumptions in accordance with GAAP and

applicable actuarial standards. Principal assumptions used in the establishment of liabilities for future policy benefits include mortality,

morbidity, policy lapse, renewal, retirement, investment returns, inflation, expenses and other contingent events as appropriate to the

respective product type. These assumptions are established at the time the policy is issued and are intended to estimate the experience for

the period the policy benefits are payable. Utilizing these assumptions, liabilities are established on a block of business basis. If experience is

less favorable than assumed and future losses are projected under loss recognition testing, then additional liabilities may be required,

resulting in a charge to policyholder benefits and claims.

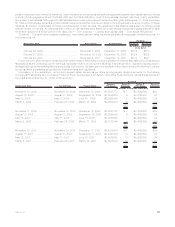

Insurance Products. Future policy benefits are comprised mainly of liabilities for disabled lives under disability waiver of premium policy

provisions, liabilities for survivor income benefit insurance, long term care policies, active life policies and premium stabilization and other

contingency liabilities held under participating life insurance contracts. In order to manage risk, the Company has often reinsured a portion of

the mortality risk on new individual life insurance policies. The reinsurance programs are routinely evaluated and this may result in increases or

decreases to existing coverage. The Company entered into various derivative positions, primarily interest rate swaps and swaptions, to

mitigate the risk that investment of premiums received and reinvestment of maturing assets over the life of the policy will be at rates below

those assumed in the original pricing of these contracts.

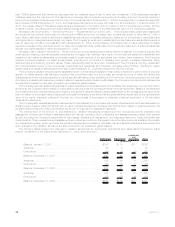

Retirement Products. Future policy benefits are comprised mainly of liabilities for life-contingent income annuities, supplemental

contracts with and without life contingencies, liabilities for Guaranteed Minimum Death Benefits (“GMDBs”) included in certain annuity

contracts, and a certain portion of guaranteed living benefits. See “— Variable Annuity Guarantees.”

Corporate Benefit Funding. Liabilities are primarily related to structured settlement annuities. There is no interest rate crediting flexibility

on these liabilities. A sustained low interest rate environment could negatively impact earnings as a result. The Company has various

derivative positions, primarily interest rate floors and interest rate swaps, to mitigate the risks associated with such a scenario.

Auto & Home. Future policy benefits include liabilities for unpaid claims and claim expenses for property and casualty insurance and

represent the amount estimated for claims that have been reported but not settled and claims incurred but not reported. Liabilities for unpaid

claims are estimated based upon assumptions such as rates of claim frequencies, levels of severities, inflation, judicial trends, legislative

changes or regulatory decisions. Assumptions are based upon the Company’s historical experience and analyses of historical development

patterns of the relationship of loss adjustment expenses to losses for each line of business, and consider the effects of current developments,

anticipated trends and risk management programs, reduced for anticipated salvage and subrogation.

International. Future policy benefits are held primarily for immediate annuities in the Latin America region, as well as for total return pass-

thru provisions included in certain universal life and savings products in Latin America, and traditional life, endowment and annuity contracts

sold in various countries in the Asia Pacific region. They also include certain liabilities for variable annuity guarantees of minimum death

51MetLife, Inc.