MetLife 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

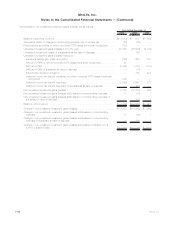

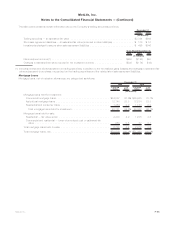

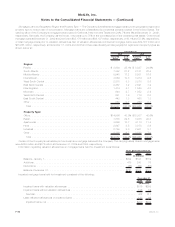

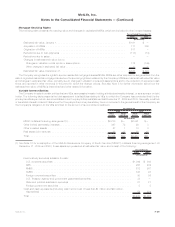

Mortgage Loans by Geographic Region and Property Type — The Company diversifies its mortgage loans by both geographic region and

property type to reduce risk of concentration. Mortgage loans are collateralized by properties primarily located in the United States. The

carrying value of the Company’s mortgage loans located in California, New York and Texas were 20%, 7% and 6% at December 31, 2009,

respectively. Generally, the Company, as the lender, only loans up to 75% of the purchase price of the underlying real estate. Commercial

mortgage loans at December 31, 2009 and 2008 were $35,176 million and $36,197 million, respectively, or 68.1% and 72.9%, respectively,

of total mortgage loans prior to valuation allowances. Net of valuation allowances commercial mortgage loans were $34,587 million and

$35,965 million, respectively, at December 31, 2009 and 2008 and there was diversity across geographic regions and property types as

shown below at:

Carrying

Value %of

Total Carrying

Value %of

Total

2009 2008

December 31,

(In millions)

Region:

Pacific ................................................ $ 8,684 25.1% $ 8,837 24.6%

SouthAtlantic ........................................... 7,342 21.2 8,101 22.5

MiddleAtlantic........................................... 5,948 17.2 5,931 16.5

International............................................. 3,564 10.3 3,414 9.5

WestSouthCentral........................................ 2,870 8.3 3,070 8.5

EastNorthCentral ........................................ 2,487 7.2 2,591 7.2

NewEngland............................................ 1,414 4.1 1,529 4.3

Mountain .............................................. 944 2.7 1,052 2.9

WestNorthCentral........................................ 641 1.9 716 2.0

EastSouthCentral ........................................ 443 1.3 468 1.3

Other................................................. 250 0.7 256 0.7

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $34,587 100.0% $35,965 100.0%

Property Type:

Office................................................. $14,986 43.3% $15,307 42.6%

Retail................................................. 7,870 22.8 8,038 22.3

Apartments............................................. 3,696 10.7 4,113 11.4

Hotel ................................................. 2,947 8.5 3,078 8.6

Industrial............................................... 2,759 8.0 2,901 8.1

Other................................................. 2,329 6.7 2,528 7.0

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $34,587 100.0% $35,965 100.0%

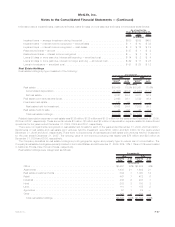

Certain of the Company’s real estate joint ventures have mortgage loans with the Company. The carrying values of such mortgage loans

were $368 million and $372 million at December 31, 2009 and 2008, respectively.

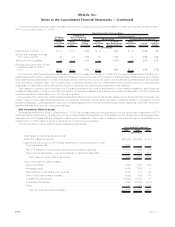

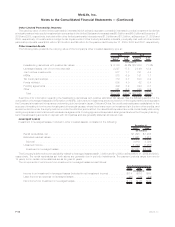

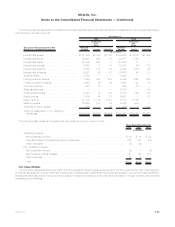

Information regarding valuation allowances on mortgage loans held-for-investment is as follows:

2009 2008 2007

Years Ended December 31,

(In millions)

Balance,January1,................................................. $304 $197 $182

Additions........................................................ 475 200 76

Deductions ...................................................... (58) (93) (61)

Balance,December31, .............................................. $721 $304 $197

Impaired mortgage loans held-for-investment consisted of the following:

2009 2008

December 31,

(In millions)

Impairedloanswithvaluationallowances .......................................... $316 $259

Impairedloanswithoutvaluationallowances ........................................ 106 52

Subtotal.............................................................. 422 311

Less:Valuationallowancesonimpairedloans ....................................... 123 69

Impairedloans,net....................................................... $299 $242

F-46 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)