MetLife 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

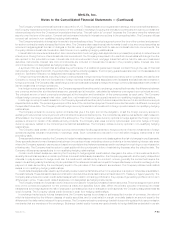

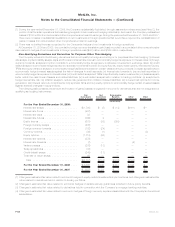

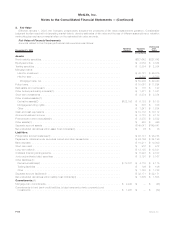

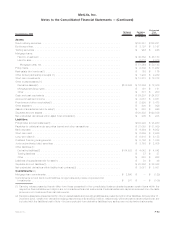

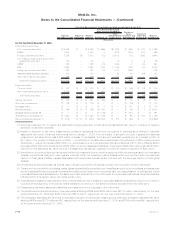

December 31, 2008 Notional

Amount Carrying

Value

Estimated

Fair

Value

(In millions)

Assets:

Fixedmaturitysecurities................................................. $188,251 $188,251

Equitysecurities...................................................... $ 3,197 $ 3,197

Tradingsecurities..................................................... $ 946 $ 946

Mortgage loans:

Held-for-investment .................................................. $ 49,352 $ 48,133

Held-for-sale....................................................... 2,012 2,010

Mortgageloans,net................................................. $ 51,364 $ 50,143

Policyloans......................................................... $ 9,802 $ 11,952

Realestatejointventures(1) .............................................. $ 163 $ 176

Otherlimitedpartnershipinterests(1) ........................................ $ 1,900 $ 2,269

Short-terminvestments ................................................. $ 13,878 $ 13,878

Other invested assets:(1)

Derivativeassets(2) .................................................. $133,565 $ 12,306 $ 12,306

Mortgageservicingrights............................................... $ 191 $ 191

Other ........................................................... $ 801 $ 900

Cashandcashequivalents............................................... $ 24,207 $ 24,207

Accruedinvestmentincome .............................................. $ 3,061 $ 3,061

Premiumsandotherreceivables(1).......................................... $ 2,995 $ 3,473

Otherassets(1) ...................................................... $ 800 $ 629

Assetsofsubsidiariesheld-for-sale(1)........................................ $ 630 $ 649

Separateaccountassets ................................................ $120,839 $120,839

Netembeddedderivativeswithinassethostcontracts(3)............................ $ 205 $ 205

Liabilities:

Policyholderaccountbalances(1)........................................... $103,290 $ 95,950

Payables for collateral under securities loaned and other transactions . . . . . . . . . . . . . . . . . . . $ 31,059 $ 31,059

Bankdeposits ....................................................... $ 6,884 $ 6,952

Short-termdebt...................................................... $ 2,659 $ 2,659

Long-termdebt(1)..................................................... $ 9,619 $ 8,155

Collateralfinancingarrangements........................................... $ 5,192 $ 1,880

Juniorsubordinateddebtsecurities ......................................... $ 3,758 $ 2,606

Other liabilities:(1)

Derivativeliabilities(2) ................................................. $ 64,523 $ 4,042 $ 4,042

Tradingliabilities .................................................... $ 57 $ 57

Other ........................................................... $ 638 $ 638

Liabilitiesofsubsidiariesheld-for-sale(1) ...................................... $ 50 $ 49

Separateaccountliabilities(1) ............................................. $ 28,862 $ 28,862

Netembeddedderivativeswithinliabilityhostcontracts(3)........................... $ 3,051 $ 3,051

Commitments:(4)

Mortgageloancommitments.............................................. $ 2,690 $ — $ (129)

Commitments to fund bank credit facilities, bridge loans and private corporate bond

investments ....................................................... $ 971 $ — $ (105)

(1) Carrying values presented herein differ from those presented in the consolidated balance sheets because certain items within the

respective financial statement caption are not considered financial instruments. Financial statement captions excluded from the table

above are not considered financial instruments.

(2) Derivative assets are presented within other invested assets and derivative liabilities are presented within other liabilities. At December 31,

2009 and 2008, certain non-derivative hedging instruments of $0 and $323 million, respectively, which are carried at amortized cost, are

included with the liabilities total in Note 4 but are excluded from derivative liabilities here as they are not derivative instruments.

F-63MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)