MetLife 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

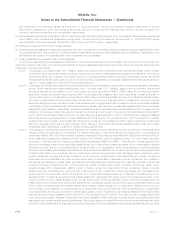

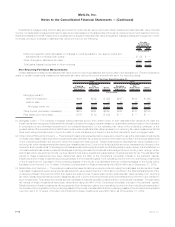

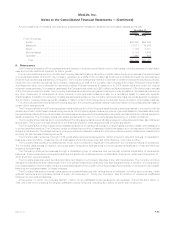

Residential mortgage loans held-for-sale accounted for under the fair value option are initially measured at estimated fair value. Interest

income on residential mortgage loans held-for-sale is recorded based on the stated rate of the loan and is recorded in net investment income.

Gains and losses from initial measurement, subsequent changes in estimated fair value and gains or losses on sales are recognized in other

revenues, and such changes in estimated fair value were due to the following:

2009 2008

For the

Years Ended

December 31,

(In millions)

Instrument-specific credit risk based on changes in credit spreads for non-agency loans and

adjustmentsinindividualloanquality........................................... $ (2) $ —

Otherchangesinestimatedfairvalue............................................ 600 55

Totalgains(losses)recognizedinotherrevenues .................................... $598 $ 55

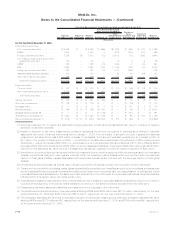

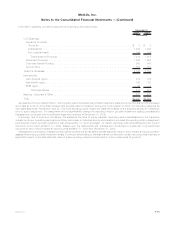

Non-Recurring Fair Value Measurements

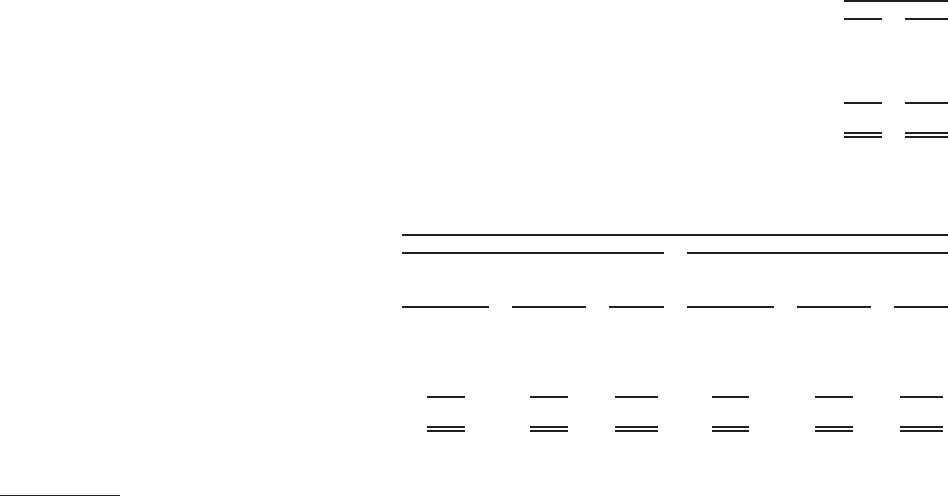

Certain assets are measured at estimated fair value on a non-recurring basis and are not included in the tables above. The amounts below

relate to certain investments measured at estimated fair value during the period and still held as of the reporting dates.

Carrying

Value Prior to

Impairment

Estimated

Fair

Value After

Impairment Gains

(Losses)

Carrying

Value Prior to

Impairment

Estimated

Fair

Value After

Impairment Gains

(Losses)

2009 2008

For the Years Ended December 31,

(In millions)

Mortgage loans(1):

Held-for-investment............... $294 $202 $ (92) $257 $188 $ (69)

Held-for-sale ................... 9 8 (1) 42 32 (10)

Mortgageloans,net ............. $303 $210 $ (93) $299 $220 $ (79)

Other limited partnership interests(2) . . . . . $915 $561 $(354) $242 $137 $(105)

Realestatejointventures(3)........... $175 $ 93 $ (82) $ — $ — $ —

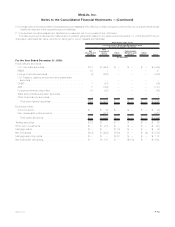

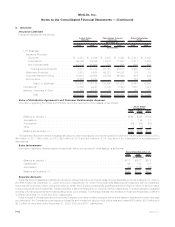

(1) Mortgage Loans — The impaired mortgage loans presented above were written down to their estimated fair values at the date the

impairments were recognized. Estimated fair values for impaired mortgage loans are based on observable market prices or, if the loans are

in foreclosure or are otherwise determined to be collateral dependent, on the estimated fair value of the underlying collateral, or the

present value of the expected future cash flows. Impairments to estimated fair value represent non-recurring fair value measurements that

have been categorized as Level 3 due to the lack of price transparency inherent in the limited markets for such mortgage loans.

(2) Other Limited Partnership Interests — The impaired investments presented above were accounted for using the cost basis. Impairments

on these cost basis investments were recognized at estimated fair value determined from information provided in the financial statements

of the underlying entities in the period in which the impairment was incurred. These impairments to estimated fair value represent non-

recurring fair value measurements that have been classified as Level 3 due to the limited activity and price transparency inherent in the

market for such investments. This category includes several private equity and debt funds that typically invest primarily in a diversified pool

of investments across certain investment strategies including domestic and international leveraged buyout funds; power, energy, timber

and infrastructure development funds; venture capital funds; below investment grade debt and mezzanine debt funds. The estimated fair

values of these investments have been determined using the NAV of the Company’s ownership interest in the partners’ capital.

Distributions from these investments will be generated from investment gains, from operating income from the underlying investments

of the funds and from liquidation of the underlying assets of the funds. It is estimated that the underlying assets of the funds will be

liquidated over the next 2 to 10 years. Unfunded commitments for these investments were $354 million as of December 31, 2009.

(3) Real Estate Joint Ventures — The impaired investments presented above were accounted for using the cost basis. Impairments on these

cost basis investments were recognized at estimated fair value determined from information provided in the financial statements of the

underlying entities in the period in which the impairment was incurred. These impairments to estimated fair value represent non-recurring

fair value measurements that have been classified as Level 3 due to the limited activity and price transparency inherent in the market for

such investments. This category includes several real estate funds that typically invest primarily in commercial real estate. The estimated

fair values of these investments have been determined using the NAV of the Company’s ownership interest in the partners’ capital.

Distributions from these investments will be generated from investment gains, from operating income from the underlying investments of

the funds and from liquidation of the underlying assets of the funds. It is estimated that the underlying assets of the funds will be liquidated

over the next 2 to 10 years. Unfunded commitments for these investments were $86 million as of December 31, 2009.

F-76 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)