MetLife 2009 Annual Report Download - page 4

Download and view the complete annual report

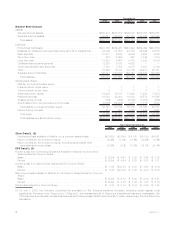

Please find page 4 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to the strong performance of our U.S. insurance and retirement businesses, MetLife Bank also

grew considerably. In 2008, we acquired both forward and reverse mortgage businesses, which helped drive the

Bank’s total revenues to $1.3 billion in 2009, up substantially from $284 million in 2008. In addition, total assets

grew 37% from year-end 2008 to reach $14.1 billion.

Expanding Our International Reach

The diversification in both product offerings and distribution that has benefited our businesses in the U.S. has

also enabled us to grow internationally. In 2009, our International business generated premiums, fees & other

revenues of $4.3 billion as we continued to focus on expanding our established businesses in certain countries

while also investing in operations that will deliver future growth.

Our international growth will be accelerated as a result of our recently announced agreement to acquire one of

American International Group, Inc.’s international subsidiaries, American Life Insurance Company (ALICO) — one

of the world’s largest and most diversified international life insurance companies. With this acquisition, MetLife will

create a global life insurance and employee benefits powerhouse, and is delivering on its strategy to accelerate

international expansion as a powerful growth engine for our company. Upon completion of the transaction, MetLife,

which is already the largest life insurer in the United States and Mexico, will become a leading competitor in Japan,

the world’s second-largest life insurance market. The transaction will give MetLife a presence in more than 50

countries outside of the U.S. It will materially advance our positioninEuropeandmoveMetLifeintoatopfivemarket

position in many high growth emerging markets in Central and Eastern Europe, the Middle East and Latin America.

During the remainder of 2010, while ensuring customers of both MetLife and ALICO receive seamless service,

we are dedicated to unlocking the value and earnings accretion that this acquisition will bring to MetLife’s

shareholders.

Demonstrating the Value of MetLife

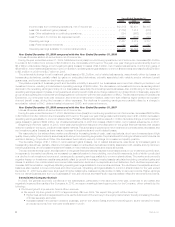

Over the course of 2009, we continued to see the benefits of the initiative we took to reposition MetLife’s

investment portfolio prior to the recession. As the year progressed, net unrealized losses dropped dramatically. At

year-end 2009, our book value was $37.54 per share, a 37% increase over year-end 2008.

In addition, we took a number of proactive steps in 2008 and 2009 to further improve shareholder value. Not only

did we pay an annual common stock dividend of $0.74 per share — unchanged from 2007 and 2008 — but we did

not let the recession distract us from the strategic efforts we began in 2007. Specifically, we made significant

progress on our Operational Excellence initiative in 2009, achieving our goal of attaining at least $400 million in pre-

tax annualized savings one year ahead of our target. As a result, we have increased our pre-tax annualized savings

goal by $200 million to reach $600 million by year-end 2010.

Affirming MetLife’s Strong Financial Position

Before I conclude this letter, I feel it is important to highlight two key issues that affirmed MetLife’s great financial

strength last year.

As you know, the economic challenges in the U.S. spurred the government to implement a number of efforts to

create stability in the economy in 2009. One of these efforts was the U.S. Department of the Treasury’s Capital

Purchase Program, otherwise known as TARP. In April, we announced that MetLife had elected not to participate in

the program. We made this decision because of the actions we had already taken to reinforce our strong financial

position, including raising capital in the marketplace in late 2008. This strong position was validated when the

results of the U.S. Treasury’s capital assessment exercise (known as the stress test) affirmed that, based on the

economic scenarios and methodology of the exercise, MetLife was deemed to have adequate capital to sustain a

further deterioration in the economy. It also reinforced what MetLife had been saying since the financial crisis

began — that we are financially strong and well positioned for both the current environment and a potential further

economic downturn.