MetLife 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

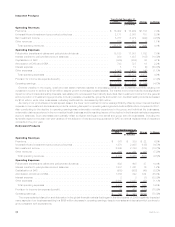

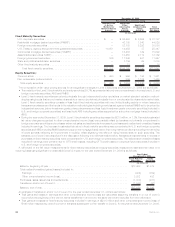

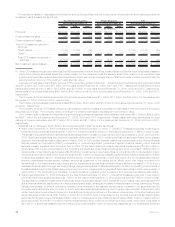

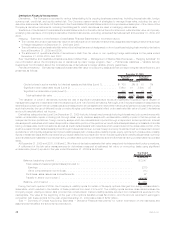

The following tables present the Company’s total fixed maturity securities, based on estimated fair value, by sector classification and by

NRSRO designation and the equivalent ratings of the NAIC, that each designation is comprised of at December 31, 2009 and 2008, with the

exception of non-agency RMBS held by the Company’s domestic insurance subsidiaries at December 31, 2009, which are presented as

described above.

NAIC Rating

Rating Agency Designation Aaa/Aa/A Baa Ba B Caa and

Lower In or Near

Default

Total

Estimated

Fair Value

123456

Fixed Maturity Securities — by Sector & Credit Quality Rating at December 31, 2009

(In millions)

U.S. corporate securities . . . . . . . . . . $ 31,848 $30,266 $ 6,319 $2,965 $ 616 $173 $ 72,187

RMBS . . . . . . . . . . . . . . . . . . . . . . 38,464 1,563 2,260 1,391 339 3 44,020

Foreign corporate securities . . . . . . . . 16,678 17,393 2,067 1,530 281 81 38,030

U.S. Treasury, agency and government

guaranteed securities . . . . . . . . . . . 25,447 — — — — — 25,447

CMBS ...................... 15,000 434 152 22 14 — 15,622

ABS . . . . . . . . . . . . . . . . . . . . . . . . 11,573 1,033 275 124 117 40 13,162

Foreign government securities . . . . . . . 5,786 4,841 890 415 — 15 11,947

State and political subdivision

securities................... 6,337 765 40 8 58 — 7,208

Other fixed maturity securities . . . . . . . 3 10 — 6 — — 19

Total fixed maturity securities . . . . . . $151,136 $56,305 $12,003 $6,461 $1,425 $312 $227,642

Percentage of total . . . . . . . . . . . . . 66.4% 24.7% 5.3% 2.9% 0.6% 0.1% 100.0%

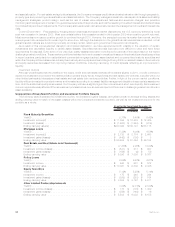

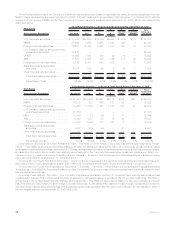

Rating Agency Designation Aaa/Aa/A Baa Ba B Caa and

Lower In or Near

Default

Total

Estimated

Fair Value

NAICRating 1 2 345 6

Fixed Maturity Securities — by Sector & Credit Quality Rating at December 31, 2008

(In millions)

U.S. corporate securities . . . . . . . . . . . $ 31,403 $24,438 $4,891 $2,112 $399 $60 $ 63,303

RMBS . . . . . . . . . . . . . . . . . . . . . . . 34,512 638 695 103 80 — 36,028

Foreign corporate securities . . . . . . . . . 15,936 11,039 1,357 1,184 148 15 29,679

U.S. Treasury, agency and government

guaranteedsecurities............ 21,310 — — — — — 21,310

MBS ........................ 12,486 81 59 7 11 — 12,644

ABS......................... 9,393 1,037 35 16 42 — 10,523

Foreign government securities . . . . . . . . 8,030 1,049 713 357 4 — 10,153

State and political subdivision

securities.................... 4,002 479 46 — 30 — 4,557

Other fixed maturity securities . . . . . . . . 53 — — — 1 — 54

Total fixed maturity securities . . . . . . . $137,125 $38,761 $7,796 $3,779 $715 $75 $188,251

Percentage of total . . . . . . . . . . . . . . 72.9% 20.6% 4.1% 2.0% 0.4% —% 100.0%

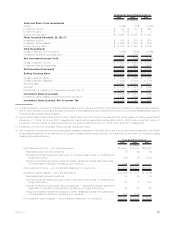

Fixed Maturity and Equity Securities Available-for-Sale. See Note 3 of the Notes to the Consolidated Financial Statements “Invest-

ments — Fixed Maturity and Equity Securities Available-for-Sale” for tables summarizing the cost or amortized cost, gross unrealized gains

and losses, including noncredit loss component of OTTI loss, and estimated fair value of fixed maturity and equity securities on a sector basis,

and selected information about certain fixed maturity securities held by the Company that were below investment grade or non-rated, non-

income producing, credit enhanced by financial guarantor insurers — by sector, and the ratings of the financial guarantor insurers providing

the credit enhancement at December 31, 2009 and 2008.

Concentrations of Credit Risk (Equity Securities). The Company is not exposed to any significant concentrations of credit risk in its equity

securities portfolio of any single issuer greater than 10% of the Company’s stockholders’ equity at December 31, 2009 and 2008.

Concentrations of Credit Risk (Fixed Maturity Securities) — Summary. See Note 3 of the Notes to the Consolidated Financial Statements

“Investments— Fixed Maturity Securities Available-for-Sale Concentrations” for a summary of the concentrations of credit risk related to fixed

maturity securities holdings.

Corporate Fixed Maturity Securities. The Company maintains a diversified portfolio of corporate fixed maturity securities across

industries and issuers. This portfolio does not have an exposure to any single issuer in excess of 1% of the total investments. See Note 3

of the Notes to the Consolidated Financial Statements “Investments — Fixed Maturity Securities Available-for-Sale Concentrations of Credit

Risk (Fixed Maturity Securities) U.S. and Foreign Corporate Securities”for the tables that present the major industry types that comprise the

corporate fixed maturity securities holdings, the largest exposure to a single issuer and the combined holdings in the ten issuers to which it

had the largest exposure at December 31, 2009 and 2008.

38 MetLife, Inc.