MetLife 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and asset allocation. For real estate and agricultural assets, the Company manages credit risk and market valuation risk through geographic,

property type and product type diversification and asset allocation. The Company manages interest rate risk as part of its asset and liability

management strategies; product design, such as the use of market value adjustment features and surrender charges; and proactive

monitoring and management of certain non-guaranteed elements of its products, such as the resetting of credited interest and dividend rates

for policies that permit such adjustments. The Company also uses certain derivative instruments in the management of credit and interest rate

risks.

Current Environment. Precipitated by housing sector weakness and severe market dislocations, the U.S. economy entered its worst

post-war recession in January 2008. Most economists believe this recession ended in third quarter 2009 when positive growth returned.

Most economists now expect positive growth to continue through 2010. However, the expected recovery is weaker than normal, and the

unemployment rate is expected to remain high for some time. Although the disruption in the global financial markets has moderated, not all

global financial markets are functioning normally, and many remain reliant upon government intervention and liquidity.

As a result of this unprecedented disruption and market dislocation, we have experienced both volatility in the valuation of certain

investments and decreased liquidity in certain asset classes. Securities that are less liquid are more difficult to value and have fewer

opportunities for disposal. Even some of our very high quality assets have been more illiquid for periods of time as a result of the recent

challenging market conditions. These market conditions had also led to an increase in unrealized losses on fixed maturity and equity securities

in recent quarters, particularly for residential and commercial mortgage-backed, asset-backed and corporate fixed maturity securities and

within the Company’s financial services industry fixed maturity and equity securities holdings. During 2009, unrealized losses on fixed maturity

and equity securities decreased from improving market conditions, including narrowing of credit spreads reflecting an improvement in

liquidity.

Investment Outlook

Although we anticipate that the volatility in the equity, credit and real estate markets will moderate slightly in 2010, it could continue to

impact net investment income and the related yields on private equity funds, hedge funds and real estate joint ventures, included within our

other limited partnership interests and real estate and real estate joint venture portfolios. Further, in light of the current market conditions,

liquidity will be reinvested in a prudent manner and invested according to our asset-liability management discipline in appropriate assets over

time. Until the additional liquidity is reinvested, the Company will have a slightly higher than normal level of short-term liquidity. Net investment

income may be adversely affected if the reinvestment process occurs over an extended period of time due to challenging market conditions or

asset availability.

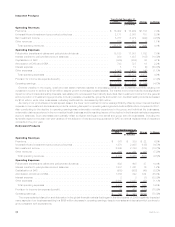

Composition of Investment Portfolio and Investment Portfolio Results

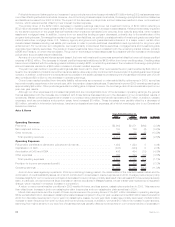

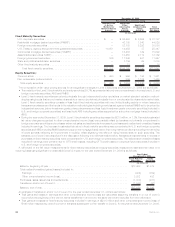

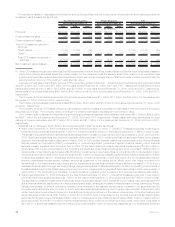

The following table illustrates the investment income, net investment gains (losses), annualized yields on average ending assets and

ending carrying value for each of the asset classes within the Company’s investment portfolio, as well as net investment income for the

portfolio as a whole:

2009 2008 2007

At and for the Years Ended December 31,

(In millions)

Fixed Maturity Securities

Yield(1).................................................. 5.77% 6.40% 6.42%

Investmentincome(2) ........................................ $ 11,899 $ 12,403 $ 12,425

Investment(losses).......................................... $ (1,663) $ (1,953) $ (615)

Endingcarryingvalue(2)....................................... $230,026 $189,197 $233,115

Mortgage Loans

Yield(1).................................................. 5.38% 6.08% 6.56%

Investmentincome(3) ........................................ $ 2,735 $ 2,774 $ 2,648

Investmentgains(losses)...................................... $ (442) $ (136) $ 3

Endingcarryingvalue ........................................ $ 50,909 $ 51,364 $ 46,154

Real Estate and Real Estate Joint Ventures(4)

Yield(1).................................................. (7.47)% 2.98% 10.29%

Investmentincome(losses)..................................... $ (541) $ 217 $ 607

Investmentgains(losses)...................................... $ (156) $ (9) $ 59

Endingcarryingvalue ........................................ $ 6,896 $ 7,586 $ 6,767

Policy Loans

Yield(1).................................................. 6.54% 6.22% 6.21%

Investmentincome .......................................... $ 648 $ 601 $ 572

Endingcarryingvalue ........................................ $ 10,061 $ 9,802 $ 9,326

Equity Securities

Yield(1).................................................. 5.12% 5.25% 5.14%

Investmentincome .......................................... $ 175 $ 249 $ 244

Investmentgains(losses)...................................... $ (399) $ (253) $ 164

Endingcarryingvalue ........................................ $ 3,084 $ 3,197 $ 5,911

Other Limited Partnership Interests

Yield(1).................................................. 3.22% (2.77)% 27.09%

Investmentincome(losses)..................................... $ 173 $ (170) $ 1,309

Investmentgains(losses)...................................... $ (356) $ (140) $ 16

Endingcarryingvalue ........................................ $ 5,508 $ 6,039 $ 6,155

32 MetLife, Inc.