MetLife 2009 Annual Report Download - page 63

Download and view the complete annual report

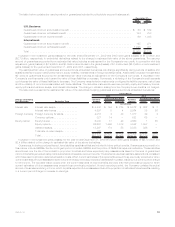

Please find page 63 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.scheduled redemption date. In the event the debt securities are not redeemed on or before the scheduled redemption date, interest will

accrue at an annual rate of 3-month LIBOR plus a margin equal to 7.548%, payable quarterly in arrears. In connection with the offering, the

Holding Company incurred $5 million of issuance costs which have been capitalized and included in other assets. These costs are being

amortized over the term of the securities. See Note 13 of the Notes to the Consolidated Financial Statements for a description of the terms of

the junior subordinated debt securities.

In May 2009, the Holding Company issued $1,250 million of senior notes due June 1, 2016. The notes bear interest at a fixed rate of

6.75%, payable semi-annually. In connection with the offering, the Holding Company incurred $6 million of issuance costs which have been

capitalized and included in other assets. These costs are being amortized over the term of the notes.

In March 2009, the Holding Company issued $397 million of senior notes due June 2012 under the FDIC Program. The notes bear interest

at a floating rate equal to 3-month LIBOR, reset quarterly, plus 0.32%. In connection with the offering, the Holding Company incurred

$15 million of issuance costs which have been capitalized and included in other assets. These costs are being amortized over the term of the

notes.

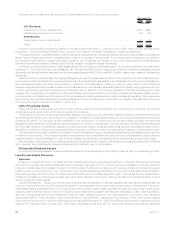

In February 2009, the Holding Company remarketed its existing $1,035 million 4.91% Series B junior subordinated debt securities as

7.717% senior debt securities, Series B, due 2019 payable semi-annually. In August 2008, the Holding Company remarketed its existing

$1,035 million 4.82% Series A junior subordinated debt securities as 6.817% senior debt securities, Series A, due 2018 payable semi-

annually. The Series A and Series B junior subordinated debt securities were originally issued in 2005 in connection with the common equity

units. See “— The Company — Liquidity and Capital Sources — Remarketing of Junior Subordinated Debt Securities and Settlement of

Stock Purchase Contracts.”

In April 2008, MetLife Capital Trust X, a VIE consolidated by the Company, issued exchangeable surplus trust securities (the “2008

Trust Securities”) with a face amount of $750 million. Interest on the 2008 Trust Securities or debt securities is payable semi-annually at a fixed

rate of 9.25% up to, but not including, April 8, 2038, the scheduled redemption date. In the event the 2008 Trust Securities or debt securities

are not redeemed on or before the scheduled redemption date, interest will accrue at an annual rate of 3-month LIBOR plus a margin equal to

5.540%, payable quarterly in arrears. See Note 13 of the Notes to the Consolidated Financial Statements for a description of the terms of the

junior subordinated debt securities.

In December 2007, MetLife Capital Trust IV, a VIE consolidated by the Company, issued exchangeable surplus trust securities (the “2007

Trust Securities”) with a face amount of $700 million and a discount of $6 million. Interest on the 2007 Trust Securities or debt securities is

payable semi-annually at a fixed rate of 7.875% up to, but not including, December 15, 2037, the scheduled redemption date. In the event the

2007 Trust Securities or debt securities are not redeemed on or before the scheduled redemption date, interest will accrue at an annual rate of

3-month LIBOR plus a margin equal to 3.96%, payable quarterly in arrears. See Note 13 of the Notes to the Consolidated Financial Statements

for a description of the terms of the junior subordinated debt securities.

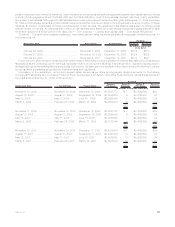

Collateral Financing Arrangements. As described more fully in Note 12 of the Notes to the Consolidated Financial Statements:

• In December 2007, the Holding Company, in connection with the collateral financing arrangement associated with MetLife Reinsurance

Company of Charleston’s (“MRC”) reinsurance of the closed block liabilities, entered into an agreement with an unaffiliated financial

institution that referenced the $2.5 billion aggregate principal amount of 35-year surplus notes issued by MRC. Under the agreement,

the Holding Company is entitled to the interest paid by MRC on the surplus notes of 3-month LIBOR plus 0.55% in exchange for the

payment of 3-month LIBOR plus 1.12%, payable quarterly on such amount as adjusted, as described below.

Under this agreement, the Holding Company may also be required to pledge collateral or make payments to the unaffiliated financial

institution related to any decline in the estimated fair value of the surplus notes. Any such payments would be accounted for as a

receivable and included in other assets on the Company’s consolidated balance sheets and would not reduce the principal amount

outstanding of the surplus notes. Such payments would, however, reduce the amount of interest payments due from the Holding

Company under the agreement. Any payment received from the unaffiliated financial institution would reduce the receivable by an

amount equal to such payment and would also increase the amount of interest payments due from the Holding Company under the

agreement. In addition, the unaffiliated financial institution may be required to pledge collateral to the Holding Company related to any

increase in the estimated fair value of the surplus notes. During 2008, the Holding Company paid an aggregate of $800 million to the

unaffiliated financial institution relating to declines in the estimated fair value of the surplus notes. The Holding Company did not receive

any payments from the unaffiliated financial institution during 2008. During 2009, on a net basis, the Holding Company received

$375 million from the unaffiliated financial institution related to changes in the estimated fair value of the surplus notes. No payments

were made or received by the Holding Company during 2007. Since the closing of the collateral financing arrangement in December

2007, on a net basis, the Holding Company has paid $425 million to the unaffiliated financial institution related to changes in the

estimated fair value of the surplus notes. In addition, at December 31, 2008, the Company had pledged collateral with an estimated fair

value of $230 million to the unaffiliated financial institution. At December 31, 2009, the Company had no collateral pledged to the

unaffiliated third-party in connection with this agreement. The Holding Company mayalsoberequiredtomakeapaymenttothe

unaffiliated financial institution in connection with any early termination of this agreement.

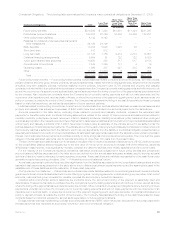

• In May 2007, the Holding Company, in connection with the collateral financing arrangement associated with MetLife Reinsurance

Company of South Carolina’s (“MRSC”) reinsurance of universal life secondary guarantees, entered into an agreement with an

unaffiliated financial institution under which the Holding Company is entitled to the return on the investment portfolio held by trusts

established in connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the

unaffiliated financial institution of 3-month LIBOR plus 0.70%, payable quarterly. The collateral financing agreement may be extended by

agreement of the Holding Company and the unaffiliated financial institution on each anniversary of the closing. The Holding Company

may also be required to make payments to the unaffiliated financial institution, for deposit into the trusts, related to any decline in the

estimated fair value of the assets held by the trusts, as well as amounts outstanding upon maturity or early termination of the collateral

financing arrangement. During 2009 and 2008, the Holding Company contributed $360 million and $320 million, respectively, as a

result of declines in the estimated fair value of the assets in the trusts, and cumulatively, since May 2007, the Holding Company has

contributed a total of $680 million as a result of declines in the estimated fair value of the assets in the trusts, all of which was deposited

into the trusts.

In addition, the Holding Company may be required to pledge collateral to the unaffiliated financial institution under this agreement. At

December 31, 2009 and 2008, the Holding Company had pledged $80 million and $86 million under the agreement, respectively.

57MetLife, Inc.