MetLife 2009 Annual Report Download - page 208

Download and view the complete annual report

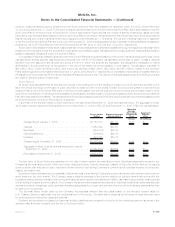

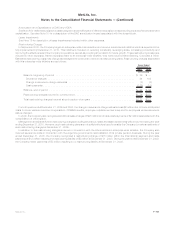

Please find page 208 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Had the amounts been reflected during the first, second and third quarters of 2008 — in the periods in which they arose — DAC

amortization would have increased (decreased) by $100 million, ($61) million and $85 million, respectively, resulting in an increase

(decrease) of net income by ($65) million, $40 million and ($55) million, respectively. Net income available to common shareholders per

diluted common share would have been higher (lower) by ($0.09), $0.06, ($0.08) and $0.10 during the first, second, third and fourth

quarters, respectively, of 2008 had the amounts been reflected in the periods in which they arose. Based upon an evaluation of all relevant

quantitative and qualitative factors, management believes this correcting adjustment was not material to the Company’s full year results

for 2008 or the trend of earnings.

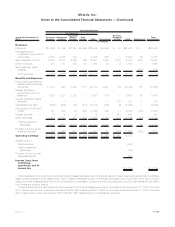

22. Business Segment Information

As further described in Note 1, during 2009 MetLife combined its former institutional and individual businesses, as well as its auto & home

unit, into a single U.S. Business organization. U.S. Business consists of Insurance Products, Retirement Products, Corporate Benefit

Funding and Auto & Home segments. The Company also has an International segment. In addition, the Company reports certain of its results

of operations in Banking, Corporate & Other.

Insurance Products offers a broad range of protection products and services to individuals, corporations and other institutions, and is

organized into three distinct businesses: Group Life, Individual Life and Non-Medical Health. Group Life insurance products and services

include variable life, universal life and term life. Individual Life includes variable life, universal life, term life and whole life insurance products.

Non-Medical Health includes short- and long-term disability, long-term care, and dental insurance, and other insurance products. Retirement

Products offers asset accumulation and income products, including a wide variety of annuities. Corporate Benefit Funding offers pension risk

solutions, structured settlements, stable value & investment products and other benefit funding products. Auto & Home provides personal

lines property and casualty insurance, including private passenger automobile, homeowners and personal excess liability insurance.

International provides life insurance, accident and health insurance, annuities and retirement products to both individuals and groups.

Banking, Corporate & Other contains the excess capital not allocated to the business segments, the results of operations of MetLife Bank,

various start-up entities and run-off entities, as well as interest expense related to the majority of the Company’s outstanding debt and

expenses associated with certain legal proceedings and income tax audit issues. Banking, Corporate & Other also includes the elimination of

intersegment amounts, which generally relate to intersegment loans, which bear interest rates commensurate with related borrowings. The

operations of RGA are also reported in Banking, Corporate & Other as discontinued operations. See Note 23 for disclosures regarding

discontinued operations, including real estate.

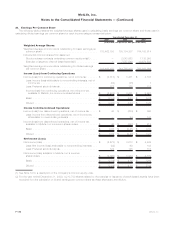

Operating earnings is the measure of segment profit or loss the Company uses to evaluate segment performance and allocate resources.

Consistent with GAAP accounting guidance for segment reporting, it is the Company’s measure of segment performance reported below.

Operating earnings is not determined in accordance with GAAP and should not be viewed as a substitute for GAAP income (loss) from

continuing operations, net of income tax. However, the Company believes the presentation of operating earnings herein as we measure it for

management purposes enhances the understanding of segment performance by highlighting the results from operations and the underlying

profitability drivers of the businesses.

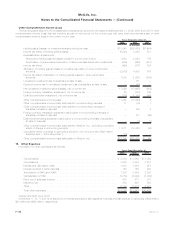

Operating earnings is defined as operating revenues less operating expenses, net of income tax.

Operating revenues is defined as GAAP revenues (i) less net investment gains (losses), (ii) less amortization of unearned revenue related to

net investment gains (losses), (iii) plus scheduled periodic settlement payments on derivative instruments that are hedges of investments but

do not qualify for hedge accounting treatment, (iv) plus income from discontinued real estate operations, and (v) plus, for operating joint

ventures reported under the equity method of accounting, the aforementioned adjustments and those identified in the definition of operating

expenses, net of income tax, if applicable to these joint ventures.

Operating expenses is defined as GAAP expenses (i) less changes in experience-rated contractholder liabilities due to asset value

fluctuations, (ii) less costs related to business combinations (since January 1, 2009) and noncontrolling interests, (iii) less amortization of DAC

and VOBA and changes in the policyholder dividend obligation related to net investment gains (losses), and (iv) plus scheduled periodic

settlement payments on derivative instruments that are hedges of policyholder account balances but do not qualify for hedge accounting

treatment.

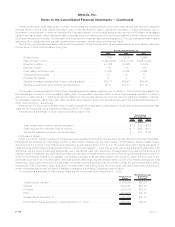

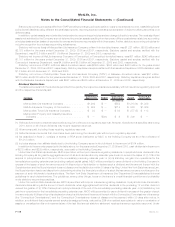

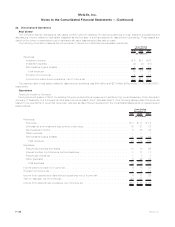

Set forth in the tables below is certain financial information with respect to the Company’s segments as well as Banking, Corporate & Other

for the years ended December 31, 2009, 2008 and 2007 and at December 31, 2009 and 2008. The accounting policies of the segments are

thesameasthoseoftheCompany,exceptforthemethodofcapitalallocation and the accounting for gains (losses) from intercompany sales,

which are eliminated in consolidation. Economic capital is an internally developed risk capital model, the purpose of which is to measure the

risk in the business and to provide a basis upon which capital is deployed. The economic capital model accounts for the unique and specific

nature of the risks inherent in the Company’s businesses. As a part of the economic capital process, a portion of net investment income is

credited to the segments based on the level of allocated equity. The Company allocates certain non-recurring items, such as expenses

associated with certain legal proceedings, to Banking, Corporate & Other.

F-124 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)