MetLife 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

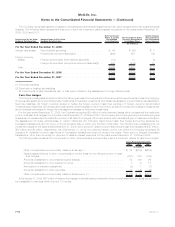

securities. The counterparties are permitted by contract to sell or repledge this collateral. At December 31, 2009 and 2008, the Company

provided cash collateral for exchange-traded futures of $562 million and $686 million, respectively, which is included in premiums and other

receivables.

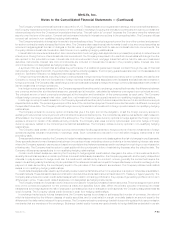

Embedded Derivatives

The Company has certain embedded derivatives that are required to be separated from their host contracts and accounted for as

derivatives. These host contracts principally include: variable annuities with guaranteed minimum benefits, including GMWBs, GMABs and

certain GMIBs; ceded reinsurance contracts of guaranteed minimum benefits related to GMABs and certain GMIBs; and funding agreements

with equity or bond indexed crediting rates.

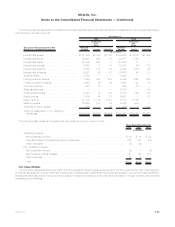

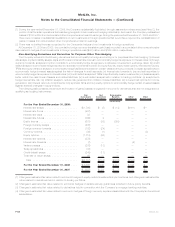

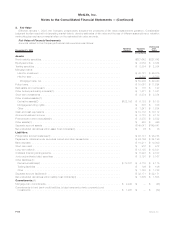

The following table presents the estimated fair value of the Company’s embedded derivatives at:

2009 2008

December 31,

(In millions)

Net embedded derivatives within asset host contracts:

Cededguaranteedminimumbenefits......................................... $ 76 $ 205

Calloptionsinequitysecurities ............................................ (37) (173)

Netembeddedderivativeswithinassethostcontracts............................ $ 39 $ 32

Net embedded derivatives within liability host contracts:

Directguaranteedminimumbenefits......................................... $1,500 $3,134

Other............................................................. 5 (83)

Netembeddedderivativeswithinliabilityhostcontracts ........................... $1,505 $3,051

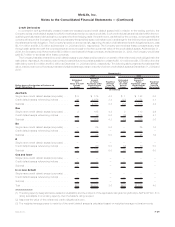

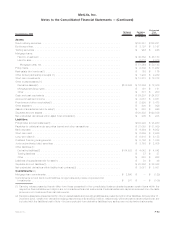

The following table presents changes in estimated fair value related to embedded derivatives:

2009 2008 2007

Years Ended December 31,

(In millions)

Net investment gains (losses)(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,758 $(2,650) $(321)

Policyholderbenefitsandclaims....................................... $ (114) $ 182 $ —

(1) Effective January 1, 2008, the valuation of the Company’s guaranteed minimum benefits includes an adjustment for the Company’s own

credit. Included in net investment gains (losses) for the years ended December 31, 2009 and 2008 were gains (losses) of ($1,932) million

and $2,994 million, respectively, in connection with this adjustment.

F-61MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)