MetLife 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

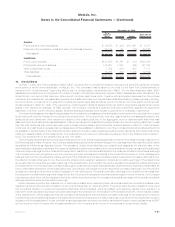

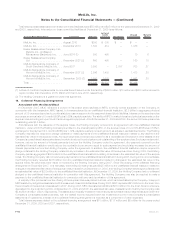

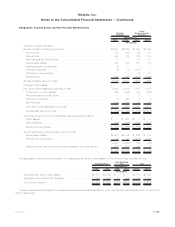

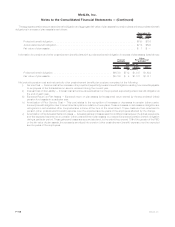

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred

income tax assets and liabilities consisted of the following:

2009 2008

December 31,

(In millions)

Deferred income tax assets:

Policyholderliabilitiesandreceivables ....................................... $3,929 $ 5,553

Netoperatinglosscarryforwards .......................................... 871 741

Employeebenefits.................................................... 661 657

Capitallosscarryforwards............................................... 551 273

Taxcreditcarryforwards ................................................ 401 348

Netunrealizedinvestmentlosses .......................................... 816 6,590

Litigation-relatedandgovernmentmandated................................... 240 284

Other ............................................................ 276 242

7,745 14,688

Less:Valuationallowance............................................... 217 272

7,528 14,416

Deferred income tax liabilities:

Investments,includingderivatives.......................................... 1,434 5,299

Intangibles......................................................... 334 156

DAC............................................................. 4,439 3,939

Other ............................................................ 93 95

6,300 9,489

Netdeferredincometaxasset ............................................. $1,228 $ 4,927

Domestic net operating loss carryforwards amount to $1,998 million at December 31, 2009 and will expire beginning in 2020. Foreign net

operating loss carryforwards amount to $669 million at December 31, 2009 and were generated in various foreign countries with expiration

periods of five years to indefinite expiration. Domestic capital loss carryforwards amount to $1,525 million at December 31, 2009 and will

expire beginning in 2010. Foreign capital loss carryforwards amount to $51 million at December 31, 2009 and will expire beginning in 2014.

Tax credit carryforwards amount to $401 million at December 31, 2009.

The Company has recorded a valuation allowance related to tax benefits of certain foreign net operating and capital loss carryforwards and

certain foreign unrealized losses. The valuation allowance reflects management’s assessment, based on available information, that it is more

likely than not that the deferred income tax asset for certain foreign net operating and capital loss carryforwards and certain foreign unrealized

losses will not be realized. The tax benefit will be recognized when management believes that it is more likely than not that these deferred

income tax assets are realizable. In 2009, the Company recorded an overall decrease to the deferred tax valuation allowance of $55 million,

comprised of a decrease of $80 million related to certain foreign unrealized losses, an increase of $13 million related to certain foreign capital

loss carryforwards and an increase of $12 million related to certain foreign net operating loss carryforwards.

The Company has not established a valuation allowance against the deferred tax asset of $816 million recognized in connection with

unrealized losses at December 31, 2009, other than the $2 million of valuation allowance recognized in connection with certain foreign

unrealized losses. A valuation allowance was not considered necessary based upon the Company’s intent and ability to hold such securities

until their recovery or maturity and the existence of tax-planning strategies that include sources of future taxable income against which such

losses could be offset.

The Company files income tax returns with the U.S. federal government and various state and local jurisdictions, as well as foreign

jurisdictions. The Company is under continuous examination by the Internal Revenue Service (“IRS”) and other tax authorities in jurisdictions in

which the Company has significant business operations. The income tax years under examination vary by jurisdiction. With a few exceptions,

the Company is no longer subject to U.S. federal, state and local, or foreign income tax examinations by tax authorities for years prior to 2000.

In early 2009, the Company and the IRS completed and substantially settled the audit years of 2000 to 2002. A few issues not settled have

been escalated to the next level, IRS Appeals. The IRS exam of the next audit cycle, years 2003 to 2005, is expected to begin in early 2010.

The Company classifies interest accrued related to unrecognized tax benefits in interest expense, while penalties are included within

income tax expense.

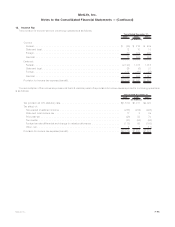

At December 31, 2007, the Company’s total amount of unrecognized tax benefits was $840 million and the total amount of unrecognized

tax benefits that would affect the effective tax rate, if recognized, was $565 million. The total amount of unrecognized tax benefits decreased

by $92 million from January 1, 2007 primarily due to settlements reached with the IRS with respect to certain significant issues involving

demutualization, post-sale purchase price adjustments and reinsurance offset by additions for tax positions of the current year. As a result of

the settlements, items within the liability for unrecognized tax benefits, in the amount of $177 million, were reclassified to current and deferred

income tax payable, as applicable, and a payment of $156 million was made in December of 2007, with $6 million paid in 2009 and the

remaining$15milliontobepaidinfutureyears.

F-96 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)