MetLife 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

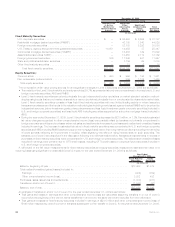

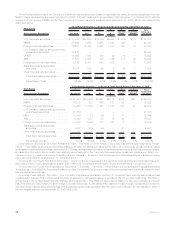

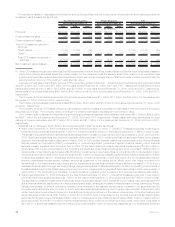

stock. A substantial portion of the financial services industry impairments were concentrated in the Company’s holdings in three

financial institutions that in 2008 entered bankruptcy, entered FDIC receivership or received federal government capital infusions -

Lehman Brothers Holdings Inc. (“Lehman”), Washington Mutual, Inc. (“Washington Mutual”) and American International Group, Inc.

(“AIG”). Overall, impairments related to Lehman, Washington Mutual and AIG in 2008 were $606 million comprised of $489 million for

fixed maturity securities and $117 million for equity securities. These three counterparties account for a substantial portion, $489 mil-

lion, of the financial services industry fixed maturity security impairments of $673 million; however, at $117 million, they do not account

for the majority of the financial services industry equity security impairments of $341 million. As a result of the Company’s equity

securities impairment review process, which included a review of the duration and severity of the unrealized loss position of its equity

securities holdings, additional OTTI charges totaling $313 million were recorded in 2008. These additional impairments were principally

related to impairments on financial services industry preferred securities that had either been in an unrealized loss position for an

extended duration (i.e., 12 months or more), or were in a severe unrealized loss position. In the fourth quarter of 2008, the Company not

only considered the severity and duration of unrealized losses on its preferred securities, but placed greater weight and emphasis on

whether there had been any credit deterioration in the issuer of these holdings in accordance with new guidance. As result of the

economic environment as described above, fixed maturity and equity securities impairments on the Company’s financial services

industry holdings and total impairments across all industries sectors were higher in 2008 than 2007, as presented in the tables below.

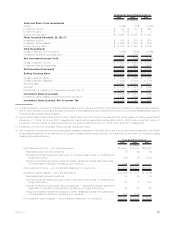

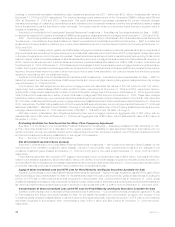

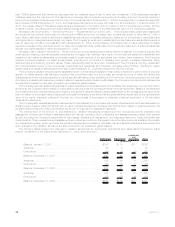

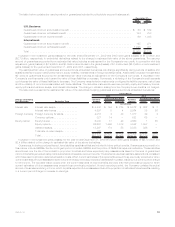

Fixed maturity security OTTI losses recognized in earnings relates to the following sectors and industries:

2009 2008 2007

Years Ended December 31,

(In millions)

U.S. and foreign corporate securities:

Finance....................................................... $ 459 $ 673 $18

Communications ................................................. 235 134 —

Consumer ..................................................... 211 107 —

Utility......................................................... 89 5 1

Industrial ...................................................... 30 26 18

Other ........................................................ 26 185 28

TotalU.S.andforeigncorporatesecurities............................... 1,050 1,130 65

RMBS ......................................................... 193 — —

ABS........................................................... 168 99 13

CMBS ......................................................... 88 65 —

Foreigngovernmentsecurities.......................................... 1 2 —

Total........................................................ $1,500 $1,296 $78

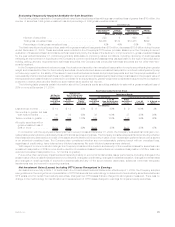

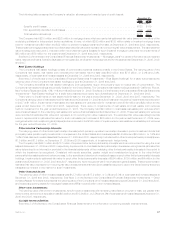

Equity security OTTI losses recognized in earnings relates to the following sectors and industries:

2009 2008 2007

Years Ended December 31,

(In millions)

Sector:

Non-redeemablepreferredstock ......................................... $333 $319 $ 1

Commonstock..................................................... 67 111 18

Total .......................................................... $400 $430 $19

Industry:

Financial services industry:

Perpetualhybridsecurities............................................ $310 $ 90 $—

Commonandremainingnon-redeemablepreferredstock ........................ 30 251 1

Totalfinancialservicesindustry........................................ 340 341 1

Other ........................................................... 60 89 18

Total .......................................................... $400 $430 $19

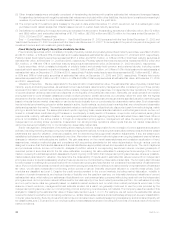

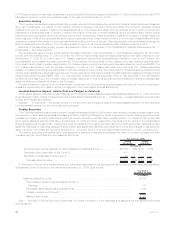

Future Impairments. Future other-than-temporary impairments will depend primarily on economic fundamentals, issuer performance,

changes in credit ratings, changes in collateral valuation, changes in interest rates and changes in credit spreads. If economic fundamentals

and other of the above factors deteriorate, additional other-than-temporary impairments may be incurred in upcoming periods. See also

“— Investments — Fixed Maturity and Equity Securities Available-for-Sale — Net Unrealized Investment Gains (Losses).”

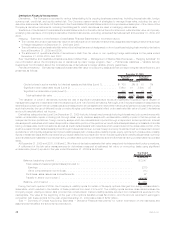

Credit Loss Rollforward — Rollforward of the Cumulative Credit Loss Component of OTTI Loss Recognized in Earn-

ings on Fixed Maturity Securities Still Held for Which a Portion of the OTTI Loss was Recognized in Other Compre-

hensive Loss

See Note 3 of the Notes to the Consolidated Financial Statements “Investments — Credit Loss Rollforward — Rollforward of the

Cumulative Credit Loss Component of OTTI Loss Recognized in Earnings on Fixed Maturity Securities Still Held for Which a Portion of

the OTTI Loss was Recognized in Other Comprehensive Loss” for the table that presents a rollforward of the cumulative credit loss component

43MetLife, Inc.