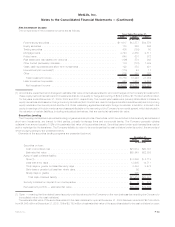

MetLife 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

Cost or

Amortized

Cost

Estimated

Fair

Value

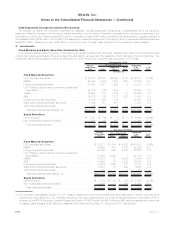

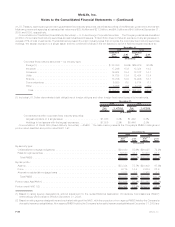

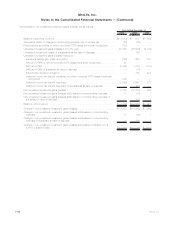

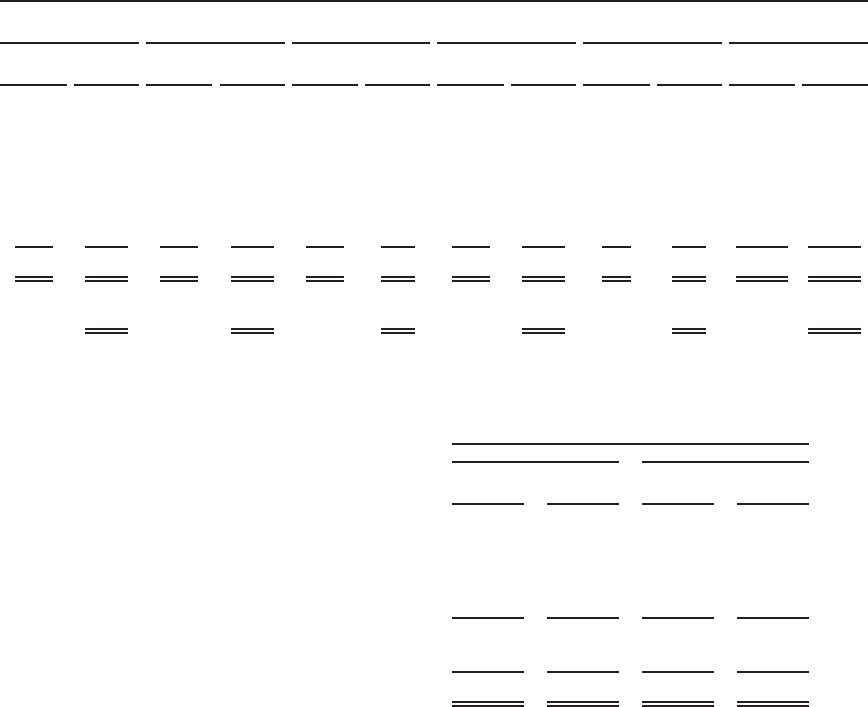

Aaa Aa A Baa

Below

Investment

Grade Total

December 31, 2008

(In millions)

2003 & Prior . . . $ 96 $ 77 $ 92 $ 72 $ 26 $ 16 $ 83 $ 53 $ 8 $ 4 $ 305 $ 222

2004 . . . . . . . . 129 70 372 204 5 3 37 28 2 1 545 306

2005 . . . . . . . . 357 227 186 114 20 11 79 46 4 4 646 402

2006 . . . . . . . . 146 106 69 30 15 10 26 7 2 2 258 155

2007 . . . . . . . . — — 78 33 35 21 2 2 3 1 118 57

2008 . . . . . . . . — — — — — — — — — — — —

Total . . . . . . . $728 $ 480 $797 $ 453 $101 $ 61 $227 $ 136 $19 $ 12 $1,872 $1,142

Ratings

Distribution . . . 42.0% 39.7% 5.3% 11.9% 1.1% 100.0%

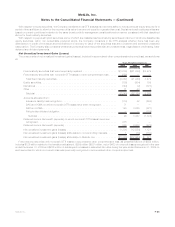

Concentrations of Credit Risk (Equity Securities). The Company is not exposed to any concentrations of credit risk in its equity securities

holdings of any single issuer greater than 10% of the Company’s stockholders’ equity at December 31, 2009 and 2008.

