MetLife 2009 Annual Report Download - page 148

Download and view the complete annual report

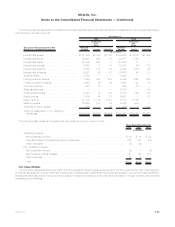

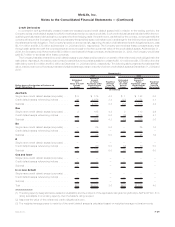

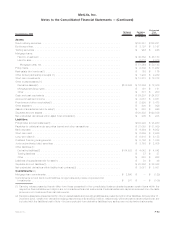

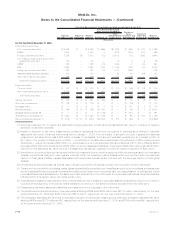

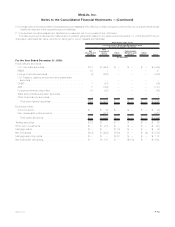

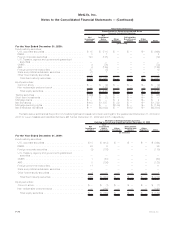

Please find page 148 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(3) Net embedded derivatives within asset host contracts are presented within premiums and other receivables. Net embedded derivatives

within liability host contracts are presented primarily within policyholder account balances. At December 31, 2009 and 2008, equity

securities also included embedded derivatives of ($37) million and ($173) million, respectively.

(4) Commitments are off-balance sheet obligations. Negative estimated fair values represent off-balance sheet liabilities.

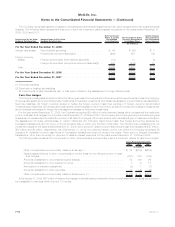

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

Fixed Maturity Securities, Equity Securities and Trading Securities — When available, the estimated fair value of the Company’s fixed

maturity, equity and trading securities are based on quoted prices in active markets that are readily and regularly obtainable. Generally, these

are the most liquid of the Company’s securities holdings and valuation of these securities does not involve management judgment.

When quoted prices in active markets are not available, the determination of estimated fair value is based on market standard valuation

methodologies. The market standard valuation methodologies utilized include: discounted cash flow methodologies, matrix pricing or other

similar techniques. The inputs in applying these market standard valuation methodologies include, but are not limited to: interest rates, credit

standing of the issuer or counterparty, industry sector of the issuer, coupon rate, call provisions, sinking fund requirements, maturity and

management’s assumptions regarding estimated duration, liquidity and estimated future cash flows. Accordingly, the estimated fair values

are based on available market information and management’s judgments about financial instruments.

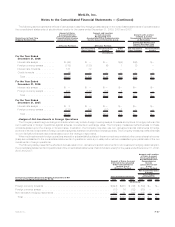

The significant inputs to the market standard valuation methodologies for certain types of securities with reasonable levels of price

transparency are inputs that are observable in the market or can be derived principally from or corroborated by observable market data. Such

observable inputs include benchmarking prices for similar assets in active markets, quoted prices in markets that are not active and

observable yields and spreads in the market.

When observable inputs are not available, the market standard valuation methodologies for determining the estimated fair value of certain

types of securities that trade infrequently, and therefore have little or no price transparency, rely on inputs that are significant to the estimated

fair value that are not observable in the market or cannot be derived principally from or corroborated by observable market data. These

unobservable inputs can be based in large part on management judgment or estimation and cannot be supported by reference to market

activity. Even though unobservable, these inputs are assumed to be consistent with what other market participants would use when pricing

such securities and are considered appropriate given the circumstances.

The use of different methodologies, assumptions and inputs may have a material effect on the estimated fair values of the Company’s

securities holdings.

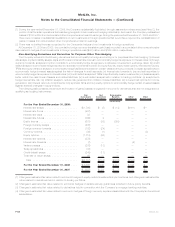

Mortgage Loans — The Company originates mortgage loans for both investment purposes and with the intention to sell them to third

parties. Commercial and agricultural mortgage loans are originated for investment purposes and are primarily carried at amortized cost.

Residential mortgage and consumer loans are generally purchased from third parties for investment purposes and are primarily carried at

amortized cost. Mortgage loans held-for-sale consist principally of residential mortgage loans for which the Company has elected the fair

value option and which are carried at estimated fair value and to a significantly lesser degree certain mortgage loans which were previously

held-for-investment but where the Company has changed its intention as it relates to holding them for investment. The estimated fair values of

these mortgage loans are determined as follows:

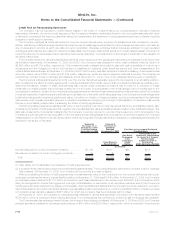

Mortgage Loans Held-for-Investment — For mortgage loans held-for-investment and carried at amortized cost, estimated fair value was

primarily determined by estimating expected future cash flows and discounting them using current interest rates for similar mortgage loans

with similar credit risk.

Mortgage Loans Held-for-Sale — Mortgage loans held-for-sale principally include residential mortgage loans for which the fair value

option was elected and which are carried at estimated fair value. Generally, quoted market prices are not available for residential mortgage

loans held-for-sale; accordingly, the estimated fair values of such assets are determined based on observable pricing of residential mortgage

loans held-for-sale with similar characteristics, or observable pricing for securities backed by similar types of mortgage loans, adjusted to

convert the securities prices to mortgage loan prices. When observable pricing for similar loans or securities that are backed by similar loans

are not available, the estimated fair values of residential mortgage loans held-for-sale are determined using independent broker quotations,

which is intended to approximate the amounts that would be received from third parties. Certain other mortgage loans previously classified as

held-for-investment have also been designated as held-for-sale. For these mortgage loans, estimated fair value is determined using

independent broker quotations or, when the mortgage loan is in foreclosure or otherwise determined to be collateral dependent, the fair value

of the underlying collateral is estimated using internal models.

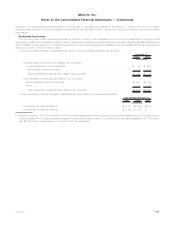

Policy Loans — For policy loans with fixed interest rates, estimated fair values are determined using a discounted cash flow model applied

to groups of similar policy loans determined by the nature of the underlying insurance liabilities. Cash flow estimates are developed applying a

weighted-average interest rate to the outstanding principal balance of the respective group of policy loans and an estimated average maturity

determined through experience studies of the past performance of policyholder repayment behavior for similar loans. These cash flows are

discounted using current risk-free interest rates with no adjustment for borrower credit risk as these loans are fully collateralized by the cash

surrender value of the underlying insurance policy. The estimated fair value for policy loans with variable interest rates approximates carrying

value due to the absence of borrower credit risk and the short time period between interest rate resets, which presents minimal risk of a

material change in estimated fair value due to changes in market interest rates.

Real Estate Joint Ventures and Other Limited Partnership Interests — Real estate joint ventures and other limited partnership interests

included in the preceding tables consist of those investments accounted for using the cost method. The remaining carrying value recognized

in the consolidated balance sheets represents investments in real estate or real estate joint ventures and other limited partnership interests

accounted for using the equity method, which do not meet the definition of financial instruments for which fair value is required to be

disclosed.

The estimated fair values for other limited partnership interests and real estate joint ventures accounted for under the cost method are

generally based on the Company’s share of the NAV as provided in the financial statements of the investees. In certain circumstances,

management may adjust the NAV by a premium or discount when it has sufficient evidence to support applying such adjustments.

F-64 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)