MetLife 2009 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

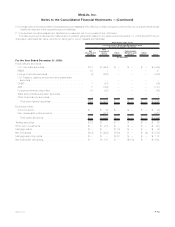

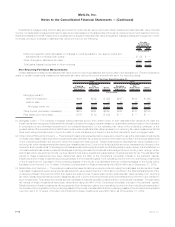

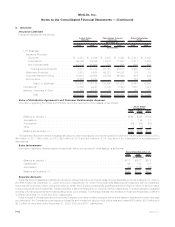

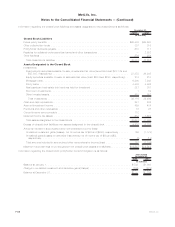

Information regarding the types of guarantees relating to annuity contracts and universal and variable life contracts is as follows:

In the

Event of Death At

Annuitization In the

Event of Death At

Annuitization

2009 2008

December 31,

(In millions)

Annuity Contracts(1)

Return of Net Deposits

Separateaccountvalue........................ $ 24,747 N/A $ 15,882 N/A

Netamountatrisk(2).......................... $ 1,531(3) N/A $ 4,384(3) N/A

Averageattainedageofcontractholders ............. 62years N/A 62years N/A

Anniversary Contract Value or Minimum Return

Separateaccountvalue........................ $ 78,808 $ 40,234 $ 62,345 $ 24,328

Netamountatrisk(2).......................... $ 9,039(3) $ 7,361(4) $ 18,637(3) $ 11,312(4)

Averageattainedageofcontractholders ............. 61years 61years 60years 61years

Two Tier Annuities

Generalaccountvalue......................... N/A $ 282 N/A $ 283

Netamountatrisk(2).......................... N/A $ 50(5) N/A $ 50(5)

Averageattainedageofcontractholders ............. N/A 61years N/A 60years

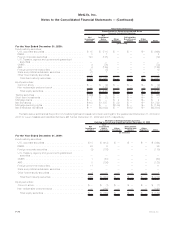

Secondary

Guarantees Paid-Up

Guarantees Secondary

Guarantees Paid-Up

Guarantees

2009 2008

December 31,

(In millions)

Universal and Variable Life Contracts(1)

Account value (general and separate account) . . . . . . . . . $ 9,483 $ 4,104 $ 7,825 $ 4,135

Net amount at risk(2) . . . . . . . . . . . . . . . . . . . . . . . . . . $150,905 (3) $ 28,826 (3) $145,927 (3) $ 31,274 (3)

Averageattainedageofpolicyholders............... 52years 57years 50years 56years

(1) The Company’s annuity and life contracts with guarantees may offer more than one type of guarantee in each contract. Therefore, the

amounts listed above may not be mutually exclusive.

(2) The net amount at risk is based on the direct amount at risk (excluding reinsurance).

(3) The net amount at risk for guarantees of amounts in the event of death is defined as the current GMDB in excess of the current account

balance at the balance sheet date.

(4) The net amount at risk for guarantees of amounts at annuitization is defined as the present value of the minimum guaranteed annuity

payments available to the contractholder determined in accordance with the terms of the contract in excess of the current account

balance.

(5) The net amount at risk for two tier annuities is based on the excess of the upper tier, adjusted for a profit margin, less the lower tier.

F-83MetLife, Inc.

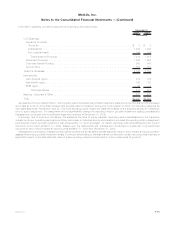

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)