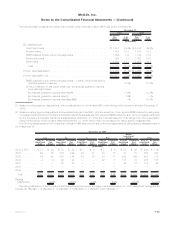

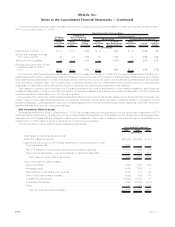

Maturities of Fixed Maturity Securities. The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity

date (excluding scheduled sinking funds), are as follows:

Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value

2009 2008

December 31,

(In millions)

Dueinoneyearorless............................... $ 6,845 $ 6,924 $ 5,556 $ 5,491

Due after one year through five years . . . . . . . . . . . . . . . . . . . . . . 38,408 39,399 33,604 30,884

Due after five years through ten years . . . . . . . . . . . . . . . . . . . . . 40,448 41,568 41,481 36,895

Dueaftertenyears ................................. 67,838 66,947 58,547 55,786

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153,539 154,838 139,188 129,056

RMBS,CMBSandABS .............................. 76,170 72,804 70,320 59,195

Totalfixedmaturitysecurities.......................... $229,709 $227,642 $209,508 $188,251

Actual maturities may differ from contractual maturities due to the exercise of call or prepayment options. Fixed maturity securities not due

at a single maturity date have been included in the above table in the year of final contractual maturity. RMBS, CMBS and ABS are shown

separately in the table, as they are not due at a single maturity.

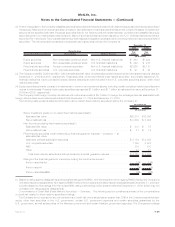

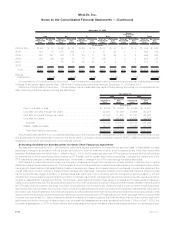

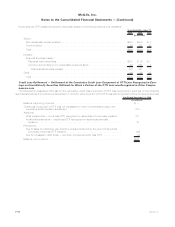

Evaluating Available-for-Sale Securities for Other-Than-Temporary Impairment

As described more fully in Note 1, the Company performs a regular evaluation, on a security-by-security basis, of its available-for-sale

securities holdings in accordance with its impairment policy in order to evaluate whether such investments are other-than-temporarily

impaired. As described more fully in Note 1, effective April 1, 2009, the Company adopted new OTTI guidance that amends the methodology

for determining for fixed maturity securities whether an OTTI exists, and for certain fixed maturity securities, changes how the amount of the

OTTI loss that is charged to earnings is determined. There was no change in the OTTI methodology for equity securities.

With respect to fixed maturity securities, the Company considers, amongst other impairment criteria, whether it has the intent to sell a

particular impaired fixed maturity security. The Company’s intent to sell a particular impaired fixed maturity security considers broad portfolio

management objectives such as asset/liability duration management, issuer and industry segment exposures, interest rate views and the

overall total return focus. In following these portfolio management objectives, changes in facts and circumstances that were present in past

reporting periods may trigger a decision to sell securities that were held in prior reporting periods. Decisions to sell are based on current

conditions or the Company’s need to shift the portfolio to maintain its portfolio management objectives including liquidity needs or duration

targets on asset/liability managed portfolios. The Company attempts to anticipate these types of changes and if a sale decision has been

made on an impaired security, the security will be deemed other-than-temporarily impaired in the period that the sale decision was made and

an OTTI loss will be recorded in earnings. In certain circumstances, the Company may determine that it does not intend to sell a particular

security but that it is more likely than not that it will be required to sell that security before recovery of the decline in estimated fair value below

amortized cost. In such instances, the fixed maturity security will be deemed other-than-temporarily impaired in the period during which it was

determined more likely than not that the security will be required to be sold and an OTTI loss will be recorded in earnings. If the Company does

not have the intent to sell (i.e., has not made the decision to sell) and it does not believe that it is more likely than not that it will be required to

sell the security before recovery of its amortized cost, an impairment assessment is made, as described in Note 1. Prior to April 1, 2009, the

Company’s assessment of OTTI for fixed maturity securities was performed in the same manner as described below for equity securities.

F-34 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)