MetLife 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.significant volatility in the Company’s consolidated net income in future periods. The Company provided all of the material disclosures in

Note 5.

In February 2007, the FASB issued guidance related to the fair value option for financial assets and financial liabilities. This guidance

permits entities the option to measure most financial instruments and certain other items at fair value at specified election dates and to

recognize related unrealized gains and losses in earnings. The fair value option is applied on an instrument-by-instrument basis upon

adoption of the standard, upon the acquisition of an eligible financial asset, financial liability or firm commitment or when certain specified

reconsideration events occur. The fair value election is an irrevocable election. Effective January 1, 2008, the Company elected the fair value

option on fixed maturity and equity securities backing certain pension products sold in Brazil. Such securities are presented as trading

securities in the consolidated balance sheets with subsequent changes in estimated fair value recognized in net investment income.

Previously, these securities were accounted for as available-for-sale securities and unrealized gains and losses on these securities were

recorded as a separate component of accumulated other comprehensive income (loss). The Company’s insurance joint venture in Japan also

elected the fair value option for certain of its existing single premium deferred annuities and the assets supporting such liabilities. The fair

value option was elected to achieve improved reporting of the asset/liability matching associated with these products. Adoption of this

guidance by the Company and its Japanese joint venture resulted in an increase in retained earnings of $27 million, net of income tax, at

January 1, 2008. The election of the fair value option resulted in the reclassification of $10 million, net of income tax, of net unrealized gains

from accumulated other comprehensive income (loss) to retained earnings on January 1, 2008.

Effective April 1, 2009, the Company adopted new guidance on: (i) estimating the fair value of an asset or liability if there was a significant

decrease in the volume and level of trading activity for these assets or liabilities; and (ii) identifying transactions that are not orderly. The

Company has provided all of the material disclosures in its consolidated financial statements. This adoption did not have any other material

impact on the Company’s consolidated financial statements.

The following new pronouncements relating to fair value had no material impact on the Company’s consolidated financial statements:

• Effective September 30, 2008, the Company adopted new guidance relating to the fair value measurements of financial assets when

themarketforthoseassetsisnotactive.Itprovidesguidanceonhowacompany’sinternalcashflowanddiscountrateassumptions

should be considered in the measurement of fair value when relevant market data does not exist, how observable market information in

an inactive market affects fair value measurement and how the use of market quotes should be considered when assessing the

relevance of observable and unobservable data available to measure fair value.

• Effective January 1, 2009, the Company implemented fair value measurements guidance for certain nonfinancial assets and liabilities

that are recorded at fair value on a non-recurring basis. This guidance applies to such items as: (i) nonfinancial assets and nonfinancial

liabilities initially measured at estimated fair value in a business combination; (ii) reporting units measured at estimated fair value in the

first step of a goodwill impairment test; and (iii) indefinite-lived intangible assets measured at estimated fair value for impairment

assessment.

• Effective January 1, 2009, the Company adopted prospectively guidance on issuer’s accounting for liabilities measured at fair value

with a third-party credit enhancement. This guidance states that an issuer of a liability with a third-party credit enhancement should not

include the effect of the credit enhancement in the fair value measurement of the liability. In addition, it requires disclosures about the

existence of any third-party credit enhancement related to liabilities that are measured at fair value.

• Effective December 31, 2009, the Company adopted new guidance on: (i) measuring the fair value of investments in certain entities that

calculate NAV per share; (ii) how investments within its scope would be classified in the fair value hierarchy; and (iii) enhanced disclosure

requirements, for both interim and annual periods, about the nature and risks of investments measured at fair value on a recurring or

non-recurring basis.

• Effective December 31, 2009, the Company adopted new guidance on measuring liabilities at fair value. This guidance provides

clarification for measuring fair value in circumstances in which a quoted price in an active market for the identical liability is not available.

In such circumstances a company is required to measure fair value using either a valuation technique that uses: (i) the quoted price of

the identical liability when traded as an asset; or (ii) quoted prices for similar liabilities or similar liabilities when traded as assets; or

(iii) another valuation technique that is consistent with the principles of fair value measurement such as an income approach (e.g.,

present value technique) or a market approach (e.g., “entry” value technique).

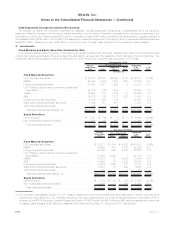

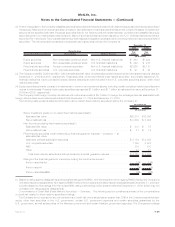

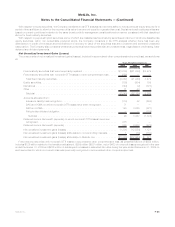

Defined Benefit and Other Postretirement Plans

Effective December 31, 2009, the Company adopted new guidance to enhance the transparency surrounding the types of assets and

associated risks in an employer’s defined benefit pension or other postretirement benefit plans. This guidance requires an employer to

disclose information about the valuation of plan assets similar to that required under other fair value disclosure guidance. The Company

provided all of the material disclosures in its consolidated financial statements.

Other Pronouncements

Effective April 1, 2009, the Company adopted prospectively new guidance which establishes general standards for accounting and

disclosures of events that occur subsequent to the balance sheet date but before financial statements are issued or available to be issued.

The Company has provided all of the required disclosures in its consolidated financial statements.

Effective December 31, 2008, the Company adopted new guidance relating to disclosures by public entities about transfers of financial

assets and interests in VIEs. This guidance requires additional qualitative and quantitative disclosures about a transferors’ continuing

involvement in transferred financial assets and involvement in VIEs. The exact nature of the additional required VIE disclosures vary and

depend on whether or not the VIE is a qualifying special purpose entity (“QSPE”). For VIEs that are QSPEs, the additional disclosures are only

required for a non-transferor sponsor holding a variable interest or a non-transferor servicer holding a significant variable interest. For VIEs

that are not QSPEs, the additional disclosures are only required if the Company is the primary beneficiary, and if not the primary beneficiary,

only if the Company holds a significant variable interest in the VIE or is its sponsor. The Company provided all of the material disclosures in its

consolidated financial statements.

F-25MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)